John Anderson, Bell Potter Securities

BUY RECOMMENDATIONS

Aristocrat Leisure (ALL)

Aristocrat generates revenue from leasing and selling poker machines to venues. It also continues to invest in expanding its digital gaming pipeline. It has a dominant market position in North America. Aristocrat is included in our top 10 recovery stocks post COVID-19. The share price has enjoyed a strong 12 months and we expect positive momentum to continue moving forward.

Aeris Resources (AIS)

AIS own the Tritton copper operations in New South Wales and the Cracow gold mine in Queensland. The company is now debt free after a determined effort. It has $70 million in cash on its balance sheet and is well capitalised. It offers exposure to copper and gold producing assets and exploration success emerging at Tritton. There’s potential for the mine life at Tritton to be materially extended.

HOLD RECOMMENDATIONS

Appen (APX)

APX provides language technology and data services to business and government. First half group revenue of $US196.6 million was down 2 per cent on the prior corresponding period. Appen recently downgraded its calendar year 2021 guidance. However, cash between December 31, 2020 and June 30, 2021 rose to $US66 million. It had no debt. Keep an eye on the news flow.

Uniti Group (UWL)

UWL delivers fixed wireless broadband and telecommunication services. It provides a competitively priced alternative to the National Broadband Network. UWL is a solid cash generator and is well managed. We believe it’s well placed to benefit from an increasing number of households consuming more data during COVID-19 lockdowns.

SELL RECOMMENDATIONS

Metcash (MTS)

MTS is a distribution and marketing company operating in the grocery and liquor wholesaling industries. Metcash also has exposure to the hardware and home improvement markets. We believe its bigger supermarket competitors are better positioned to retain or grow their market shares at the expense of MTS and others when COVID-19 restrictions are lifted.

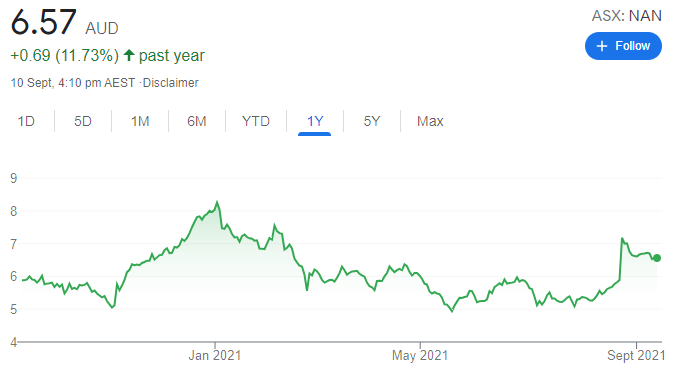

Nanosonics (NAN)

NAN developed and commercialised the trophon device to prevent infection in hospitals and clinics. The company recently reported a reasonable full year 2021 result. Revenue grew, but, in our view, increasing operating expenses are impacting profitability. The company expects to grow earnings in fiscal years 2023 and 2024. But we don’t believe future earnings can justify a recent forecast 12 month price/earnings multiple of almost 300 times in fiscal year 2022.

Julia Lee, Burman Invest

BUY RECOMMENDATIONS

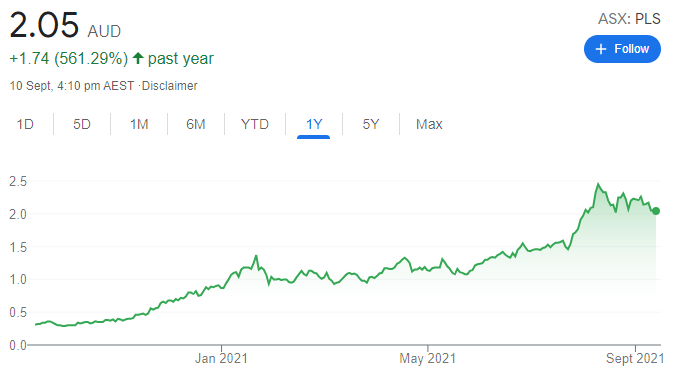

Pilbara Minerals (PLS)

This lithium miner recently announced an increase in JORC resources at its Pilgangoora project in Western Australia. An ore estimate is expected in October. Demand for lithium is rapidly increasing in response to electric vehicle growth. Low supply compared to demand for lithium is expected to support prices in the near term. PLS production growth is possible in the short term, so it’s my key pick among lithium miners.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

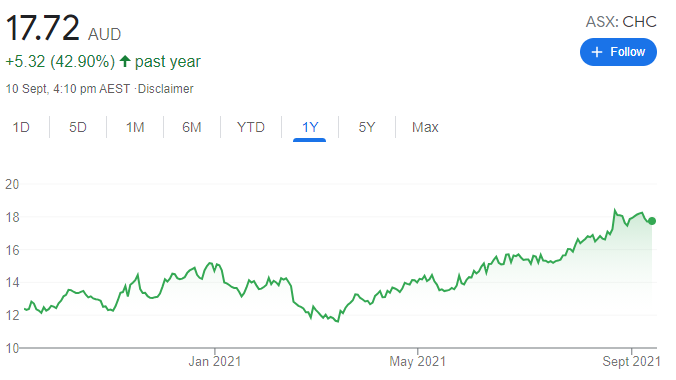

Charter Hall Group (CHC)

The company has generated strong funds under management growth in the past 12 months. The company’s pipeline is driven by office and commercial projects. Performance fees should be boosted in the next six to 12 months as a result of several outperforming funds. A combination of funds under management growth, a strong development pipeline and rising asset values should underpin the share price.

HOLD RECOMMENDATIONS

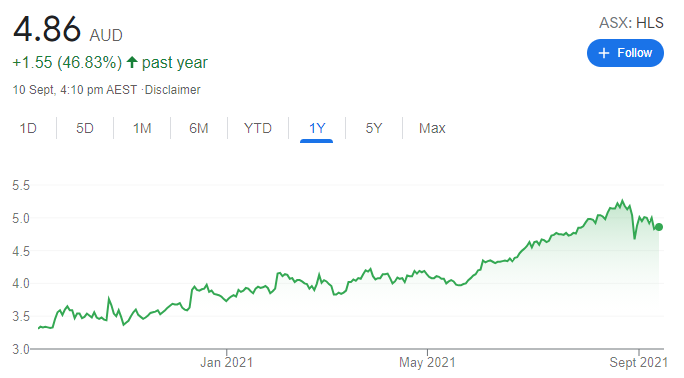

Healius (HLS)

There’s a risk of a short term price retreat as COVID-19 testing volumes may have peaked. COVID-19 testing boosted pathology revenue in fiscal year 2021. So far in fiscal year 2022, COVID-19 tests are way up on last year’s corresponding period. The company’s other businesses should continue to grow after New South Wales and Victoria emerge from lockdowns.

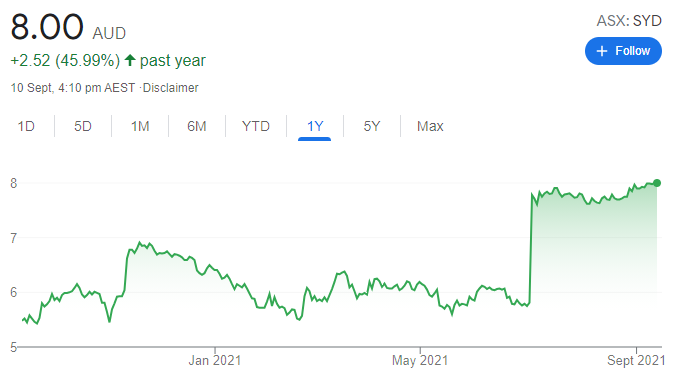

Sydney Airport (SYD)

A recovery in passenger numbers to pre-COVID-19 levels is likely to take a few years, in my view. I’m not expecting international passenger levels to return to pre-COVID-19 levels until 2023/24. Expect a domestic recovery sooner than an international recovery. The best short term outcome is another takeover bid, in my view. The last takeover bid from the Sydney Aviation Alliance was $8.45 per stapled security. The SYD board concluded the bid undervalued the company.

SELL RECOMMENDATIONS

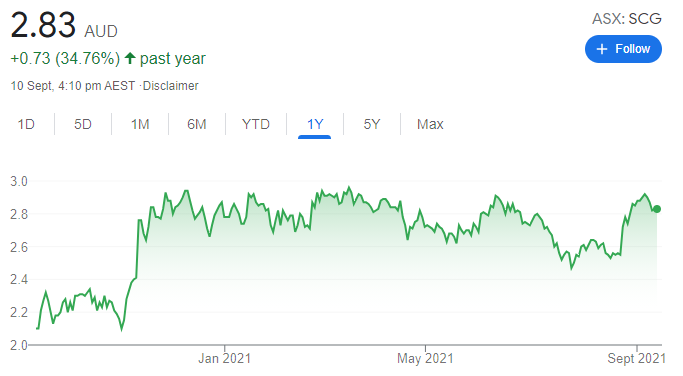

Scentre Group (SCG)

This property group owns a big portfolio of shopping centres in Australia and New Zealand. More retail outlets are likely to close as lockdowns continue. The rent outlook for shopping centre owners is weak, in my view. While bricks and mortar stores should start recovering when lockdowns lift, I see fewer retailers at that starting line. We prefer others at this point of the cycle.

The A2 Milk Company (A2M)

The infant formula company isn’t providing specific guidance. In my view, this highlights an uncertain strategy. China is focusing on domestic brands and its birth rate is struggling. A2M is unlikely to return to pre-COVID-19 levels in the short term, in my view. Expect an update on its strategy review in late October. I’m concerned about potentially lower profitability in the short to medium term if more investment is required to re-set the growth strategy.

Braden Gardiner, TradeDirect365

BUY RECOMMENDATIONS

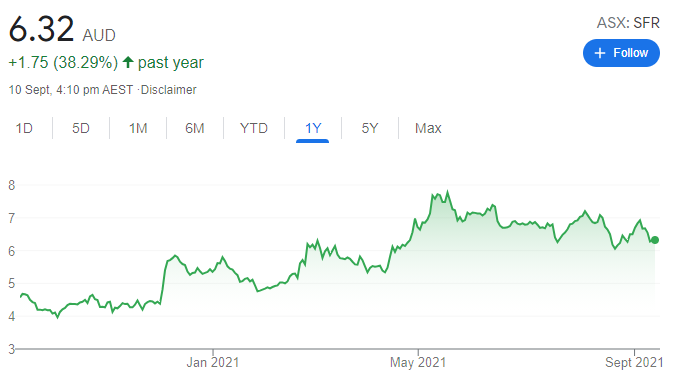

Sandfire Resources (SFR)

The share price of this copper and gold miner recently retreated from approaching high $7 levels. Buyers have been supporting the stock above $6, which is encouraging. According to our technical analysis, we expect the stock to move towards $7.50 before targeting $9. The shares closed at $6.28 on September 9.

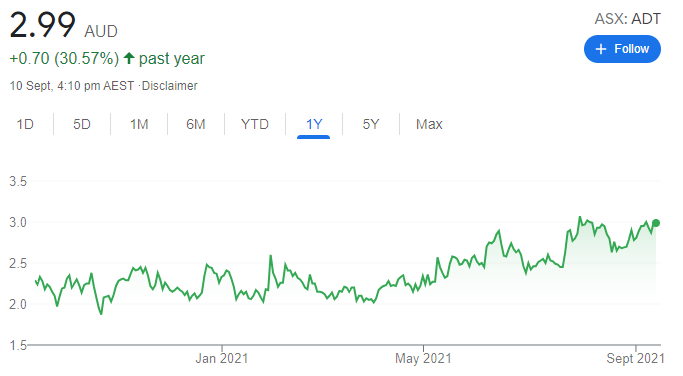

Adriatic Metals PLC (ADT)

Between August 2020 and late May 2021, this base metal explorer held a narrow range of between $2.40 and $2.60. Since late June, buyer interest has been increasing and the price has started trending higher. The shares have risen from $2.38 on June 30 to finish at $2.87 on September 9. We expect the favourable momentum to continue.

HOLD RECOMMENDATIONS

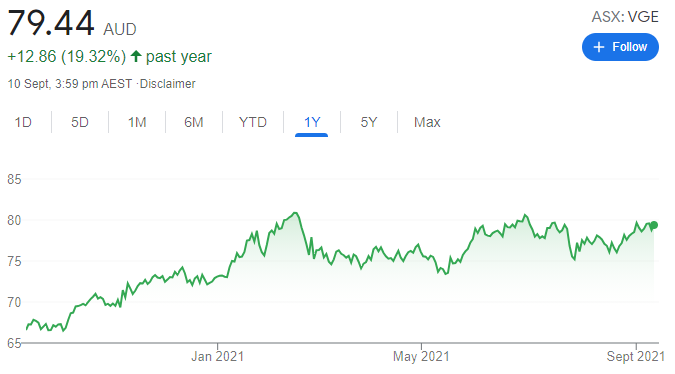

Vanguard FTSE Emerging Markets Shares ETF (VGE)

This exchange traded fund enables exposure to companies listed on emerging markets. It’s exposed to the fluctuating values of foreign currencies in the absence of hedging to the Australian dollar. Although the price has been moving higher, we’re hesitant to add more risk at these levels. We prefer to wait and see if buyers can breach recent highs of $81.36. A move above this level would provide investors with more confidence to buy.

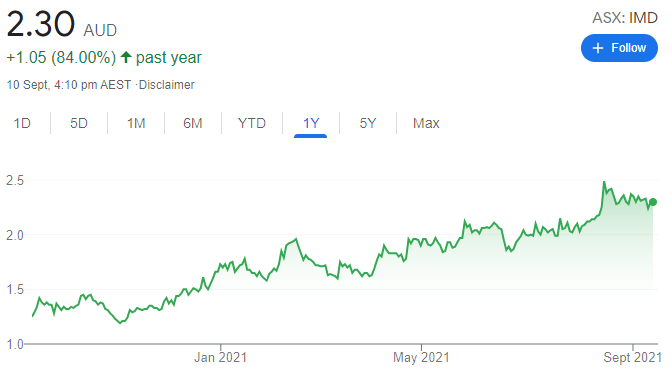

Imdex (IMD)

This mining technology company has risen from a low of 76 cents on March 25, 2020 to an intra day high of $2.63 on August 16 this year. From recent highs, the sellers moved in and took profits after full year results were released. Some investors may fear a further share price retreat, so others may need to buy for the uptrend to continue. Keep an eye on daily movements. The shares finished at $2.24 on September 9.

SELL RECOMMENDATIONS

Novonix (NVX)

In the past four months, this battery technology and materials business has enjoyed a good run up from about $2 to close at $5.54 on September 9. In my view, the stock is priced to perfection, so a pause in upward momentum may trigger some selling. Investors may want to consider locking in some gains.

Lifestyle Communities (LIC)

LIC operates land lease communities that provide affordable housing options in Australia. The share price has soared in the past 12 months to close at $21.65 on September 9. We expect support from its impending inclusion in the S&P/ASX 200. However, in my view, sustaining momentum moving forward will be a challenge given the share price rise. It may be prudent to reduce risk and lock in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.