Elio D’Amato, Spotee Connect

BUY RECOMMENDATIONS

West Wits Mining (WWI)

WWI has approval for its 4.3 million ounce Witwatersrand Basin Project, and is expected to produce later this month. South Africa is a good mining jurisdiction and the Witwatersrand area has a long history of delivering gold. Exploration drilling at the Mt Cecelia project should start this year. Reducing risks leaves the stock as a better buy today than six months ago, in my view.

Strandline Resources (STA)

The company recently announced that first production of heavy mineral concentrate from its Coburn Mineral Sands Project is set for the December 2022 quarter. Construction work is half completed and buoyant commodity prices are generating positive sentiment for the 20-year mine. Further potential exists from the Fungoni and Tajiri mineral sands projects in Tanzania.

HOLD RECOMMENDATIONS

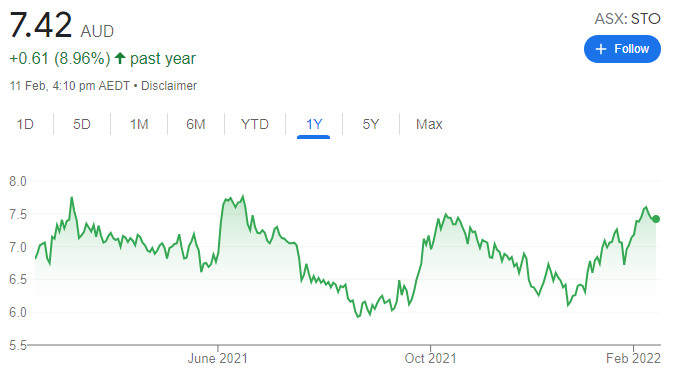

Santos (STO)

The merger with Oil Search puts Santos in a strong position. In the latest quarterly update, Santos achieved record sales and free cash flow. The company’s plan to cut several minor projects should result in lower auxiliary costs. The $US3.6 billion Barossa gas project off northern Australia is 20 per cent completed. Santos is also developing a carbon capture and storage project at Moomba in South Australia.

Imdex (IMD)

This mining technology business delivered a strong half year result, reporting record revenue and profit. IMD has $30 million in the bank. Investors were also treated to a dividend of 1.5 cents, a 50 per cent increase on the prior corresponding period. The company has started the second half of 2022 strongly, with sales growth across its divisions.

SELL RECOMMENDATIONS

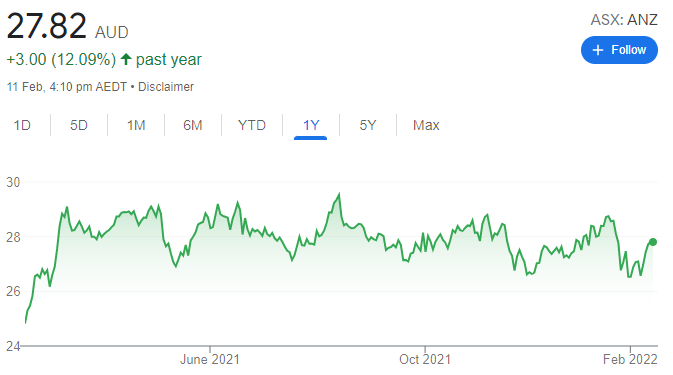

ANZ Bank (ANZ)

Competition is starting to impact ANZ, with a recent quarterly update highlighting a falling group net interest margin and new product mix reducing profitability. We’re expecting a weaker half year result in May. The potential for a larger buy-back may tempt investors to hold. But meeting challenges will take time, so investors may want to consider cashing in some gains.

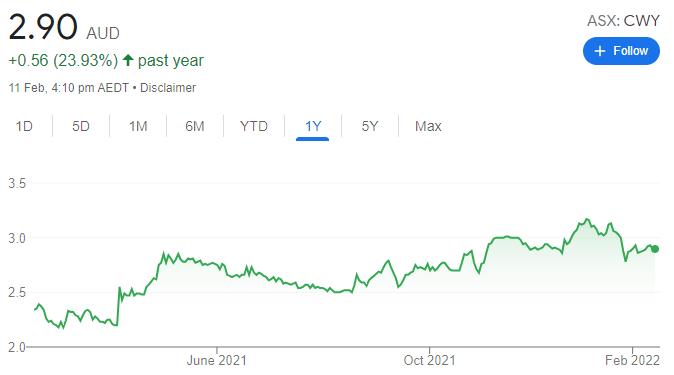

Cleanaway Waste Management (CWY)

The company has endured challenging times due to the Omicron variant. Investors will learn whether the pandemic impacted first half 2022 results when the company plans to report on February 17. While any impact is expected to be short term, we would prefer to be on the sidelines prior to the result.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Woodside Petroleum (WPL)

We expect WPL to benefit from the proposed merger with BHP Group’s oil and gas portfolio. WPL is a quality operator. Synergies are yet to be included into proposed deal metrics. The deal is transformative, lifting WPL into the top 10 global petroleum players – with growth options. WPL posted sales revenue of $2.852 billion in the 2021 fourth quarter, up 86 per cent on the third quarter.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

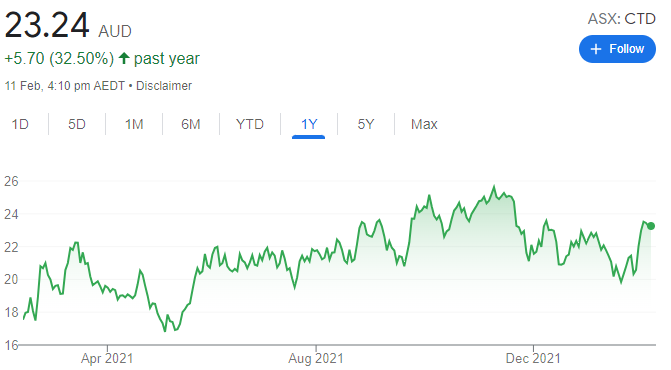

Corporate Travel Management (CTD)

CTD remains our key pick in the travel sector. CTD has a higher than average level of exposure to essential and domestic travel. In future, the company is expected to generate higher market share than pre-COVID-19 levels. Also, a lower cost base is anticipated. The balance sheet is strong and CTD has plenty of liquidity. Key share price catalysts include borders re-opening and the execution of a highly accretive acquisition in Helloworld Corporate.

HOLD RECOMMENDATIONS

Macquarie Group (MQG)

This diversified financial services firm recently posted a record third quarter result. We still see MQG as relatively inexpensive and continue to like its exposure to long-term structural growth sectors, such as infrastructure and renewables. The company has a strong track record and should continue to seize opportunities moving forward.

Endeavour Group (EDV)

The company’s liquor outlets benefited from lockdowns at the expense of its hotels business. Re-opening of venues in New South Wales and Victoria is positive for the company moving forward. The hotel portfolio is a higher margin business than the retail arm.

SELL RECOMMENDATIONS

Monadelphous Group (MND)

Labour pressures are likely to persist into full year 2022 for this engineering services group, in our view. Management has previously highlighted that border restrictions in its key Western Australian market are resulting in challenges to accessing skilled labour, as well as impacting operational productivity levels. Competing for labour is challenging given demand.

Temple & Webster Group (TPW)

This online furniture, homewares and other lifestyle products company posted a significant increase in revenue in the first half of fiscal year 2022. However, moving forward, we believe the discretionary retail space remains a challenging environment at this point. It has much competition. And higher interest rates in Australia are on the horizon.

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

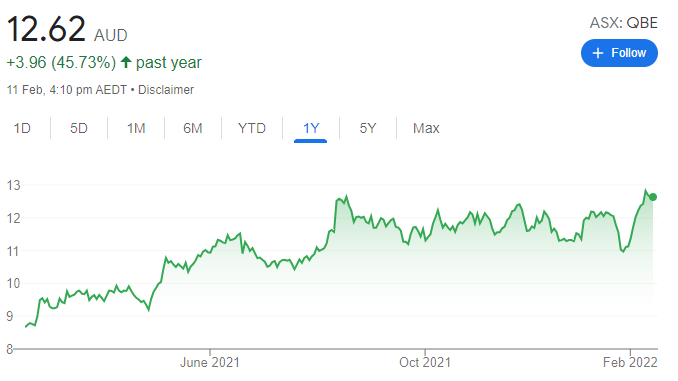

QBE Insurance Group (QBE)

QBE’s investment portfolio benefits when interest rates rise. And, the market is pricing in higher interest rates. Premium revenue has been growing. Margins have been increasing. The shares have risen from $10.97 on January 27 to close at $12.69 on February 10. We like the company’s outlook. QBE plans to report full year results on February 18.

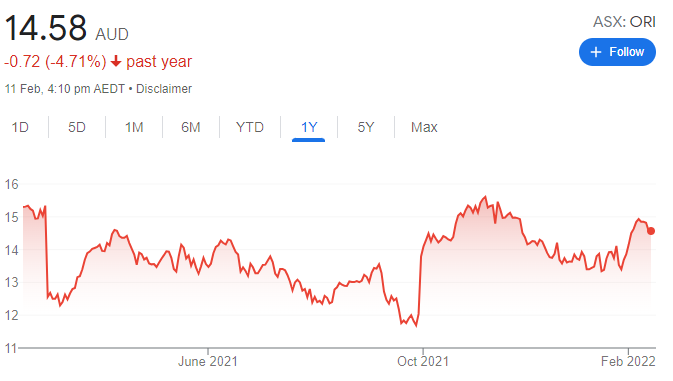

Orica (ORI)

We expect this explosives supplier to benefit from Russia banning exports of ammonium nitrate until April. Ammonium nitrate is a major component in explosives. We expect Orica to benefit from higher ammonium nitrate prices. The company should be able to leverage higher prices as contracts roll over in the next 12 months.

HOLD RECOMMENDATIONS

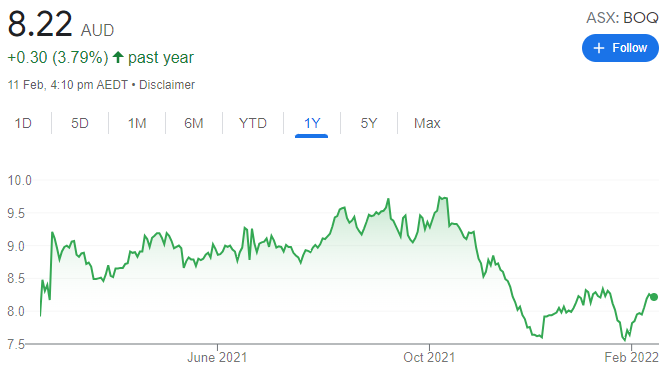

Bank of Queensland (BOQ)

Housing growth has remained strong in Australia. While concerns exist around BOQ’s net interest margin, the company has reaffirmed fiscal year 2022 positive guidance of at least 2 per cent, so income should grow more than expenses. At these prices, BOQ looks cheap and offers an attractive dividend yield.

James Hardie Industries PLC (JHX)

This global building products company has benefited from strong housing markets. The company recently upgraded forecasts for fiscal year 2023. Momentum is strong. Macro concerns remain about the impact of potentially rising interest rates on housing markets. Despite strong fundamentals, macro concerns are holding back the share price.

SELL RECOMMENDATIONS

Zip Co (Z1P)

Competition in the buy now, pay later space is fierce. This has meant higher marketing costs to achieve growth. Unwinding of stimulus in the US may impact this business. Z1P’s share price has fallen from $10.78 on February 11, 2021 to finish at $3.07 on February 10, 2022. It’s difficult for us to find sufficient positive near term catalysts for the company in an over-crowded market.

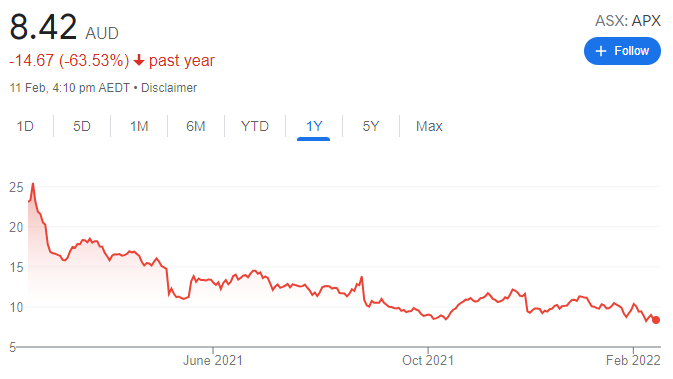

Appen (APX)

Appen is involved in data annotation. In the past, this has been an advantage, as Appen grew with the big technology companies. Appen is now up against increasing competition involving investment in artificial intelligence and data annotation. In my view, it needs a big jump in second half earnings to meet expectations. Appen is due to report on February 24.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.