Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

Goodman Group (GMG)

Goodman is an industrial property group. Recently rising bond yields and exposure to Europe are short-term concerns. However, over the longer term, we believe GMG now presents a good buying opportunity given near full occupancy and a development pipeline of about $13 billion. In our view, earnings per share growth guidance of about 11 per cent is conservative.

Healius (HLS)

The healthcare company benefited from extensive COVID-19 testing. In our opinion, the COVID-19 testing boom has subsided. But we expect the pathology arm to perform well as elective surgery restrictions are ending. We believe the company offers a cheap entry point for a quality defensive stock with a decent yield. The company’s share price has fallen from $5.17 on January 4 to trade at $3.355 on November 10.

HOLD RECOMMENDATIONS

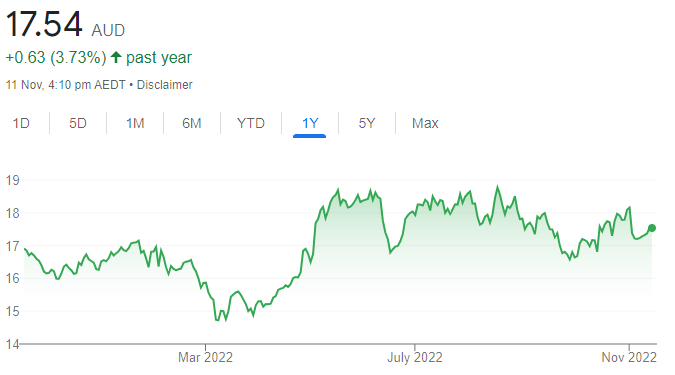

BHP Group (BHP)

The global miner posted record underlying EBITDA of $US40.6 billion in fiscal year 2022, up 16 per cent on the prior corresponding period. A concern is possibly softer commodity prices if higher interest rates slow down global economies. The stock has risen from $37.98 on November 3 to trade at $40.52 on November 10. In our view, BHP is trading on an undemanding price/earnings multiple.

ResMed Inc (RMD)

This medical device maker is benefiting from competitor Philips announcing a product recall last year and the consequences that have followed. Acquiring German software company MediFox Dan lifts leverage. RMD is trading around fair value, in our view.

SELL RECOMMENDATIONS

Woodside Energy Group (WDS)

The energy giant delivered record production and revenue in the third quarter ending September 30, 2022. But our concerns are possibly slowing economies in Europe and the US and potentially softer crude oil prices. The stock has risen from $22.77 on January 5 to trade at $38.15 on November 10. We believe the stock may be nearing a peak. Investors may want to consider taking some profits.

Amcor PLC (AMC)

The packaging giant reported increasing net sales in the first quarter of fiscal year 2023. However, the net interest expense was higher due to rising interest rates. The company is forecasting largely flat earnings per share on a reported basis in fiscal year 2023. The shares closed at $14.74 on March 7. Investors may want to consider cashing in some gains.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

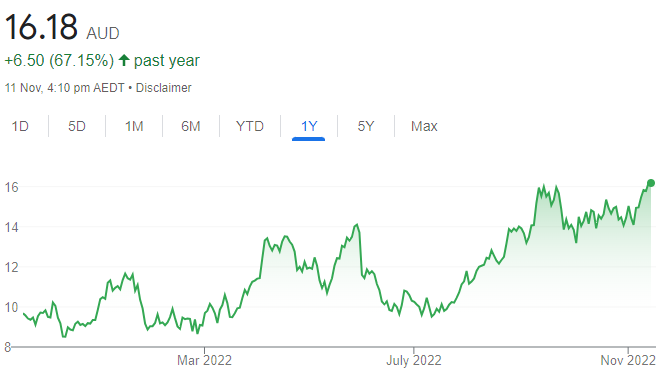

Allkem (AKE)

Allkem is a lithium chemicals company. We have reduced our earnings forecasts due to lighter production. Despite this, the stock continues to show valuation support, based on a recent price to net present value multiple of 0.76 times. Anticipated growing free cash flow yields of 5 per cent to 17 per cent between fiscal years 2023 and 2025 also appeals. There’s no stress on the balance sheet.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Brambles (BXB)

This global logistics supply company recorded a strong start to fiscal year 2023. On a constant currency basis, September quarter sales grew by 14 per cent. Management expects sales to grow between 7 per cent and 10 per cent on a constant currency basis in fiscal year 2023. Management reiterated underlying profit growth of between 8 per cent and 11 per cent on a constant currency basis in fiscal year 2023.

HOLD RECOMMENDATIONS

ResMed Inc (RMD)

The medical device maker delivered a strong September quarter result, with revenue increasing 5 per cent to $US950.3 million. Gross margins expanded 90 basis points to 56.9 per cent. Strong US device sales were supported by an improving supply of its card-to-cloud (C2C) device, which signals supply constraints have eased.

South32 (S32)

September quarter output from the Sierra Gorda copper mine in Chile and from its manganese operations were 7 per cent ahead of our forecasts. However, other operations, particularly metallurgical coal, were softer than expected, in our view. We remain cautious about the global GDP growth outlook. Any material slowdown would impact commodity prices.

SELL RECOMMENDATIONS

Woolworths Group (WOW)

We continue to see downside risks to the earnings outlook and the multiple for this supermarket giant. We have reduced our earnings per share forecasts between 3 per cent and 4 per cent, primarily due to challenges in the New Zealand business. The share price has fallen from $39.39 on August 17 to close at $33.75 on November 10.

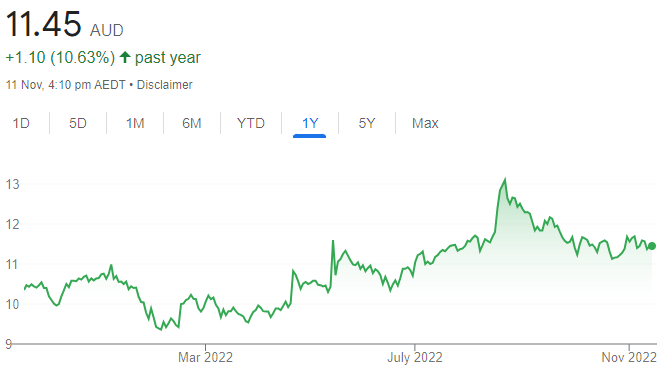

Lynas Rare Earths (LYC)

The 2023 first quarter update was weak, in our view. About 16 days of lost production was caused by a water supply outage at its Malaysian plant. Sales revenue fell from $294.5 million in the 2022 fourth quarter to $163.8 million in the first quarter of fiscal year 2023. Kalgoorlie project capital costs are forecast to increase by 15 per cent to $575 million.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

Collins Foods (CKF)

The KFC owner is positioned to grow sales volumes while passing on higher costs and retaining margins. KFC Australia has recently increased prices and there’s room for more once new poultry contract pricing is set at a later date. The continuing rollout of Taco Bell franchises in Australia provides an additional growth stream. We have an overweight rating.

PeopleIn (PPE)

PPE provides human resources outsourcing and contract staffing to a diverse range of sectors, including health and community services, early learning, government and manufacturing. PPE is benefiting from a tight labour market. PPE is also attractive for its positioning in defensive sectors, which are expected to experience strong growth over the long term. We hold an overweight rating.

HOLD RECOMMENDATIONS

Lovisa Holdings (LOV)

This fast fashion jewellery retailer has a history of impressive sales growth via its online presence and physical stores, which have increased from 208 in 2014 to more than 600 today. Although growth is expected to continue for some time, the shares are appropriately priced at this point, in our view. We hold a market weight rating.

Adairs (ADH)

In the past few years, this furniture and homewares company acquired retailers Mocka and Focus on Furniture. Although the acquisition strategy makes sense in the long term, Mocka has been a drag on company performance. Consumers are becoming more cautious about their spending. We hold a market weight rating.

SELL RECOMMENDATIONS

Appen (APX)

For many years, APX benefited from big international technology companies increasing data management services used in machine learning and artificial intelligence. However, consumers are now more reluctant to share data and the big technology companies are cautious about spending. This may be a headwind for some time, in our view. We have an underweight rating.

Bravura Solutions (BVS)

BVS provides software services to the wealth management and funds administration industries. We have been cautious about Bravura for some time, as customers have been opting for partial software upgrades rather than full system upgrades. The recent business update, which led to a sharp decline in the share price, suggests there are issues to be addressed, such as higher operating costs and growing more revenue. We have an underweight rating.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.