Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Challenger (CGF)

This financial services firm provides retirement products to investors, such as annuities and other income funds. A key feature of these products is they distribute cash flow and protect against market movements and inflation risks. Such products appeal for their stability, particularly during times of market volatility. The dividend yield was recently 3.7 per cent. Our 12-month price target is $7.74.

Silk Logistics Holdings (SLH)

The company provides port logistics, warehousing, wharf cartage, distribution and supply chain services in capital cities across Australia. SLH utilises an asset light, technology-enabled, flexible business model that guards against increasing costs as they are passed through to customers with a margin. The company generated revenue of $182.5 million in the 2022 first half, an 18.5 per cent increase on the prior corresponding period. The full year outlook is for solid growth. Our 12-month price target is $3.31 a share.

HOLD RECOMMENDATIONS

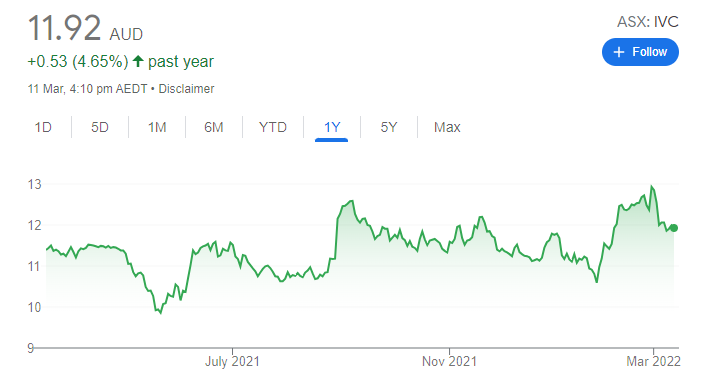

InvoCare (IVC)

We retain a positive long term view on this funeral services provider given an ageing population. The company’s fundamentals are sound. However, recent share price strength since late January leaves IVC near fully priced, in our view. Consequently, we downgrade from an add recommendation to a hold. We will review our rating should the share price weaken.

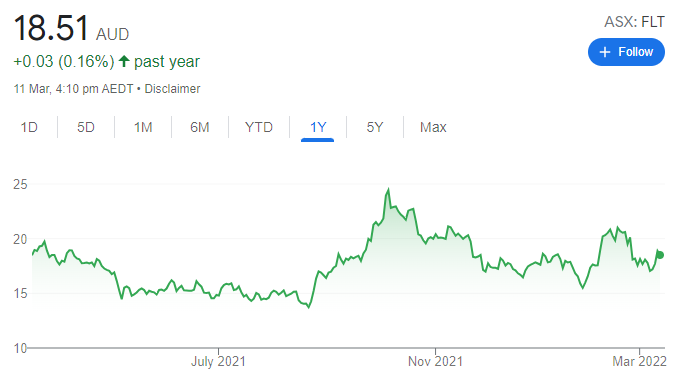

Flight Centre Travel Group (FLT)

The global travel agency’s first half underlying 2022 EBITDA loss was worse than consensus estimates. This is despite a stronger top line revenue performance. However, management is confident about travel returning to pre-COVID-19 levels by 2024. The stock is trading broadly in line with our price target, so we retain a hold rating.

SELL RECOMMENDATIONS

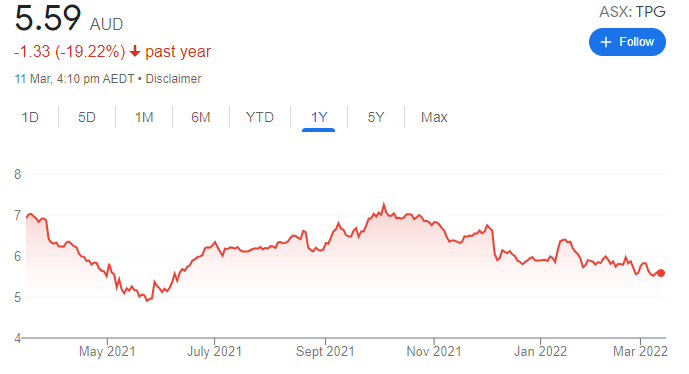

TPG Telecom (TPG)

Several one-off and upfront initiatives have accelerated capital expenditure, causing our short term numbers to decline. We acknowledge TPG is investing to grow the business and these outcomes will create long term value. But, in the short term, we have downgraded our recommendation to trim positions.

Delorean Corporation (DEL)

DEL generates renewable energy and is an energy retailer in Australia and New Zealand. It reported a 2022 first half loss of almost $2.3 million, as the business was impacted by COVID-19. We expect DEL will continue to experience a challenging operating environment in the second half. The company’s balance sheet has also tightened, with the cash balance falling to $4 million on significant operating outflows in the first half. Investors may want to consider trimming their positions.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Chimeric Therapeutics (CHM)

CHM is a clinical stage cell therapy company. The company recently reported encouraging results from the phase 1 trial of its CORE NK platform in blood cancers and solid tumours. According to CHM, the trial saw all three patients treated with blood cancers achieve a best response of stable disease at day 28. CHM is a speculative buy. The shares were trading at 15.5 cents on March 10.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

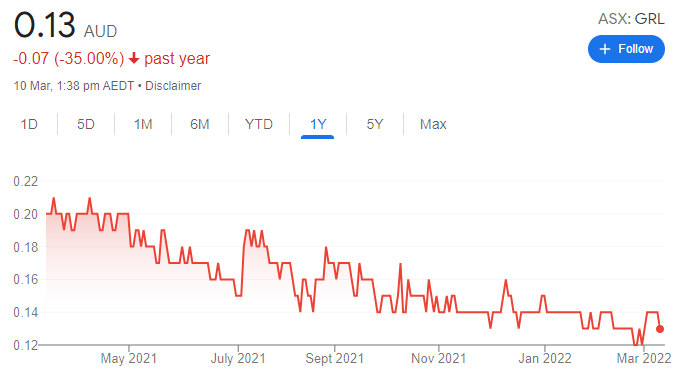

Godolphin Resources (GRL)

This New South Wales focused gold, copper and base metals explorer has announced a farm-in agreement for the Narraburra Rare Earth Element (REE) Project. It’s been identified as one of Australia’s largest zirconium, REE and rare metal resources that also hosts significant amounts of lithium. The Australian Trade and Investment Commission list it as a critical minerals project. Results from recent drilling at the Gundagai Gold project are anticipated shortly.

HOLD RECOMMENDATIONS

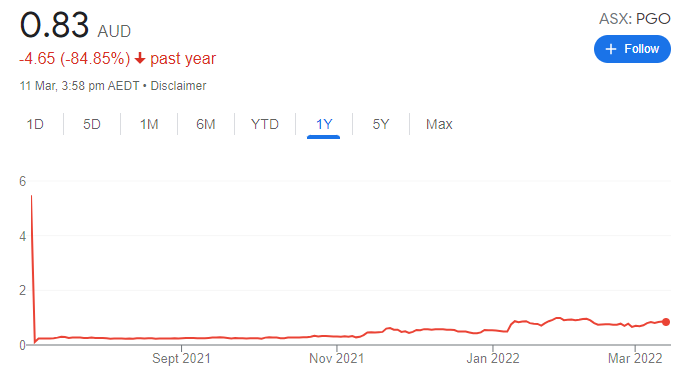

Pacgold (PGO)

PGO announced a significant expansion of the high grade F1a Zone at the Alice River Gold Project in North Queensland. Results include 43 metres at 3 grams a tonne gold, including 6 metres at 17.5 grams a tonne gold, with 1 metre at 79.1 grams a tonne gold. PGO is expanding its 2022 drilling program, with two drill rigs ready to resume towards the end of the wet season. We view PGO as a highly speculative growth opportunity in the gold sector.

Mako Gold (MKG)

Mako Gold has substantial gold interests in Cote d’Ivoire in West Africa. It recently reported encouraging drilling results at the Tchaga and Gogbala prospects. A mineral resource estimate is expected in the June half of 2022, following 60,000 metres of drilling at both prospects. Several high grade gold targets have been identified at the Korhogo project, with drilling expected to start in April 2022. We regard MKG as a growth opportunity in the gold sector.

SELL RECOMMENDATIONS

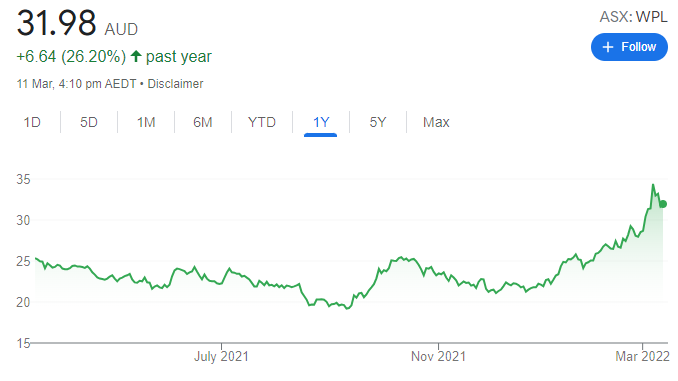

Woodside Petroleum (WPL)

The Russian and Ukraine conflict has seen the crude oil price spike above $US100 a barrel, sparking renewed interest in the energy sector. WPL’s share price recently touched a two-year high. The strong share price performance provides an opportunity for investors to consider locking in a part profit.

Genworth Mortgage Insurance Australia (GMA)

GMA reported a statutory net profit after tax of $192.8 million for the year ending December 31, 2021. Net profit after tax was underpinned by a strong underwriting result of $295.8 million. The result was driven by high dwelling price growth, falling delinquencies and low numbers of mortgages in possession. We’re expecting the property market to slow given higher interest rates are on the horizon.

Peter Moran, Wilsons

BUY RECOMMENDATIONS

Silk Laser Australia (SLA)

The laser clinic operator delivered a positive first half 2022 result despite the negative impacts from COVID-19. The company also benefited from the acquisition of Australian Skin Clinics (ASC), which moved under SLA’s control in September. The 56 ASC clinics are being smoothly integrated and provide a growth opportunity in Victoria and New Zealand, which had been previously missing from SLA’s footprint. We hold an overweight recommendation.

Integral Diagnostics (IDX)

This diagnostic imaging services company recently undertook a $90 million capital raising to fund the acquisition of Peloton Radiology. First half 2022 operating net profit after tax was down 21.7 per cent on the prior corresponding period. The result was impacted by COVID-19 restrictions. However, with restrictions easing, we expect profitability to recover as margins improve and recent investments in their business start to produce a return. We hold an overweight recommendation.

HOLD RECOMMENDATIONS

Costa Group Holdings (CGC)

In our view, CGC reported a solid fiscal year 2021 result given the challenges the company faced earlier in the year. As Australia’s largest grower, packer and marketer of fresh fruit and vegetables, Costa was able to manage supply chain and labour conditions more effectively than smaller competitors. The company expects an improving outlook in 2022. We view the shares as appropriately valued at current prices. We hold a market weight rating.

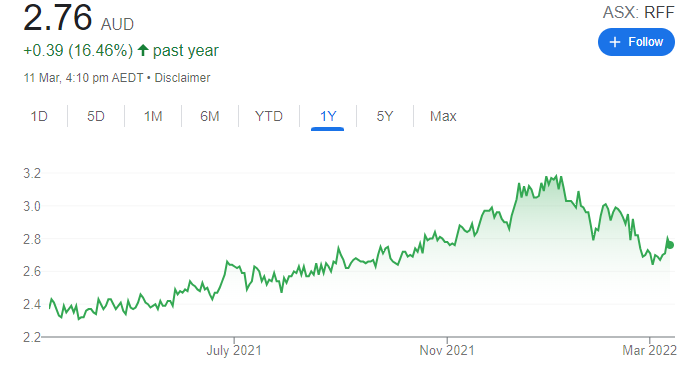

Rural Funds Group (RFF)

This real estate investment trust produced a solid half year result for the six months ending December 31, 2021. The company’s recent acquisition of macadamia properties is a shrewd move. Leasing two cattle properties to Australian Agricultural Company is evidence of their appeal. At recent prices, RFF shares were yielding marginally above 4 per cent. We hold a market weight rating, as the shares are fairly valued.

SELL RECOMMENDATIONS

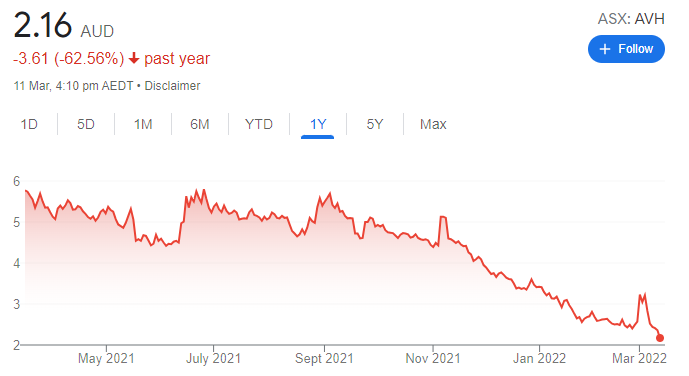

Avita Medical Inc. (AVH)

This regenerative tissue company has developed and commercialised its RECELL product for treating burns. The valuation multiples of other wound care companies have been falling. AVH faces challenges in this environment as the company recently reported a net loss. Profitability is still a considerable time away, in our view. We hold an underweight rating.

Bravura Solutions (BVS)

This provider of wealth management and funds administration software reported a first half 2022 result that was below previous guidance and market expectations. The company cited delayed revenue growth as the issue. Increasing labour and cloud costs present challenges. In today’s market, we believe there are more attractive alternatives. We hold an underweight rating.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.