Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

BUY – South32 (S32)

South32 is a diversified mining and metals company. Commodities include aluminium, alumina, manganese, nickel, silver and coal. The company offers exposure to commodities that play a vital role in powering the green energy transition. S32 is reducing costs and has a strong balance sheet. We see robust free cash flow generation beyond fiscal year 2023 that potentially generates bigger returns.

BUY – Lendlease Group (LLC)

The company provides property and infrastructure solutions in Australia, Asia, Europe and the Americas. Our buy recommendation rests on the profitable delivery of the $17.9 billion development pipeline supporting a recovery in earnings. We’re positive on LLC given the business is now approaching target returns in fiscal year 2024. We see a path to fund the pipeline via capital partnerships and asset sales.

HOLD RECOMMENDATIONS

HOLD – Fortescue Metals Group (FMG)

The iron ore producer is performing at the top end of expectations. The company shipped 48.9 million tonnes of iron ore in the fourth quarter of fiscal year 2023. It contributed to record shipments of 192 million tonnes for the full year. In our view, uncertainty about capital allocation and returns from Fortescue Future Industries and the Belinga iron ore project in Gabon leaves us cautious.

HOLD – CSR Limited (CSR)

CSR is a diversified building products company with key operations in Australia and New Zealand. It makes plasterboard, insulation and bricks among other products. We believe the company can navigate tighter financial conditions due to increasing residential work and mid-to-late cycle exposure.

SELL RECOMMENDATIONS

SELL – Costa Group Holdings (CGC)

CGC is Australia’s largest horticultural company. Diversified operations across the supply chain include farming, packing, marketing and distributing fresh fruit and vegetables. On May 31, Paine Schwartz Partners lodged a confidential, non-binding indicative proposal to acquire the remaining shares in CGC that it didn’t already own for $3.50 cash. The shares have rallied since the proposal, so investors may want to consider selling now at the latest market price. At August 10, 2023, it remains uncertain whether any transaction will proceed.

SELL – Bega Cheese (BGA)

BGA makes and distributes dairy and associated products to Australian and international markets. The company recently confirmed normalised EBITDA guidance to be at the low end of a range of between $160 million and $190 million for fiscal year 2023. Elevated farm gate prices may impact the company’s bulk dairy business. Excess processing capacity persists. Bega expects to book a non-cash impairment charge of between $180 million and $280 million.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

BUY – Silk Logistics Holdings (SLH)

This integrated logistics provider has entered into a binding agreement to acquire Secon Freight Logistics for $35 million. Secon generates more than $65 million in annual revenue. The acquisition is expected to be more than 10 per cent earnings accretive in the first year. It will provide SLH with a stronger position in the Victorian port logistics market and access to the bulk logistics market. Growth potential exists. The transaction is expected to be completed on September 30, 2023. Our 12-month share price target is $3.45.

BUY – Domino’s Pizza Enterprises (DMP)

Our confidence is growing in an earnings recovery for this fast food giant. Early signs show a turnaround in the company’s trading performance. Despite wages growth headwinds, prior food inflation has reversed in most countries and cost-out plans are expected to sustain margins. The shares have risen from $44.69 on August 7 to trade at $51.13 on August 10. Our valuation is $60.

HOLD RECOMMENDATIONS

HOLD – Atturra (ATA)

In a recent update, unaudited fiscal year 2023 revenue is expected to range between $176 million and $179 million, up more than 30 per cent on the prior corresponding period. Securing more customers in the Asia Pacific region contributed to the result for this technology services business. The company’s plan is working well. Unaudited earnings before interest and tax of between $16.3 million and $16.6 million is up more than 30 per cent on the prior corresponding period.

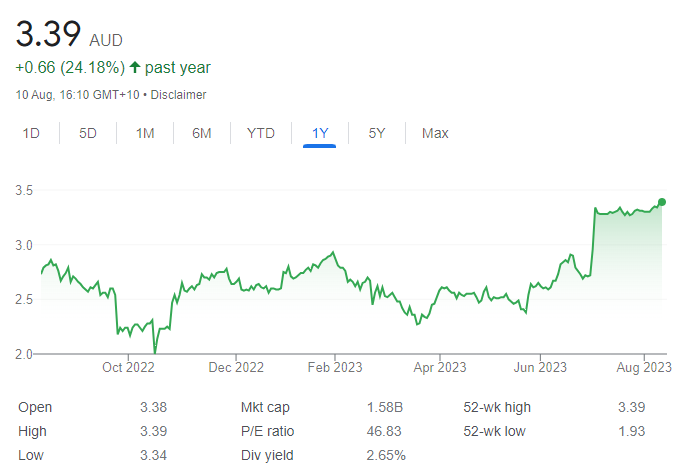

HOLD – Pilbara Minerals (PLS)

This lithium mining company recently upgraded its resource estimate by 36 per cent to 414 million tonnes at the Pilgangoora mine. Mineral quality has been sustained. The share price has risen from $3.11 on August 11, 2022 to trade above our $5 valuation on August 10, 2023. We retain a hold recommendation, as the lithium outlook is robust.

SELL RECOMMENDATIONS

SELL – Amcor PLC (AMC)

The share price of this global packaging company has fallen from $17.94 on August 11, 2022 to trade at $14.91 on August 10, 2023. Earlier this year, the company posted an earnings downgrade in response to slower consumer spending. Investors may want to consider trimming their positions ahead of full year results planned for this week.

SELL – Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. In the past 12 months, EDV has faced challenges from customers experiencing soaring cost-of-living pressures on top of higher interest rates. Moving forward, the company is exposed to consumers further cutting their spending to meet higher mortgage repayments, rents, power bills and other charges. It may be prudent for investors to trim their positions.

Toby Grimm, Baker Young

BUY RECOMMENDATIONS

BUY – Mineral Resources (MIN)

This mining services company has updated agreements with Albemarle Corporation. Albemarle will take full ownership of the Kemerton lithium hydroxide plant. MIN will no longer invest in any Chinese conversion assets with Albemarle. It won’t make any payments to Albemarle for joint downstream investments. We see the decision as prudent, which improves operational flexibility and takes significant pressure off MIN’s balance sheet as it funds the Ashburton iron ore growth project. The arrangements depend on approval from the Foreign Investment Review Board. MIN announced it would enter a transitional tolling arrangement with Albemarle to convert Wodgina spodumene until June 30, 2024.

BUY – RPMGlobal Holdings (RUL)

RUL develops and provides software and advisory services to the mining industry, including professional development. RUL delivered an impressive 2023 earnings update in July. The update revealed strength across all divisions, particularly in the newly acquired advisory services unit. We see a long growth runway given the structural trend towards net zero emissions and reducing the environmental impacts within the mining industry.

HOLD RECOMMENDATIONS

HOLD – Charter Hall Group (CHC)

CHC is a property investment management company. The share price has fallen from $21.61 on December 13, 2021 to trade at $10.605 on August 10, 2023. We believe CHC’s unit price reasonably reflects risks of further downside in property values, particularly office, and management fee income. CHC boasts a globally recognised name and tier one portfolio of assets. It was recently trading at a discount of more than 30 per cent to our valuation.

HOLD – Block Inc. (SQ2)

Shares in this payments company fell sharply despite June quarter results reflecting strong growth in the Cash App and Square businesses, with careful cost control helping margins. While the stock trades on a lofty price/earnings multiple, the demonstrated resilience of growth during recent periods is encouraging and suggests SQ2 is worthy of holding.

SELL RECOMMENDATIONS

SELL – AGL Energy (AGL)

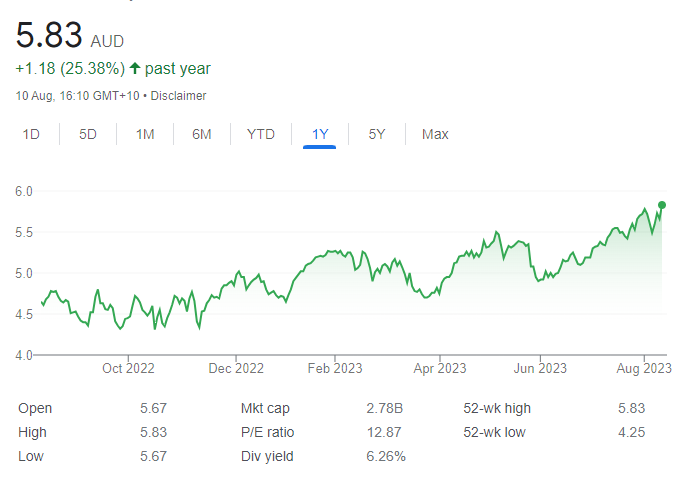

The energy giant has delivered exceptional returns in the past 12 months. Regulatory actions and improving energy prices have driven up earnings forecasts in fiscal year 2023 and guidance in fiscal year 2024. However, in our view, several short-term earnings drivers are set to peak in 2024. The stock has reached our valuation, so investors may want to consider taking part profits.

SELL – James Hardie Industries PLC (JHX)

This building materials company delivered outstanding investor returns in 2023. It significantly outperformed the materials sector and S&P/ASX 200 index on hopes of a recovery in the US market. Recent quarterly results were marginally ahead of expectations. But with US mortgage rates rising and the stock trading above our valuation, we believe locking in a portion of the recent outperformance is prudent.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.