Samuel Crompton, Shaw and Partners

BUY RECOMMENDATIONS

Dubber Corporation (DUB)

DUB is a global provider of cloud based, call recording infrastructure. In our view, DUB offers access to one of the fastest growing annual recurring revenue profiles on the ASX. We expect a material acceleration in users during and following COVID-19. IBM and Microsoft recently chose DUB infrastructure to be used on their respective platforms. Our valuation is $1.85. The shares closed at $1.56 on November 12. We recently raised capital for DUB.

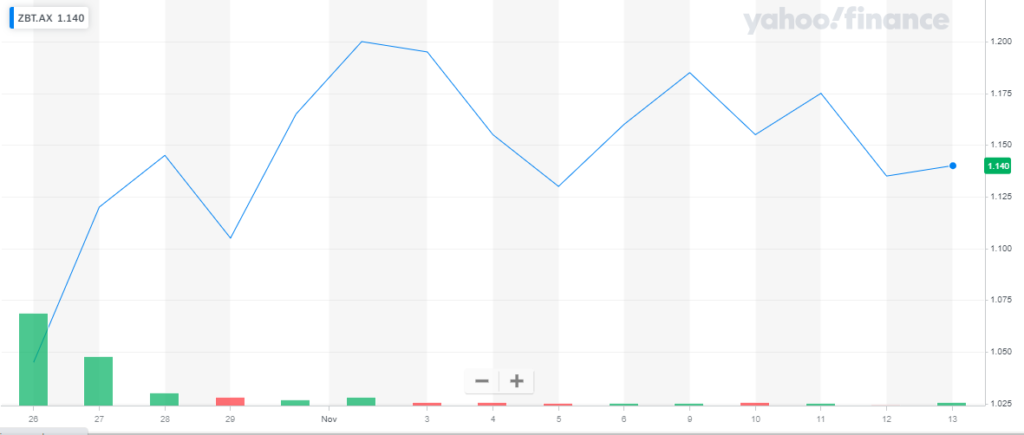

Zebit Inc. (ZBT)

This recently listed company operates an e-commerce platform in the buy now, pay later space. We believe ZBT is ideally positioned for long term growth, as it’s exposed to a big addressable and fragmented market, enabling ZBT to pursue and drive scale. We value ZBT at $2 a share. The stock closed at $1.135 on November 12. We managed and underwrote ZBT’s initial public offering.

HOLD RECOMMENDATIONS

Altium (ALU)

ALU is a leading provider of printed circuit board design software. It services designers and original equipment manufacturers around the world. Today’s uncertain macro economic outlook creates a more challenging selling environment. However, ALU operates in a massive global industry, so any company success paints a potentially bright outlook over the longer term.

WiseTech Global (WTC)

WTC is a leading supply chain software provider. The company offers multiple organic drivers, which boosts investor confidence. It also offers long term data upside. The company has signalled a return to operating leverage, which, in our view, is positive. However, we believe the stock is expensive at this level.

SELL RECOMMENDATIONS

Suncorp Group (SUN)

This diversified financial services company continues to struggle, in our view. In the September quarter, the bank’s total lending portfolio contracted by $336 million. The share price represents value and the dividend yield is attractive. But, in our view, better investment opportunities exist elsewhere.

The A2 Milk Company (A2M)

Disruption to the corporate daigou reseller channel may persist longer than expected for this infant formula company. COVID-19 is preventing Chinese tourists and students from travelling to Australia. In our view, the recent revenue downgrade may also suggest that A2M brands are facing stiffer competition.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

Temple and Webster Group (TPW)

This online furniture and homewares retailer continues to generate strong sales growth. We believe the recent share price fall has been overdone to the point it now presents a buying opportunity. The company generated revenue of $176.3 million in fiscal year 2020, up 74 per cent on the prior year. Technology stocks appear well supported on the back of the US election result.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Ardent Leisure Group (ALG)

As state borders re-open, we expect this Queensland theme park owner and operator to enjoy increasing patronage. The share price is benefiting from recent strong momentum and we expect this to continue into and during the holiday season. The shares have risen from 62.5 cents on November 2 to finish at 84.5 cents on November 12.

HOLD RECOMMENDATIONS

WiseTech Global (WTC)

WTC develops and provides software solutions to the global logistics industry. In terms of the technical chart, the shares managed to break through major resistance near $30. The shares have risen from $28.53 on November 2 to finish at $32.18 on November 12. We expect the share price rally to continue.

CSL (CSL)

The share price of this blood products and vaccine company has been recently moving higher after a period of relative stability. The company is well placed to benefit from manufacturing a COVID-19 vaccine if it’s approved in Australia. The stock was recently above $300 to close at $308.58 on November 12. CSL is a proven performer with a long history of success.

SELL RECOMMENDATIONS

Platinum Asset Management (PTM)

The company has experienced challenging times during the pandemic. PTM reported net outflows of about $197 million in October 2020. The share price has underperformed in the past few years. The technical chart looks bleak from our perspective. In our opinion, the stock appears expensive compared to its peers.

Westpac Bank (WBC)

Full year statutory net profit fell 66 per cent to $2.290 billion in fiscal year 2020. Profit was impacted by a significant increase in impairment charges. Company performance may take time to improve. Westpac is underperforming its peers. We believe better capital growth opportunities exist elsewhere in the market. The shares were priced at $18.28 on July 1. The stock finished at $18.38 on November 12.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Tyro Payments (TYR)

This payments solution and banking products provider reported strong growth in merchant applications in September, despite the COVID-19 lockdown in Victoria. Consequently, the latest update suggests potential further upside in the lead-up to Christmas. Transaction value continues to grow. We view Tyro as a specialist domestic merchant acquirer that’s gaining significant growth momentum due to its quality terminals offering.

South32 (S32)

This diversified miner released September quarter volumes that were broadly in line with our forecasts, with fiscal year 2021 guidance remaining unchanged. The company reported net cash of $US368 million, $US30 million higher than our estimate. In our view, S32 is undervalued. The shares finished at $2.23 on November 12.

HOLD RECOMMENDATIONS

Coles Group (COL)

Like-for-like sales growth in the first quarter of fiscal 2021 was better than expected in the liquor and convenience categories. Food margins were supported by lower COVID-19 costs. We have increased our underlying earnings per share forecasts by 1 per cent in fiscal year 2021 and by 1.2 per cent in fiscal year 2022 due to increasing like-for-like sales in the food, liquor and convenience categories.

Blackmores (BKL)

At its annual general meeting, BKL indicated strong sales momentum in the first half of fiscal year 2021. Expectations are for net sales growth to be in the mid single digits. This vitamins and supplements company has also announced the sale of its Global Therapeutics business to McPherson’s for $27 million. New management is focusing on simplifying the company’s structure and brand portfolio. Given the current valuation and strategy execution risk, we retail our hold recommendation.

SELL RECOMMENDATIONS

Boral (BLD)

The building products company has agreed to sell its 50 per cent interest in USG Boral for $US1.015 billion. Boral’s trading update was better than expected at the group level. However, we have particular concerns about structural supply issues facing the fly ash business, which represents between 15 per cent and 20 per cent of group earnings before interest and tax. Based on our estimates, Boral remains fully valued.

Pushpay Holdings (PPH)

Provides a donor management system to churches, non-profit organisations and education providers. We don’t see much growth from existing customers beyond fiscal year 2021. In our view, investors should be wary of consensus expectations that extrapolate current growth rates. The shares have performed strongly this calendar year, so investors may want to consider taking a profit.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.