Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Harvey Norman Holdings (HVN)

We have reduced our fiscal year 2023 underlying pre-tax profit forecast by 10 per cent to $676 million. We have lowered our fiscal year 2024 underlying pre-tax profit forecast by 6 per cent to $655 million. Despite revisions to our near term forecasts, we are more optimistic than the market on the medium term earnings outlook and expect fiscal year 2024 will be the trough for margins and earnings. From fiscal year 2025, we estimate low single digit earnings growth per year.

BUY – TPG Telecom (TPG)

The Australian Competition Tribunal has recently declined to authorise a regional mobile network sharing arrangement between TPG and Telstra. Our current forecasts didn’t incorporate any benefits from the proposed arrangement. TPG retained earnings guidance despite cost impacts. TPG is forecasting EBITDA of between $1.85 billion and $1.95 billion for the financial year ending December 31, 2023. The shares offer better value following the TPG announcement on June 21.

HOLD RECOMMENDATIONS

HOLD – Metcash (MTS)

Metcash is a wholesale distribution and marketing company involved in food, liquor and hardware. Underlying net profit after tax of $308 million in fiscal year 2023 was up 4.6 per cent on the prior corresponding period. Hardware sales and margins were better than expected, contributing $219.2 million to underlying earnings before interest and tax. The core food business lifted underlying earnings before interest and tax to $204 million, while increasing liquor sales contributed $104.1 million. A stronger result improves our near term outlook for revenue.

HOLD – APA Group (APA)

APA is an energy infrastructure business. It owns and operates a portfolio of gas, electricity, solar and wind assets around Australia. We project distributions will grow by 4 per cent per annum over the next five years. Most revenue is generated from medium term contracts, with consumer price index-linked tariffs. Revenue is also expected to increase from completing developments. APA recently announced that construction of the first stage of its east coast grid expansion had been completed.

SELL RECOMMENDATIONS

SELL – Bega Cheese (BGA)

The company recently confirmed normalised EBITDA guidance to be at the low end of a range between $160 million and $190 million. The company announced the sale and lease back of its Port Melbourne site for $114.6 million, which strengthens its balance sheet. The company’s bulk dairy business is expected to be impacted from elevated farm gate milk prices and declining global dairy prices. Bega expects to book a non-cash impairment charge of between $180 million and $280 million.

SELL – Cleanaway Waste Management (CWY)

We retain our EBITDA forecast of $673 million for fiscal year 2023. We expect earnings before interest and tax of $300 million for this waste management services provider. In our view, the shares appear overvalued, recently trading at a 25 per cent premium to our price target. Underlying net profit after tax of $66.9 million in the first half of fiscal year 2023 was down 12.3 per cent on the prior corresponding period.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

BUY – Lindsay Australia (LAU)

This transport, logistics and rural supply company upgraded guidance in April and now expects underlying EBITDA to range between $85 million and $90 million, up from between $68 million and $71 million announced in November 2022. Despite wet weather challenges, LAU has experienced a surge in demand for its transport services following the collapse of Scott’s Refrigerated Logistics. According to a company update, increased demand follows an already tightening supply chain after the exit of smaller operators over the past two years.

BUY – Data#3 (DTL)

This information technology services and solutions provider posted a record first half 2023 result. The company lifted revenue by 16.7 per cent and net profit after tax by 38.1 per cent. In the absence of detailed commentary since the half year result, the market is looking for company and broader industry guidance at its full year result. The interim dividend rose 37.9 per cent to 10 cents a share, lifting the payout ratio to 90 per cent.

HOLD RECOMMENDATIONS

HOLD – Coronado Global Resources Inc. (CRN)

This metallurgical coal business generated group revenue of $766 million for the March quarter, up 6.8 per cent on the December quarter. Cash on hand grew, and CRN reaffirmed previous sales and production targets. CRN doesn’t appear to be an operational story, but rather a commodity based cyclical narrative. Should Chinese coking coal prices improve, then we expect CRN’s share price to follow suit.

HOLD – Hotel Property Investments (HPI)

HPI’s resilient hotel and leisure portfolio has provided some stability in the first half year sell off of real estate investment trust stocks. In late May, HPI annouced that two property acquisitions are expected to be completed by the end of the year. It upgraded fiscal year 2023 distribution guidance from 18.4 cents per security to 18.6 cents. HPI also reinstated its distribution reinvestment plan.

SELL RECOMMENDATIONS

SELL – AMP (AMP)

The shares gradually rose from $1.03 on July 14, 2022 to $1.365 on February 8, 2023. The shares were trading at $1.035 on July 13, 2023. The company has been a disappointing performer for many years. While the company continues to flag a new age, its past keeps catching up. Recently, the Federal Court of Australia ruled in favour of the claims brought by a lead applicant and sample group member against AMP. The claims related to AMP Financial Planning’s decision in August 2019 to reduce takeover multiples on potentially acquiring financial planning businesses within the network. AMP is reviewing the judgement.

SELL – PointsBet Holdings (PBH)

PBH is a corporate bookmaker via its cloud based wagering platform. The company is selling its PointsBet US business to Fanatics Betting and Gaming for $US225 million. Despite the cash injection, it falls significantly short of the amount of capital previously invested in the US business, according to our calculations. Gambling stocks are up against potentially tighter regulations in Australia. Our StockRank score for PBH is 54 out of 100. Other stocks appeal more for capital growth at this stage of the cycle.

Tony Langford, Seneca Financial Solutions

BUY RECOMMENDATIONS

BUY – Carnaby Resources (CNB)

This copper and gold explorer has projects in Queensland and Western Australia. Recent drilling at the Greater Duchess copper and gold project delivered encouraging intersects at Mount Hope, confirming high purity and high concentrate along strike that adds to its rapidly emerging scale. This project could be fast tracked given its close proximity to infrastructure.

BUY – ARB Corporation (ARB)

ARB supplies 4-wheel drive accessories to Australian and international markets. In recent years, the company has engaged with the Ford Motor Company to provide accessories to a bigger US growth market. We expect the recently launched earth camper trailer to be popular among its loyal customers. This innovative company is focused on supporting export markets. A strong customer order book supports a brighter outlook.

HOLD RECOMMENDATIONS

HOLD – IGO Limited (IGO)

IGO owns and operates nickel mines in Western Australia. IGO also has a stake in the Greenbushes lithium mine via a joint venture. Greenbushes has a long mine life, and offers a high ore reserve grade. Net profit after tax of $412 million for the quarter ending March 31 was up 22 per cent on the previous quarter. Net debt also significantly fell. The share price has been a strong performer since March.

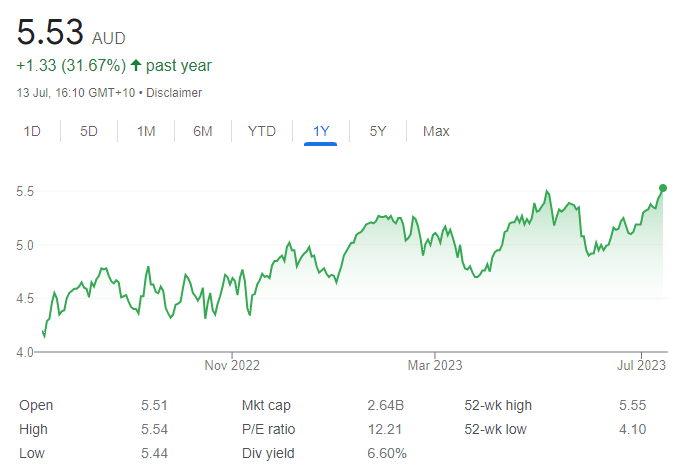

HOLD – CSR Limited (CSR)

CSR makes and distributes building products in Australia and New Zealand. CSR was recently trading on a favourable forward price/earnings ratio compared to the building materials peer group average. The company was recently trading on an annual dividend yield of 6.72 per cent. The shares have been steadily climbing since late May.

SELL RECOMMENDATIONS

SELL – Aurizon Holdings (AZJ)

AZJ operates a rail freight network, transporting coal and bulk commodities. In an update in early May, the company retained EBITDA guidance of between $1.420 billion and $1.470 billion for fiscal year 2023. Heavy rain had impacted the company’s bulk operations in the March quarter, particularly in western New South Wales and the Mount Isa region. In our view, the price/earnings ratio is trading at a premium, so investors may want to consider cashing in some gains.

SELL – Super Retail Group (SUL)

The company’s brands include Supercheap Auto, rebel, BCF and macpac. The group delivered like-for-like sales growth in the first 43 weeks of fiscal year 2023. However, possibly more interest rate increases may slow discretionary spending, presenting challenges for the company to sustain or grow earnings at this stage of the cycle. Investors can consider selling some shares now and possibly buying them cheaper at a later date.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.