Harrison Massey, Argonaut

BUY RECOMMENDATIONS

Demetallica (DRM)

Demetallica owns and operates the Chimera polymetal project in Queensland. The company has three pre-existing JORC resources on its ground. The standout is the Jericho deposit, which hosts 9.1 million tonnes at 1.4 per cent copper, 0.3 grams a tonne of gold and 1.6 grams a tonne of silver. The Chimera project is located four kilometres from the Eloise copper mine and concentrator. DRM is targeting a resource upgrade at Jericho in October.

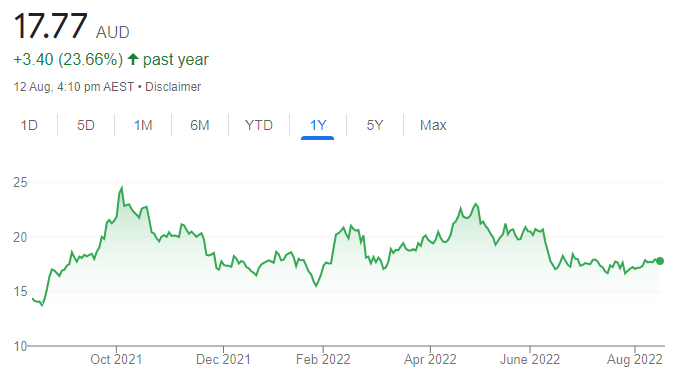

Sarytogan Graphite (SGA)

The company is exploring for graphite at its high-grade deposit in Kazakhstan. Compared to ASX peers, SGA has the second biggest graphite deposit, with an inferred mineral resource of 209 million tonnes at 28.5 per cent total graphite content. Graphite is a major raw material in constructing electric vehicle batteries. The company may announce a resource upgrade towards the end of the year.

HOLD RECOMMENDATIONS

Qantas Airways (QAN)

We expect earnings and cash flow to continue improving as the world recovers from the COVID-19 pandemic. However, in our view, over-inflated crude oil prices and increasing staff and input costs will impact its bottom line moving forward. Investors can consider holding Qantas for exposure to the travel sector. But a clearer outlook regarding the travel sector needs to emerge before we consider upgrading our recommendation.

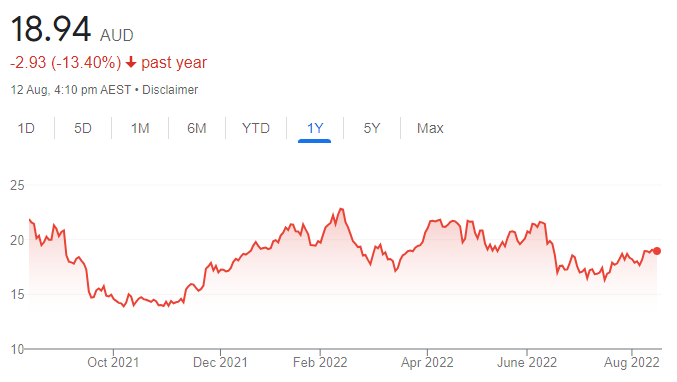

Fortescue Metals Group (FMG)

Fortescue is a premier iron ore producer. Continuing volatility in iron ore spot prices and increasing business costs are likely to hamper profitability in the short term, in our view. Investors should consider holding, as FMG typically pays one of the best dividends in the materials sector.

SELL RECOMMENDATIONS

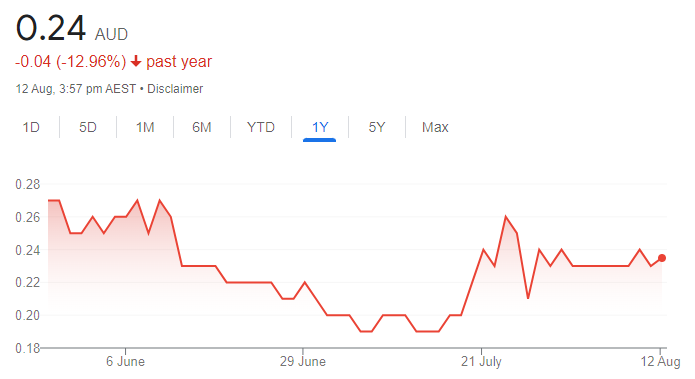

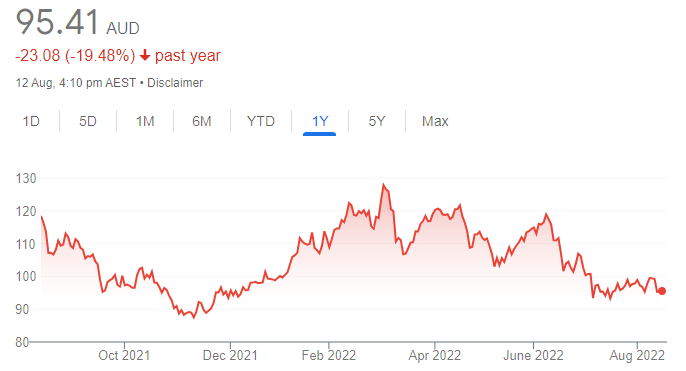

Zip Co (ZIP)

This buy now, pay later company has partnerships with merchants across the world. The proposed merger with rival Sezzle has been terminated. Reducing cash burn is part of the company’s strategy. But the company is up against higher inflation, rising interest rates and weaker consumer confidence levels. It may be worth considering a more stable investment.

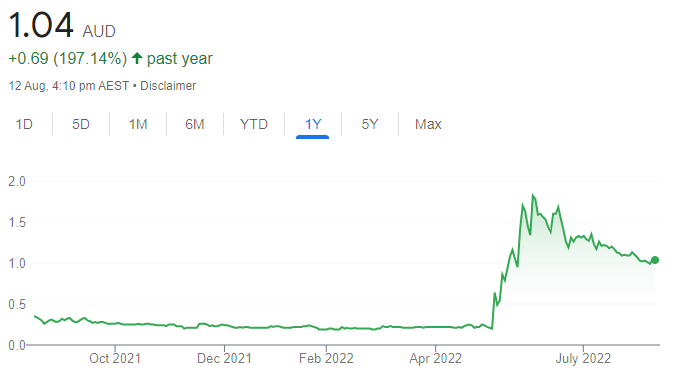

Galileo Mining (GAL)

Galileo owns and operates the Norseman and Fraser Range projects in Western Australia. The base metals explorer has uncovered several high-grade PGE (platinum group elements) assay results, which has sent the share price soaring since the start of May. Given the relatively infant nature of the exploration program and significant share price rise, investors may want to consider taking profits around current levels.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Telstra Corporation (TLS)

The telecommunications giant has lifted its final dividend to 8.5 cents a share for fiscal year 2022. TLS may soon monetise its InfraCo fixed business once the legal separation is complete in October 2022. Recent transactions highlight that demand for high quality telecommunication assets, with long-term contracts and predictable cash flows, remain strong. Despite central banks raising interest rates globally, transaction multiples for telecommunication assets haven’t declined.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Johns Lyng Group (JLG)

This building services company specialises in emergency construction. In our view, increasing catastrophes in 2022 will assist earnings moving forward. The company is looking to expand into new markets, providing a runway for strong longer-term growth and underpinning double-digit earnings per share growth. JLG has maintained a steady gross margin of about 20 per cent since listing in 2017.

HOLD RECOMMENDATIONS

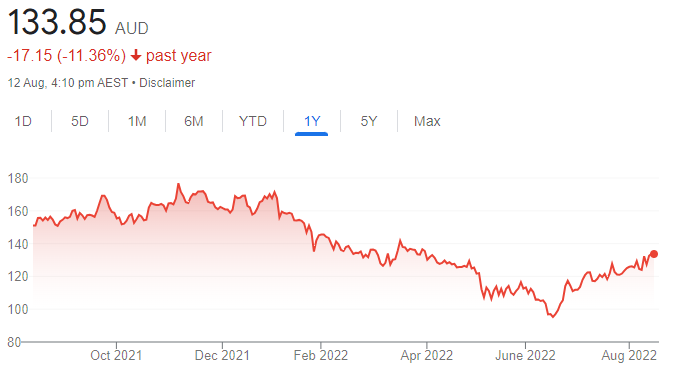

Rio Tinto (RIO)

The global miner reported underlying EBITDA and net profit essentially in line with consensus for the six months ending June 30, 2022. Underlying EBITDA of $US15.6 billion was down 26 per cent on the prior corresponding period, but 6 per cent ahead of our forecast. Although the payout ratio of 50 per cent missed consensus estimates, the company declared a dividend of $US2.67.

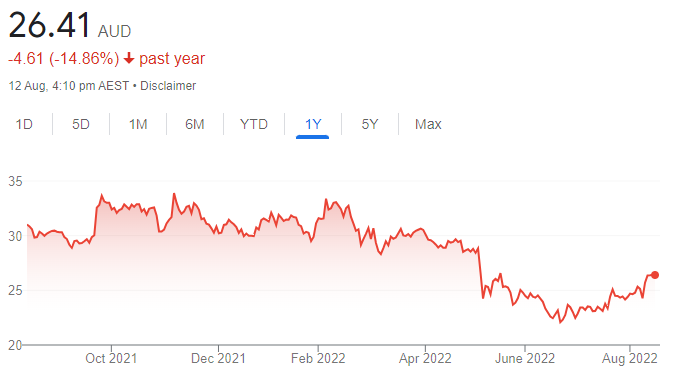

Fortescue Metals Group (FMG)

The iron ore miner released a mixed June quarter production report, in our view. It reported higher fourth quarter costs (C1) compared to the third quarter in response to higher diesel costs, labour rates and other consumables. However, it reported strong iron ore shipments in the fourth quarter, which were ahead of our forecasts.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

The leisure division is benefiting from pent-up demand for holiday travel in the northern hemisphere. Our analysis suggests corporate travel or premium airline passenger numbers are highly correlated with world trade growth (in essence global GDP). In the absence of market share gains, this points to a likely downturn in the corporate division in the next 12 months. Our updated earnings account for revised fiscal year 2022 guidance and the deteriorating global macro picture for fiscal year 2023/24.

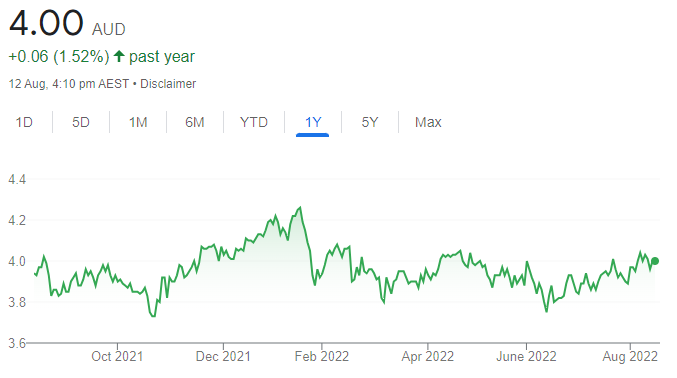

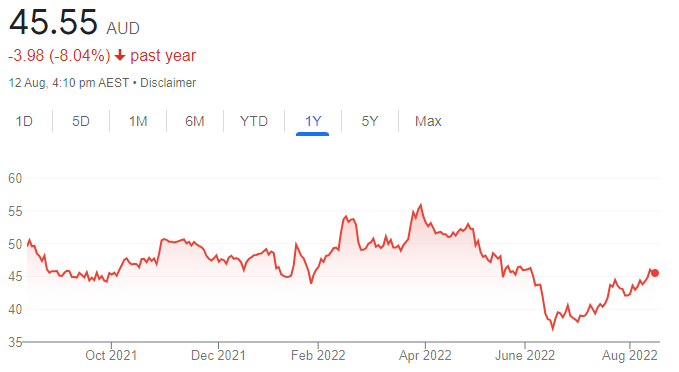

Tabcorp Holdings (TAH)

In our view, Tabcorp is doing well to compete on a more equal footing with online bookmakers by seeking to raise taxes paid by digital bookies. However, comparing TAH to online bookmaker turnover growth in the past two years reveals a fiercely competitive industry.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

JB Hi-Fi (JBH)

Preliminary results from this consumer electronics giant were well received by the market. Top and bottom lines came in ahead of most estimates. While guidance wasn’t offered, the results still painted an optimistic and resilient outlook by the consumer. Sales momentum was strong throughout the year, with total sales up 3.5 per cent to $9.2 billion.

REA Group (REA)

This digital advertising business specialising in property posted revenue of $1.170 billion in fiscal year 2022, up 26 per cent on the prior corresponding period. Net profit of $408 million was up 25 per cent. While REA expects the Australian residential property market to moderate as interest rates rise, it believes demand will be supported by robust household balance sheets, low unemployment and increasing migration.

HOLD RECOMMENDATIONS

CSL (CSL)

Improving foot traffic at its US-based collection centres is approaching peaks of May and June 2021 and ahead of pre-COVID-19 levels. Plasma collections are vital, as even a small increase has the potential to influence an earnings upgrade. Slowing economic growth in the US can also have a positive influence on plasma collections given attractive incentive payments for blood donations.

News Corporation (NWS)

The media giant reported total revenue of $US10.39 billion in fiscal year 2022, an 11 per cent increase on the prior corresponding period. Net income for the full year was $US760 million, a 95 per cent increase on the prior year. The result came in ahead of expectations and reaffirmed NWS as a quality business with robust revenue and profit drivers.

SELL RECOMMENDATIONS

Appen (APX)

The share price of this artificial intelligence company has fallen from $11.14 on January 4, 2022 to trade at $4.84 on August 11. In a first half 2022 update, the company flagged falls in unaudited group revenue and underlying EBITDA. Weaker digital advertising demand and customers reducing their spending are concerns.

Bega Cheese (BGA)

The company retains normalised fiscal year 2022 EBITDA guidance of between $175 million and $190 million. However, fiscal year 2023 normalised EBITDA guidance is between $160 million and $190 million, which has disappointed the market. Passing on milk cost increases to customers is a key headwind. The share price has fallen from $5.60 on January 4, 2022 to trade at $3.815 on August 11.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.