Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Woodside Petroleum (WPL)

Global crude oil supplies are relatively low at this point amid under investment in the sector. Consequently, we believe crude oil prices are likely to rise, which should lead to higher share prices for energy stocks. WPL’s share price chart recently revealed a tightening trading range, followed by an upside break on improved volume. We like the company’s outlook.

Mount Gibson Iron (MGX)

We remain bullish about the outlook for iron ore prices and the prospects of producers. The MGX share price initially lagged other miners, but is now moving higher. It has formed what appears to be a solid base on the share price chart. The shares have risen from 36 cents on December 6 to finish at 47.5 cents on January 13.

HOLD RECOMMENDATIONS

Fortescue Metals Group (FMG)

Shares in this iron ore producer are enjoying a strong rally. We expect iron ore prices to continue rising beyond the Beijing Winter Olympics in February. The shares have risen from $14.33 on November 1 to close at $21.40 on January 13. Strong momentum suggests a higher share price moving forward.

Whitehaven Coal (WHC)

We expect WHC to benefit from a continuing recovery in coal prices. The company’s share price drifted below $2.50 late last year. Since then, positive momentum suggests the share price uptrend will continue in line with stronger demand for coal. The company’s outlook is brighter. The shares finished at $2.95 on January 13.

SELL RECOMMENDATIONS

Pro Medicus (PME)

The share price of this strongly performing medical imaging company soared from $31.77 on January 13, 2021 to close at $62.44 on December 31, 2021. The shares finished at $48.94 on January 13, 2022. In our view, the prospects of higher interest rates and quantitative tightening are likely to pressure technology stocks and other companies trading on high price/earnings multiples. We expect PME’s share price to retreat further until we see buying support.

Zip Co (Z1P)

From early January 2021, the share price of this buy now, pay later company soared to $13.92 on February 16, 2021. But the company has been exposed to intensifying competition as the buy now, pay later space attracted a growing number of new entrants in 2021. The buy now, pay later space is crowded. In our view, the share price is also vulnerable to rising interest rates and quantitative tightening. The shares closed at $3.90 on January 13, 2022.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Radiopharm Theranostics (RAD)

The shares have performed poorly since listing in November 2021. The shares now offer a speculative buying opportunity. RAD is developing radiopharmaceutical products for diagnostic and therapeutic uses in areas of high unmet medical need. Multiple trials are underway. A breast cancer imaging study in China is encouraging, but it’s at an early stage. The shares were trading at 37.5 cents on January 13.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Red Metal (RDM)

The company is undervalued, in our view, based on an underlying 30.8 million tonne lead-silver, copper-gold resource at Maronan in Queensland. RDM has previously announced it intends to spin out the project into a dedicated company Maronan Metals. The speculative upside potential is derived from the OZ Minerals alliance involving a suite of big precious and base metal targets. Strategic landholdings are in the vicinity of Rio Tinto’s Winu copper discovery. RDM is highly speculative and suits investors with an appetite for risk.

HOLD RECOMMENDATIONS

Aurumin (AUN)

AUN recently announced the acquisition of the Sandstone Gold Project for $12 million. The project contains JORC mineral resources of 22 million tonnes at 1.1 grams a tonne of gold for 784,000 ounces of gold across 11 deposits, many of which are open along strike and at depth. Additionally, AUN has defined five new exploration targets for testing. AUN is highly speculative, but has a strong growth profile in the junior gold sector.

Proteomics International Laboratories (PIQ)

PIQ has developed the ProMarkerD test for predicting diabetic kidney disease. PIQ has contracted manufacturing capability to assist with a global commercialisation strategy. In December 2021, PIQ was awarded a $409,000 pharmacokinetic testing contract with Linear Clinical Research. PIQ is collaborating with the University of Melbourne and Royal Women’s Hospital to develop a simple blood test for endometriosis.

SELL RECOMMENDATIONS

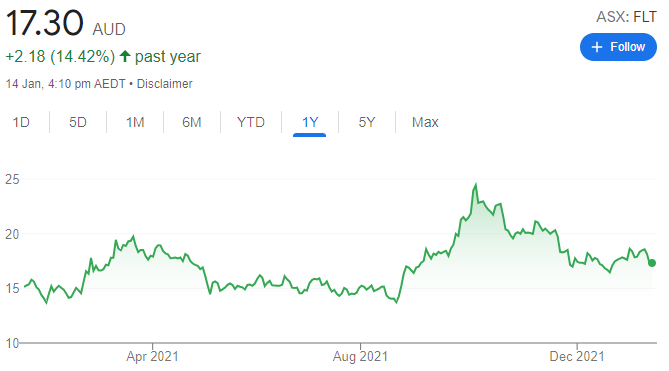

Flight Centre Travel Group (FLT)

The share price of this global travel agency rose above $24 in October 2021 as impending easing of lockdown restrictions fuelled optimism in the travel sector. The shares were trading at $18.14 on January 13, 2022. The Omicron variant is creating uncertainties about the outlook for international travel. Investors may want to consider locking in some gains.

Commonwealth Bank of Australia (CBA)

House prices rose to record levels in 2021. Home lending supported bank valuations. However, we’re concerned about the potential impact from high levels of mortgage debt in an economy facing challenges with the spread of the Omicron variant. The CBA continues to attract investor support with the shares rising from $93.88 on December 1 to trade at $102.24 on January 13. Investors may want to consider cashing in some gains.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Telstra (TLS)

TLS remains the dominant player in the Australian telecommunications industry. Its mobile market share of about 40 per cent remains well ahead of its peers. Telstra is an income stock and its financial performance is building momentum. Digitisation, customer experience developments, cost reductions and capital management have placed it in a solid position at the start of 2022.

Metcash (MTS)

MTS is the parent of grocery, liquor and hardware retailers. Underlying profit after tax of $146.6 million in the first half of 2022 was up 13.1 per cent on the prior corresponding period. Shifting consumer behaviour and improved competitiveness in its retail networks drove sales and earnings growth. MTS delivered a good result given challenges with supply chains, labour shortages and staff isolation. The trading update in December pointed to continuing success in the second half.

HOLD RECOMMENDATIONS

Novonix (NVX)

This battery technology company was a standout performer in 2021 despite reporting an $18 million loss. It’s a growth company tied to the electric vehicle revolution, with aggressive exposure to the battery theme with an emphasis on graphite. The company has an experienced management team and demand for its products are expected to gain momentum.

Fortescue Metals Group (FMG)

In November 2021, the iron ore producer announced plans for a green hydrogen investment of up to $US8.4 billion for Argentina. Rapid growth is expected in the green hydrogen industry in coming years, as the world journeys towards decarbonisation. The recent recovery in the iron ore price is another tailwind.

SELL RECOMMENDATIONS

Imugene (IMU)

IMU is a biotechnology company involved in cancer immunotherapy. Its treatments are in the clinical stage of the development process. The biotech industry is speculative and stocks carry varying degrees of risk in what can be a volatile sector. This company offers potential upside, but patience is needed in the absence of meaningful revenue. We prefer others.

Magellan Financial Group (MFG)

The global fund manager’s share price has fallen from $49.17 on January 14, 2021 to trade at $20.36 on January 13, 2022. It was recently confirmed that St James’s Place (SJP) had terminated its mandate with Magellan. The SJP mandate represented about 12 per cent of group annual revenue at December 2021. The company experienced net outflows in the December quarter. The pressure remains, in our view.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.