Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

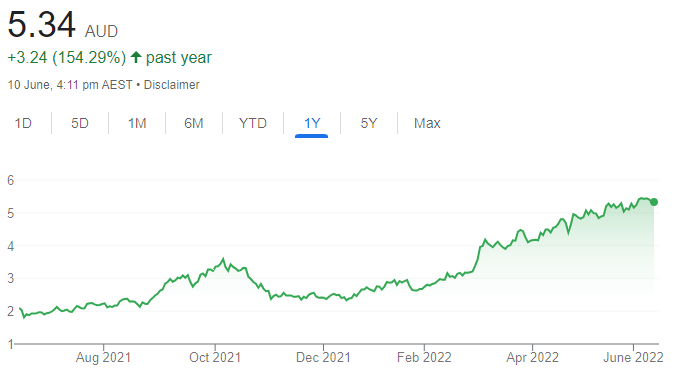

Whitehaven Coal (WHC)

Coal prices are expected to remain high due to supply constraints, and we expect this will flow through to WHC’s earnings. Despite big share price increases this year, the strong uptrend looks sustainable, as there’s no signs of it slowing at this point.

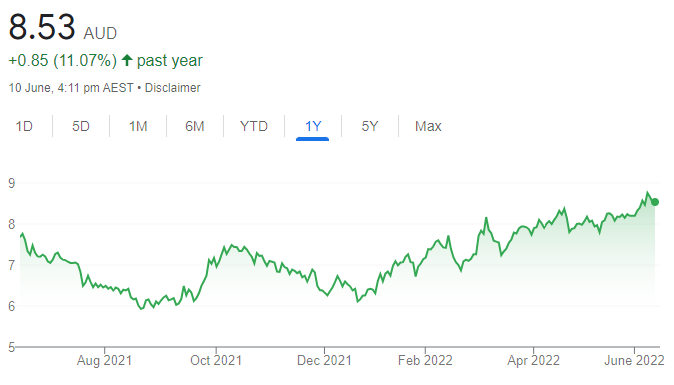

Santos (STO)

We expect gas prices to remain high this year due to the Ukraine war. It will take time for gas supplies in Australia to increase, which should lift company earnings. The share price encountered resistance near $8.40 from early March to late May. That resistance level has been breached, giving us confidence that STO should trend higher again. The shares closed at $8.66 on June 9.

HOLD RECOMMENDATIONS

CSL (CSL)

Although CSL had underperformed the S&P/ASX 200, it’s been finding good buying support in the past few months in response to recovering plasma collections across the globe. Our charting analysis indicates a low is in place, and we expect CSL’s share price to recover.

Macquarie Group (MQG)

The share price of this diversified financial services company has retreated from its recent peak due to a cautious outlook about the global economy. However, we believe MQG will attract buying support at recent levels in response to sharemarket volatility. The company has a strong track record of performance.

SELL RECOMMENDATIONS

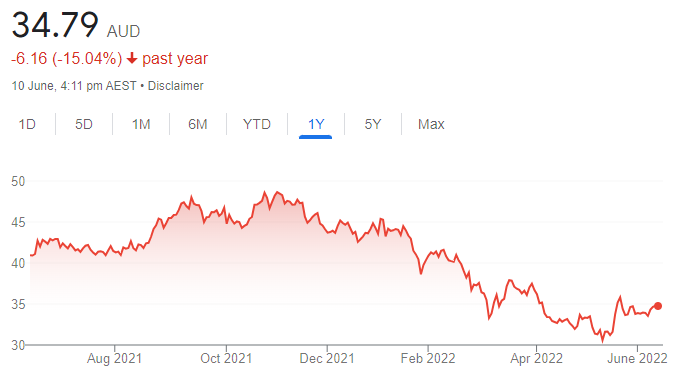

Commonwealth Bank of Australia (CBA)

CBA is our preferred bank among the majors. However, we believe the company’s valuation is too high at this point in an economy that’s likely to slow. Investors may want to consider taking some profits, and possibly buying back the stock at lower levels.

Xero (XRO)

In early May, shares in this accounting software company fell below a major support level near $90. In our view, the shares are resuming a downtrend that started in November 2021. We expect the share price to stay under pressure, as Australian and US investors remain bearish about the technology sector due to rising interest rates. The shares finished at $79.72 on June 9.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Aristocrat Leisure (ALL)

The slot machine maker remains a high quality growth business with long term opportunities, in our view. We’re forecasting 16 per cent growth in earnings before interest, taxes and amortisation in the coming year. We hold an add rating and target price of $43. The shares closed at $34.65 on June 9.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Domino’s Pizza Enterprises (DMP)

The fast food giant faces near term challenges of currency headwinds and inflation. However, the company offers growth opportunities in the key markets of Japan and Taiwan. We reiterate our add rating on DMP with a target price of $93. The stock finished at $63.70 on June 9.

HOLD RECOMMENDATIONS

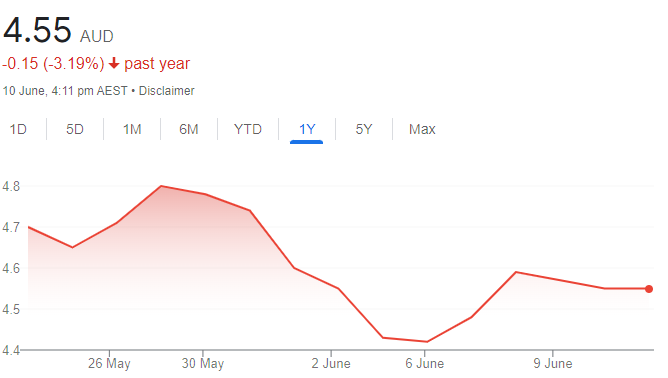

The Lottery Corporation (TLC)

TLC recently demerged from betting agency Tabcorp. TLC is one of the strongest performing lottery businesses in the world, with lengthy exclusive licences to operate across Australia, except Western Australia. Our target price is $5.40. The shares closed at $4.57 on June 9.

Woodside Energy Group (WDS)

BHP’s oil and gas portfolio has been merged with Woodside. We like the outlook for WDS in a world of high energy prices. We expect the shares to continue trading strongly. Apart from capital growth potential, the stock is supported by an attractive dividend yield.

SELL RECOMMENDATIONS

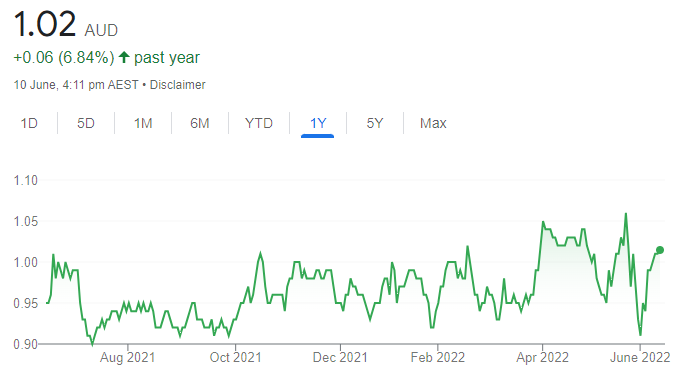

Tabcorp Holdings (TAH)

Our interest in this betting company was always about the now demerged lotteries business. We prefer the lotteries business, as we believe it offers brighter longer term prospects in the gambling sector than Tabcorp. TAH shares closed at $1.01 on June 9. Our target price is 95 cents.

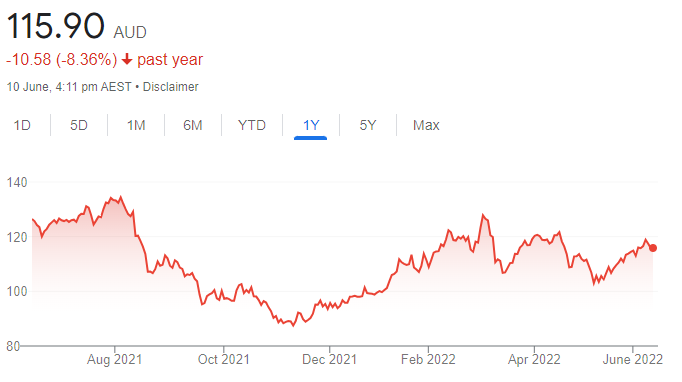

Rio Tinto (RIO)

We expect the global miner to be supported by strong revenue and its dividend yield. However, RIO is trading above our valuation. Investors may want to consider trimming their holdings rather than selling all their stock. Our target price is $114. The shares closed at $117.47 on June 9.

Angus Geddes, Fat Prophets

BUY RECOMMENDATIONS

Beston Global Food Company (BFC)

BFC made significant operational improvements at its factories in the first half of fiscal year 2022. Dairy sales revenue of $63 million was up 30 per cent on the prior corresponding period. Lactoferrin sales also increased. Operating margins in the dairy business improved. The company offers a bright outlook, in our view. The shares closed at 8.1 cents on June 9.

Elders (ELD)

Elders is leveraged to the buoyant rural sector, and reported a strong 2022 interim result. Demand exceeds supply across its rural offerings. Elders has been winning market share from targeted acquisitions and from tweaks to its strategic positioning.

HOLD RECOMMENDATIONS

Boral (BLD)

Boral has executed its strategic divestment program to focus on its Australian construction materials business. Boral will now invest in competitive and profitable projects and should deliver higher margins in the years ahead. We believe the company can deliver increasing returns to shareholders.

James Hardie Industries PLC (JHX)

Ongoing elevated profit margins and significant pricing power provides strong share price support at current levels for this building products company. While the direct-to-consumers campaign is in its infancy, the company is well positioned to take advantage of suitable market opportunities as they arise.

SELL RECOMMENDATIONS

Cettire (CTT)

The online luxury retailer lifted revenue for the 2022 third quarter and for the nine months to March 31, 2022. But the share price has fallen from $3.67 on January 4 to close at 43 cents on June 9. In March, CTT founder and chief executive Dean Mintz sold 35 million shares, or 9.18 per cent of the company’s issued capital at $1.35 a share in a block trade. Mintz retains a 56.72 per cent shareholding in the company. CTT reported a statutory net loss after tax of $8.299 million in the first half of fiscal year 2022.

The a2 Milk Company (A2M)

This infant formula company faces challenges with inventory and selling product to China. First half 2022 EBITDA of $NZ97.6 million was down 45.3 per cent on the prior corresponding period. Lower revenue was impacted by changing dynamics in China. Other stocks offer better growth prospects, in our view.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.