John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

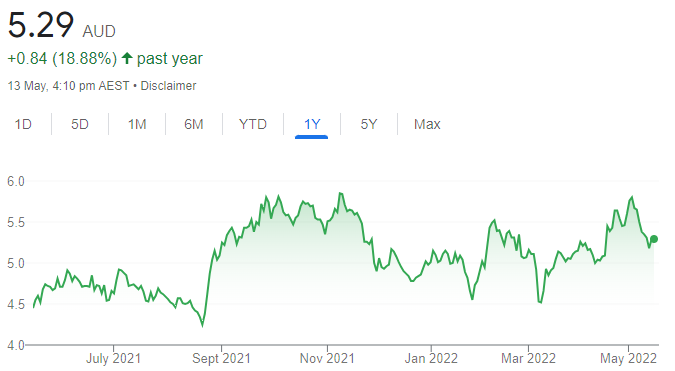

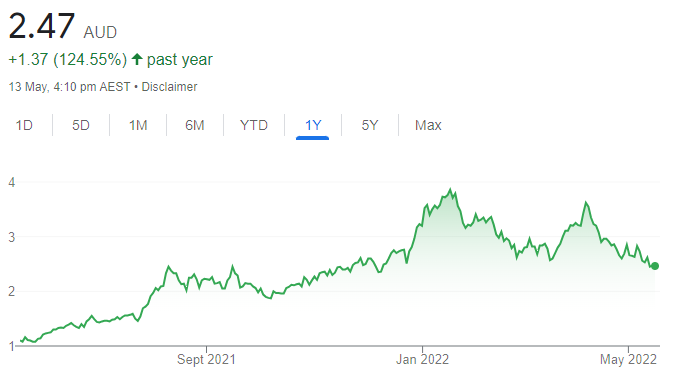

Jaxsta (JXT)

Jaxsta has built a comprehensive music credit platform. We expect JXT to benefit from US music licensing company Songtradr investing in JXT and from appointing Beth Appleton as chief executive officer. JXT is fully funded, and has committed to cutting operating costs by $1.5 million in the next 12 months without impacting revenue. JXT is integrating its platform with Songtradr and targeting profitability within 18 months.

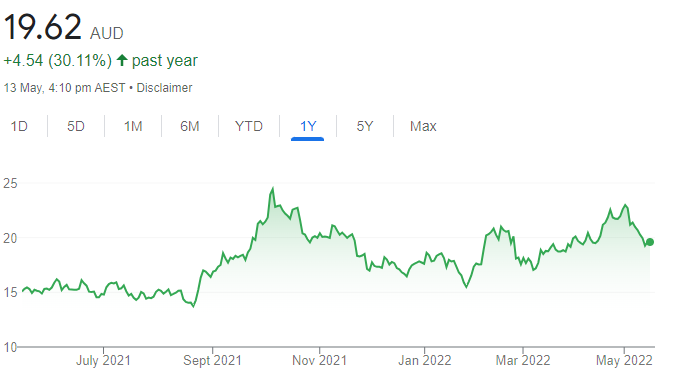

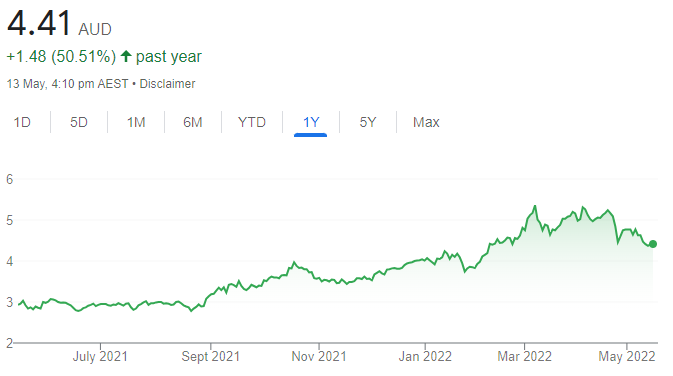

Tombador Iron (TI1)

The company’s iron ore project is in Brazil. This iron ore miner posted maiden positive net cash of $3.3 million from operating activities in the 2022 March quarter. The company held cash holdings of $28.38 million as at March 31, 2022. The company is confident of increasing its mine life from six years to 10 years. Instead of raising capital, we believe this junior miner will possibly pay a dividend.

HOLD RECOMMENDATIONS

Qantas Airways (QAN)

QAN has agreed to fully acquire Alliance Aviation Services. We consider QAN a hold until it fully integrates the acquisition. There’s enthusiasm for travel again, but this may be curbed as cost-of-living pressures continue to rise. Best to monitor QAN performance and the economy.

Flight Centre Travel Group (FLT)

The global travel agency has returned to EBITDA profitability. It has a strong balance sheet, but we retain concerns about margin pressures due to a tight labour market. We suggest investors continue holding, but keep economic and COVID-19 risks in mind.

SELL RECOMMENDATIONS

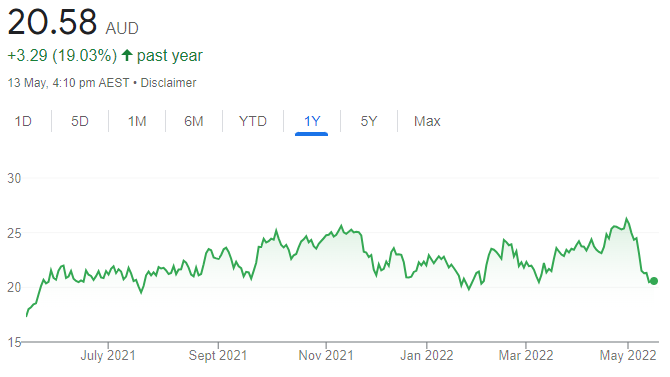

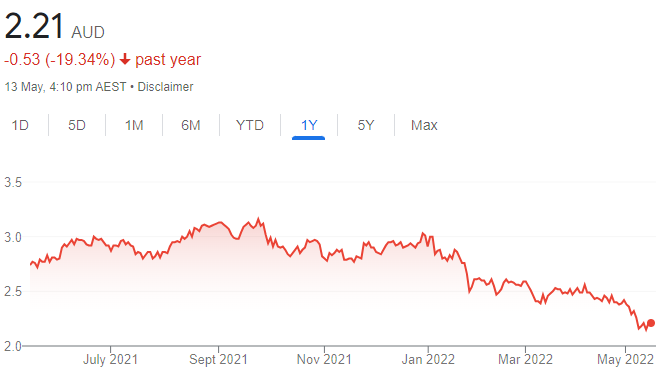

Corporate Travel Management (CTD)

In our view, organisations may be tempted to reduce corporate travel in this inflationary environment. A reduction in corporate travel may impact CTD’s performance. We prefer other stocks until a clearer picture emerges about the state of the global economy in response to the Ukraine war, lockdowns in China and higher interest rates.

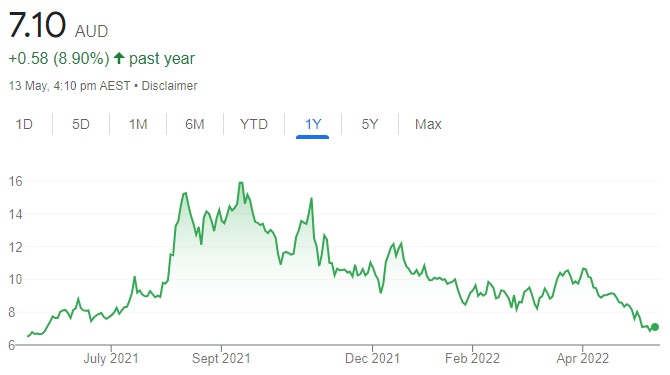

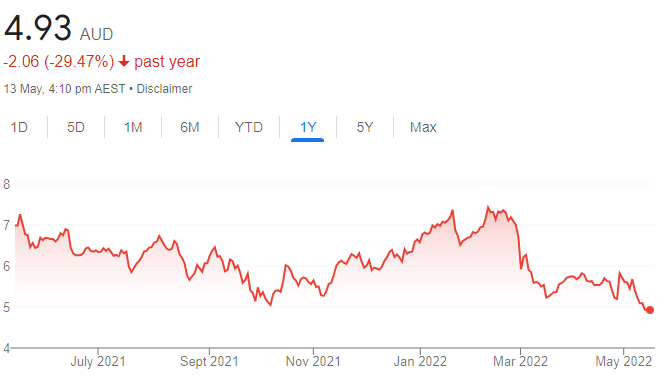

Vulcan Energy Resources (VUL)

In our view, favourable potential exists for VUL to become a lithium producer with a zero carbon footprint. The company reported a 2022 first half loss of 6.27 million euros. Market sentiment has firmly moved towards conservative profitable operations. We prefer other stocks until sentiment towards risk improves.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Pilbara Minerals (PLS)

This lithium company posted softer volumes in the March quarter. Costs were lower than our forecasts and we expect them to fall into the June quarter. Another positive pricing result at the latest Battery Metal Exchange auction provides confidence that prices should remain high in the near term. Pilbara shows deep valuation support and dominates the near term earnings metrics of our lithium coverage.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

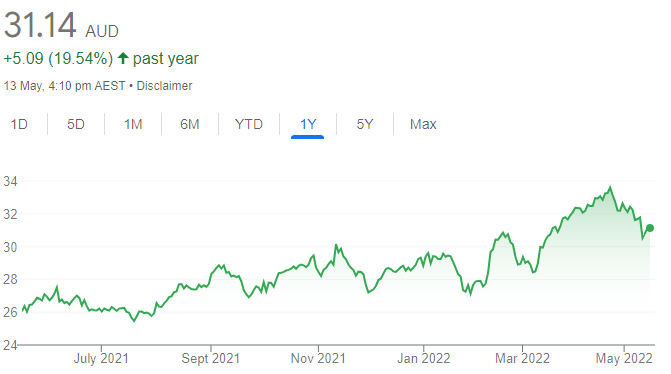

South32 (S32)

Group output for this diversified miner was broadly in line with our forecasts in the March quarter. The Cannington mine in Queensland was a highlight. Fiscal year 2022 production guidance was retained, although cost guidance across key assets increased between 5 per cent and 10 per cent. S32 generated strong free cash flow of $600 million.

HOLD RECOMMENDATIONS

Mirvac Group (MGR)

Management of this diversified property group has retained full year settlement guidance, with a caveat on weather delays. Fiscal year 2022 earnings guidance was reiterated at 15 cents a share, up 7.1 per cent on fiscal year 2021. Likely interest rate rises and increasing construction costs could impact residential sales. We see longer term value, but we expect the stock to trade at a discount in the short term.

Cochlear (COH)

An agreement by hearing implants maker Cochlear to acquire Oticon Medical is a positive strategic development, in our view. The acquisition will remove a key competitor and ultimately support a solid boost to forecast earnings and returns.

SELL RECOMMENDATIONS

Sandfire Resources (SFR)

Production costs were higher than we expected in the March quarter and flagged to increase in the fourth quarter. In our view, higher fiscal year 2022 cost guidance is a more significant driver of the medium term free cash flow outlook than marginally higher copper output for the next year. We have reduced our earnings per share forecasts by 11 per cent in fiscal year 2022 and by 1 per cent in fiscal year 2023.

Unibail-Rodamco-Westfield (URW)

Owns and operates shopping centres in the US and Europe. URW delivered a first quarter calendar year update that was broadly in line with expectations. In our view, the next two years will be shaped by Unibail’s deleveraging plans, so we don’t see a floor under our net asset value and earnings estimates until calendar years 2023 or 2024. We remain cautious in response to likely emerging economic and consumer headwinds.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Syrah Resources (SYR)

The graphite producer has been supported by increasing sales of electric vehicles. It secured a loan from the US Department of Energy to support the growing electric vehicle industry in the US and to shore up supply chains of critical minerals. Signing an offtake agreement with Tesla in December also adds to its appeal.

Challenger (CGF)

This investment manager recently upgraded profit guidance. Annuity products become more appealing in a higher interest rate environment in response to increasing yields. Challenger is leveraged to ageing populations in Australia and Japan. It benefits from more retirees seeking annuity products.

HOLD RECOMMENDATIONS

National Australia Bank (NAB)

The 2022 first half result appeared to meet expectations. NAB continued to improve its market share over the half and delivered a stable to improving net promoter score, which is the highest of the major banks in relation to consumers. Higher interest rates will benefit net interest margins.

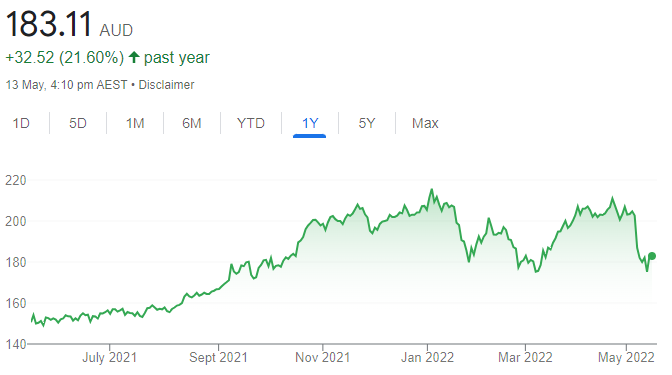

Macquarie Group (MQG)

The group recently posted a full year profit of $4.706 billion, up 56 per cent on last year’s prior corresponding period and ahead of our estimates of $4.59 billion. Despite the strong result, the market responded negatively to short term guidance. The MQG board tends to be conservative with guidance, in our view. We believe Macquarie remains well positioned to deliver superior performance in the medium term.

SELL RECOMMENDATIONS

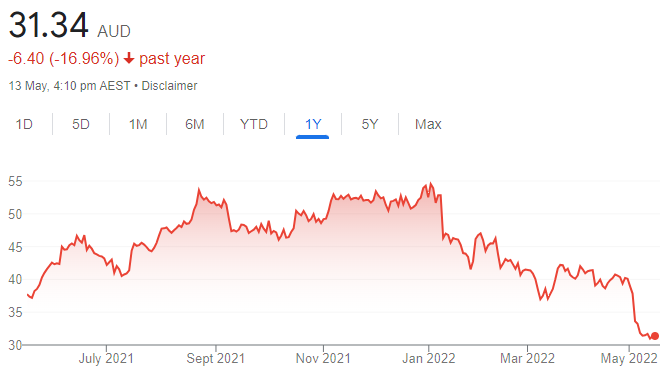

ARB Corporation (ARB)

The share price of this 4-wheel drive accessories company has fallen from $54.53 on January 4 to trade at $31.23 on May 12. Recent guidance missed analyst estimates. The consumer discretionary sector is expected to underperform in this high inflation and interest rate environment.

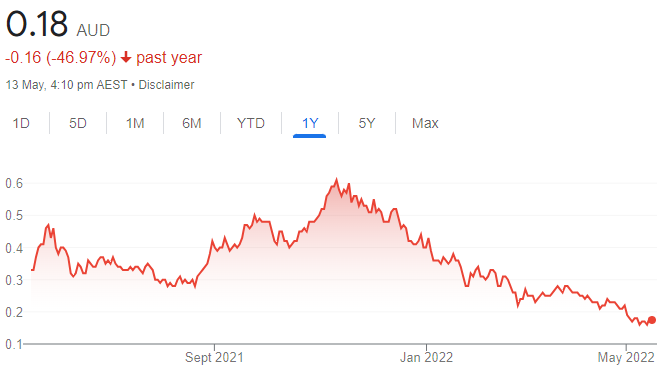

Imugene (IMU)

This biotechnology company’s share price has fallen from 60.5 cents on November 9, 2021 to trade at 16.2 cents on May 12, 2022. Recent negative attention has focused on the termination of a supply agreement with MSD, a trade name of Merck & Co. The company reported a loss of $14.83 million for the half to December 31, 2021.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.