Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

BUY – Stavely Minerals (SVY)

SVY has identified nickel-copper prospectivity at the Hawkstone project in Western Australia. The project sits directly along strike from the Buxton Resources and IGO joint venture, which hosts the Merlin nickel-copper-cobalt discovery. SVY’s Cayley Lode discovery in Victoria hosts 9.3 million tonnes at 1.23 per cent copper, 0.23 grams a tonne of gold and 7.1 grams a tonne of silver. Weakness in the junior copper sector provides a highly speculative opportunity.

BUY – AdAlta (1AD)

This clinical stage biotechnology company has been progressing its lead drug candidate AD-214 that targets fibrotic disease at planned phase 2 doses. This supports the potential efficacy of targeted intravenous doses following simulation studies. Recent results show a reduction in phase 2 risk and enhance partnering potential. 1AD has a promising i-body platform to co-develop precision engineered i-body enabled CAR-T cell therapies to bring new hope for patients suffering with cancer. In our view, 1AD is high risk, but offers speculative upside.

HOLD RECOMMENDATIONS

HOLD – Dimerix (DXB)

This clinical stage biopharmaceutical company recently announced it had entered into an exclusive licence agreement with Advanz Pharma to commercialise DMX-200 in Europe, Canada, Australia and New Zealand. DXB’s proprietary product DMX-200 is in a phase 3 trial, where the drug is targeting Focal Segmental Glomerulosclerosis (FSGS), a rare disease that causes kidney scarring and can lead to end stage kidney disease. The first analysis outcome for the phase 3 trial is expected in March 2024. Keep an eye on the news flow.

HOLD – Triangle Energy (Global) (TEG)

This energy company recently announced that drilling preparation had started for permits L7 and EP 437 in relation to its Perth Basin joint venture. The Booth well is targeting gas with a prospective resource range of 113 billion cubic feet to 540 billion cubic feet. The Becos well is targeting oil with a prospective resource range of 1 million barrels to 21 million barrels. In our view, TEG only suits investors with a high risk tolerance.

SELL RECOMMENDATIONS

SELL – Premier Investments (PMV)

Premier owns retail conglomerate Just Group. Brands include Smiggle, Just Jeans, peteralexander and Portmans, among others. PMV reported an adjusted net profit after tax of $278.6 million in fiscal year 2023, an increase of 6.4 per cent on fiscal year 2022. The company is exposed to increasing pressure on retail spending because of soaring cost of living pressures and higher interest rates. The shares have risen from $21.75 on August 18 to trade at $24.115 on October 12. Investors may want to consider cashing in some gains.

SELL – Commonwealth Bank of Australia (CBA)

The bank posted cash net profit after tax of $10.164 billion in fiscal year 2023, an increase of 6 per cent on the prior corresponding period. The CBA trades at a premium compared to other banks. The share price has been volatile in fiscal year 2023, closing above $111 in early February. The bank was trading at $102 on October 12. Investors may want to lighten holdings given potential economic headwinds moving forward.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Tom Bleakley, BW Equities

BUY RECOMMENDATIONS

BUY – BHP Group (BHP)

We expect the mining giant to benefit from increasing demand for copper as the world transitions to electric vehicles. BHP operates some of the world’s biggest copper mines. The company offers diverse revenue streams from producing iron ore, nickel and metallurgical coal. The shares offer value at recent price levels. Investors can consider buying BHP for capital growth and dividends.

BUY – Patriot Battery Metals Inc. (PMT)

Patriot is a hard rock lithium exploration company. It’s focused on advancing its Corvette property in Canada. It has a maiden inferred mineral resource estimate of 109.2 million tonnes at 1.42 per cent lithium oxide, making it one of the largest hard rock lithium deposits in North America. In our view, the shares have been oversold, as the company holds what we anticipate will become a strategic asset in the key North American market.

HOLD RECOMMENDATIONS

HOLD – Lynas Rare Earths (LYC)

LYC is the biggest Australian producer of rare earths. The rare earths price has fallen since February due to increased Chinese supply and electric car maker Tesla planning to eliminate rare earths in electric vehicle batteries in the future. We believe rare earths will be critical to the global economy moving forward and LYC is a low-cost producer.

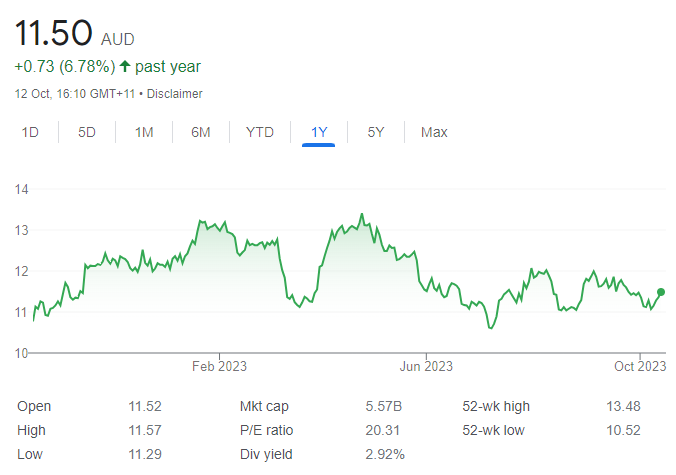

HOLD – Commonwealth Bank of Australia (CBA)

CBA continues to trade at a premium to global banking peers. We continue to view CBA as a high quality option for investors looking for banking exposure. However, generating growth may be challenging in what could be a slowing economy during the next 12 months.

SELL RECOMMENDATIONS

SELL – Bank of Queensland (BOQ)

Cash earnings after tax of $450 million in fiscal year 2023 were down 8 per cent on the prior corresponding period. Statutory net profit after tax of $124 million was down 70 per cent, which included material one-off items. The company faces a challenging economic environment in fiscal year 2024 driven by an elevated cost of living and sustained higher interest rates.

SELL – Azure Minerals (AZS)

Azure recently discovered one of the best lithium deposits in Australia with high grades, access to Infrastructure and power. AZS has been one of the best performing stocks in 2023. The shares have risen from 56 cents on June 8 to close at $2.42 on October 12. It may be a good time to lock in some profits and wait for the results of further metallurgy studies.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

BUY – Aurizon Holdings (AZJ)

Aurizon offers an appealing dividend yield underpinned by high quality rail infrastructure and haulage operations. Considerable downside is priced into the shares, and our analysis suggests that risks for investors are skewed to the upside. Haulage volumes were weak in fiscal year 2023 because of wet weather, but the outlook suggests a recovery in volumes. We expect haulage tariffs to rise with the consumer price index. We think environmental concerns are overblown, providing an opportunity for investors to buy a better-than-average quality company at a discount.

BUY – Telstra Group (TLS)

A 10 per cent increase in underlying EBITDA at its recent full year result was in line with our expectations. The decision to retain ownership of the InfraCo Fixed unit wasn’t well received by investors. We understand the appeal of monetising a percentage of InfraCo Fixed, but, in our view, there’s no rush to separate a business inextricably tied to Telstra’s mobile unit, as it could limit other potential partnerships in the future. TLS shares offer value.

HOLD RECOMMENDATIONS

HOLD – Brickworks (BKW)

Fiscal year 2023 EBITDA of $784 million was 15 per cent below our forecast. Property EBITDA of $506 million was down 21 per cent on last year’s record earnings. BKW’s property segment has been a key driver of earnings during the past five years. Recent weakness in housing permit numbers in Australia signals further deterioration in housing starts in fiscal years 2024 and 2025. However, BKW’s exposure to the more buoyant non-residential segment should provide some support for earnings.

HOLD – Myer Holdings (MYR)

The department store giant posted total sales from ordinary activities of $3.362 billion in fiscal year 2023, an increase of 12.5 per cent on the prior corresponding period. MYR is heavily exposed to fashion retailing, and we expect apparel to be one of the more vulnerable retailing categories in any cyclical slowdown. A positive is its new national distribution centre, which we expect to deliver efficiency gains and boost pre-tax margins once fully ramped up.

SELL RECOMMENDATIONS

SELL – BlueScope Steel (BSL)

The steelmaker reported a net profit after tax of $1.01 billion in fiscal year 2023, a decrease of $1.8 billion on the record result delivered in fiscal year 2022. Meeting greenhouse emission reduction targets moving forward can be costly. The shares have fallen from $22 on August 1 to trade at $19.09 on October 12.

SELL – ALS Limited (ALQ)

ALS Limited provides professional technical laboratory testing services via its commodities and life sciences segments. We expect a slowdown in the commodities business unit in fiscal year 2024. The segment experienced stellar growth in the past two years in response to a mining boom driven by post pandemic financial stimulus and subsequent demand. But near-term market dynamics haven’t significantly changed to warrant an update to our forecasts.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.