Elio D’Amato, Stockopedia

BUY RECOMMENDATIONS

Macquarie Group (MQG)

This diversified financial services company offers strong operating segments. We like the company’s outlook given growing demand for its cash products and an unwavering commitment to outperforming. The company recently announced a 2023 fiscal year net profit after tax of $5.182 billion, up 10 per cent on the prior corresponding period. We have lifted our momentum rank rating to 96 out of 100.

Codan (CDA)

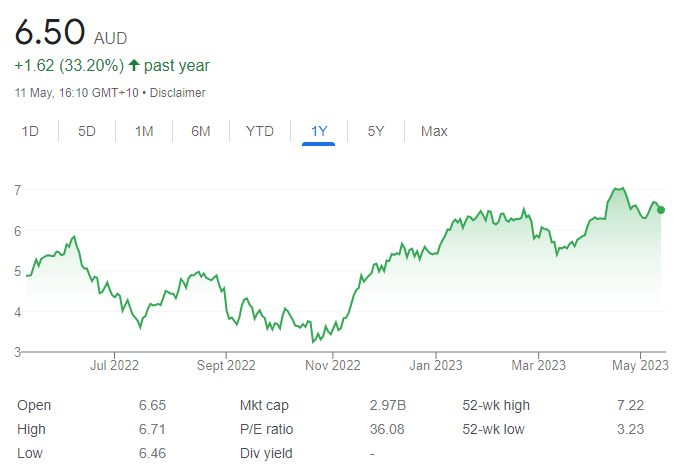

After a period of prolonged price pain, the shares have risen from $5.30 on March 29 to close at $7.33 on May 11. Despite solid earnings from its communications division, the metal detector division is likely to struggle for the remainder of fiscal year 2023. The market has taken a more optimistic position given stronger gold prices. CDA’s recovery has been impressive.

HOLD RECOMMENDATIONS

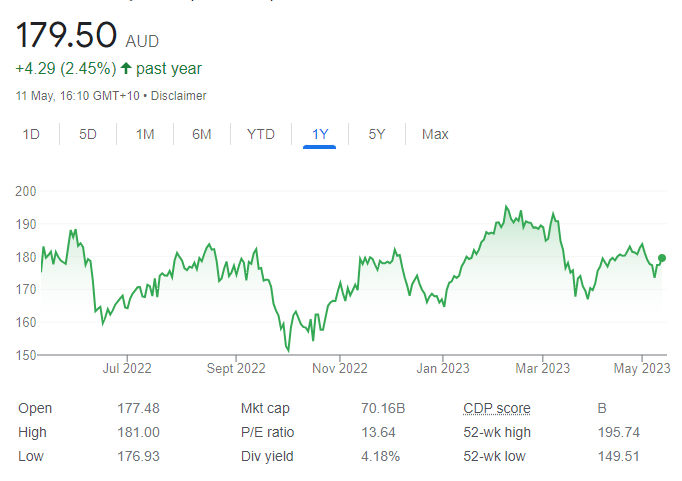

National Australia Bank (NAB)

The company posted cash earnings of $4.070 billion in the first half of fiscal year 2023, up 17 per cent on the prior corresponding period. The first half dividend of 83 cents was up 13 per cent, and net interest margins rose over the period. The company was somewhat coy about the outlook, in my view. Achieving record profits amid rising cost of living pressures means NAB must balance its success within community expectations.

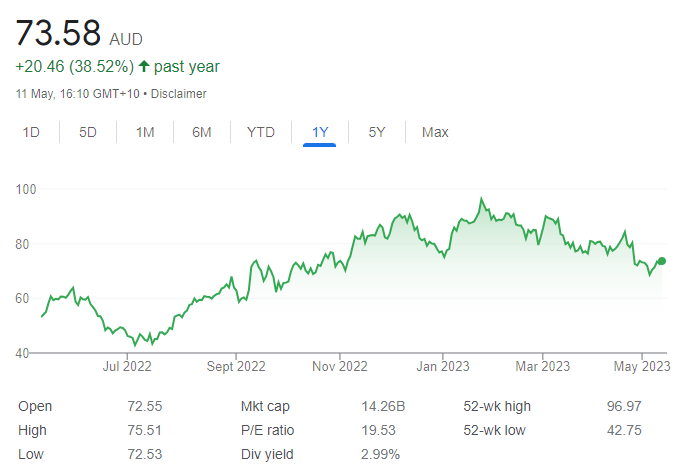

Lynas Rare Earths (LYC)

Believers in this rare earths giant breathed a sigh of relief when the Malaysian Government agreed to extend the company’s operating licence to the start of 2024. This development is short term relief. But the company should benefit from establishing the Kalgoorlie processing facility and from developing relationships with global governments eager to reduce their reliance on Chinese rare earths.

SELL RECOMMENDATIONS

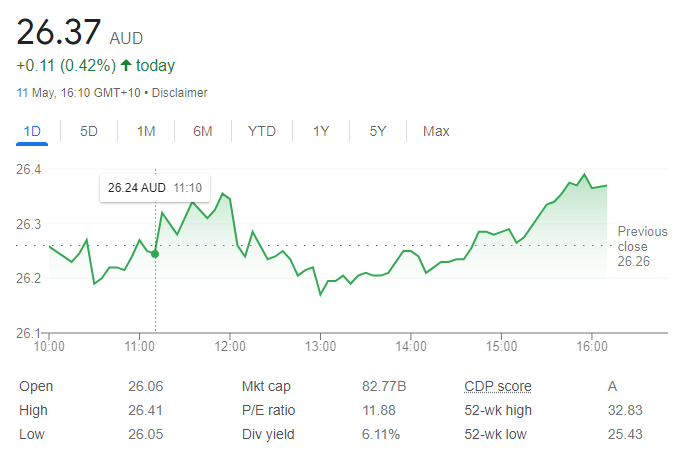

Computershare (CPU)

The share price of this share registry and corporate services giant has fallen from $27.66 on November 29, 2022 to close at $21.79 on May 11, 2023. The recent bounce off March lows, a reprieve after a solid and sustained sell off, may provide more appropriate exit levels for investors to cash in some gains. Other stocks appeal more in a global economy experiencing economic pressures. We have assigned a stock rank score of 69 out of 100.

Xero (XRO)

The company’s accounting software is the package of choice for thousands of start-ups and established businesses across the globe. Earnings per share expectations have been upgraded by analysts for fiscal year 2024. Our stock rank momentum score is 94 out of 100. The shares have risen from $70.11 on January 3 to close at $93.16 on May 11. In our view, the stock is too expensive given the risk of a slowdown in global business activity from higher interest rates to curb inflation.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Santos (STO)

The energy giant reported a solid first quarter production result in fiscal year 2023. In our view, STO remains a discounted energy stock with the lowest implied oil price. The company retained fiscal year 2023 guidance. STO is geographically diversified. Also, it offers a diversified product mix across LNG, domestic gas, crude oil and liquids.

Mineral Resources (MIN)

This mining services company and iron ore producer has diversified into the lithium space via a joint venture with global producer Albemarle Corporation. MIN is well managed and has big mineral reserves. Growing demand for its products should drive future long-term earnings growth. Recent share price weakness provides an attractive entry point.

HOLD RECOMMENDATIONS

PointsBet Holdings (PBH)

The corporate bookmaker operates a cloud-based wagering platform. It has operations in Australia, the US, Canada and Ireland. PBH released a solid third quarter trading update. The total net group win of $106.6 million was up 39 per cent on the prior corresponding period. Corporate activity is possible in Australia and the US.

Stockland (SGP)

Stockland is a diversified property group. The logistics portfolio continues to grow, while residential contracts are running at record levels. The company retained a funds from operations per security guidance range of between 36.4 cents and 37.4 cents for fiscal year 2023.

SELL RECOMMENDATIONS

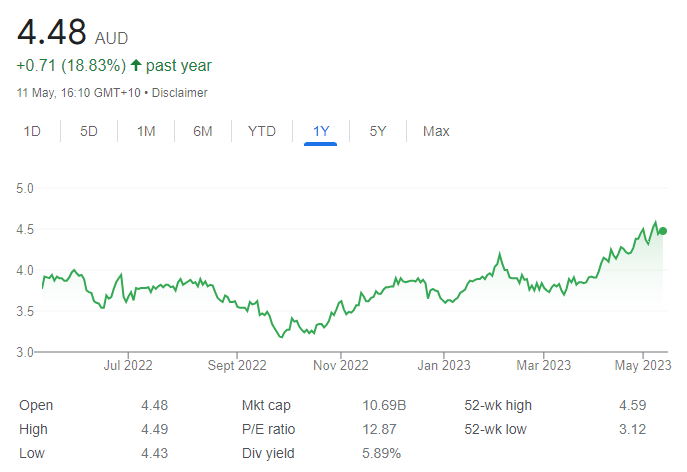

Insignia Financial (IFL)

IFL is a wealth manager. Despite reporting positive third quarter inflows, IFL continues to experience a decline in adviser and practice numbers. Integrating the MLC acquisition may prove more challenging than expected in the near term. The shares have fallen from $3.74 on January 18 to trade at $3.065 on May 11.

Alumina (AWC)

Alumina holds a 40 per cent equity share in Alcoa World Alumina and Chemicals (AWAC). Alumina downgraded 2023 production guidance due to bauxite grade issues. Excluding significant items, AWC posted a full year net profit after tax of $US109.3 million in calendar year 2022, which was down 52 per cent on the prior corresponding period. There was no final dividend. Other stocks appeal more at this point of the cycle.

Stuart Bromley, Medallion Financial Group

BUY RECOMMENDATIONS

Goodman Group (GMG)

Goodman is an industrial property group. It has high quality properties, blue chip tenants, an occupancy rate of 99 per cent and long average lease expiries. Competition is modest and rental growth is accelerating. The company continues to build, as it progresses $13.9 billion of existing projects. The gearing ratio is lower than other more exposed property plays. The company offers a bright outlook.

Sandfire Resources (SFR)

Record first half revenue of $US431.7 million was up 38 per cent on the prior corresponding period. March quarter results identified an extension to the San Pedro mineralisation zone near the existing MATSA mine. The Motheo mine is closing in on first production, acting as a catalyst for short term growth prospects, while simultaneously substantiating long term aspirations of about 25 per cent growth in copper production by late 2025.

HOLD RECOMMENDATIONS

Audinate Group (AD8)

This technology business enables audio and video equipment to transition from analogue to digital networking. Economies re-opening from COVID-19 provided tailwinds. First half 2023 revenue of $30.8 million was up 39.3 per cent on the prior corresponding period. The business is now seeing a record sales backlog driven by strong demand from clients. Margins should improve in fiscal years 2024 and 2025.

CSL (CSL)

Plasma collections are 10 per cent above pre-pandemic levels, with Mexican border sites recovering particularly well. The company delivered total revenue of $US7.184 billion for the six months ending on December 31, 2022, an increase of 19 per cent on the prior corresponding period. Encouragingly, its recently acquired renal disease treatment business Vifor Pharma was a solid contributor to the result.

SELL RECOMMENDATIONS

Dusk Group (DSK)

The specialty retailer sells home fragrance products from its physical stores and online. DSK reported total sales revenue of $86.1 million in the first half of fiscal year 2023, up 7.6 per cent on the prior corresponding period. However, total like-for-like sales fell 10.4 per cent. Rising cost of living pressures, higher mortgage repayments and shoppers reducing discretionary spending presents a challenging short-term outlook.

Adairs (ADH)

This furniture and homewares company posted underlying group earnings before interest and tax of $35.5 million in the first half of fiscal year 2023, up 7.9 per cent on the prior corresponding period. The company has reduced full year group EBIT guidance to between $70 million and $80 million. Elevated supply chain costs are behind the decline in full year EBIT guidance. The company operates in a challenging sector at this point of the cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.