Tom Beakley, BW Equities

BUY RECOMMENDATIONS

IperionX (IPX)

IPX recycles titanium from scrap material. This reduces the cost and carbon footprint compared to traditional manufacturing processes. IPX manufacturing is based in the US. Titanium is a critical metal used in numerous military and consumer applications. IPX recently announced it would be producing parts for the US Navy.

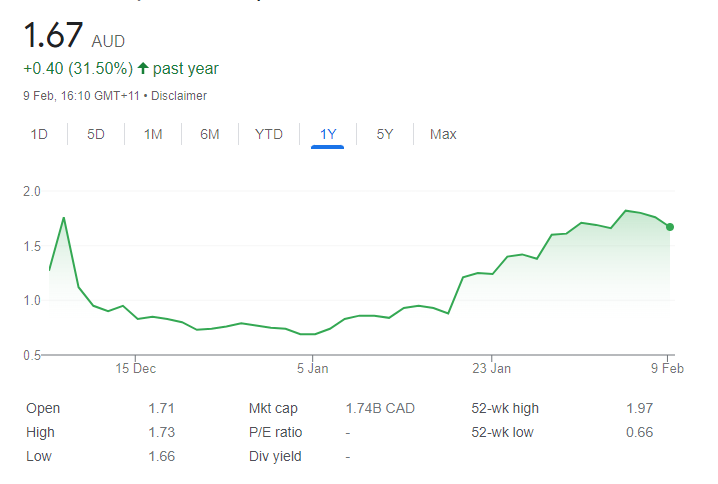

Patriot Battery Metals Inc. (PMT)

The explorer is focusing on acquiring and developing mineral properties containing battery, base and precious metals. Patriot has big lithium deposits in North America. Lithium is a critical mineral to produce batteries for electric vehicles. A key advantage is its close proximity to North American battery manufacturers.

HOLD RECOMMENDATIONS

City Chic Collective (CCX)

City Chic is a fashion retailer, specialising in women’s apparel, footwear and accessories. The company has reduced inventory during the past six months, and we expect further discounting to clear excess stock. Retail entrepreneur Brett Blundy now holds a 7.3 per cent stake in the company, prompting market speculation of a potential takeover of CCX.

The Hydration Pharmaceuticals Company (HPC)

The company makes rehydration electrolyte supplements. The company generated $US2.52 million in net sales in the 2022 fourth quarter, an increase of 45 per cent on the prior corresponding period. Gross margins were up 5 per cent. HPC is working with high profile influencers in the North American market to gain more traction.

SELL RECOMMENDATIONS

ARB Corporation (ARB)

ARB supplies 4-wheel drive accessories to Australian and international markets. The company recently provided a market update based on preliminary unaudited management accounts for the first half of fiscal year 2023. Sales revenue of $340.9 million was down 5.1 per cent on the prior corresponding period. Sales to export markets fell 8.8 per cent. We’re concerned about higher interest rates impacting discretionary spending in Australia and abroad.

Super Retail Group (SUL)

Company brands include Supercheap Auto, rebel, BCF and Macpac. A recent trading update revealed growth in all businesses for the six months to December 31, 2022. The company is well managed, but recent share price outperformance provides an opportunity for investors to cash in some gains.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Endeavour Group (EDV)

Endeavour operates liquor outlets, hotels and gaming facilities. The company was impacted by COVID-19 in fiscal year 2022. We expect a strong recovery in the hotels division in the first half of fiscal year 2023. EDV offers strong businesses with defensive qualities. Expect investment opportunities to emerge going forward. We retain our positive recommendation.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Liontown Resources (LTR)

LTR is an emerging tier 1 battery minerals producer. Open pit mining has started at the Kathleen Valley Lithium Project in Western Australia. The company plans to supply about 500,000 tonnes of 6 per cent lithium oxide concentrate a year. First production is expected in 2024. We believe sustaining the development timeline is a key catalyst for LTR.

HOLD RECOMMENDATIONS

Best & Less Group Holdings (BST)

On an unaudited basis, this specialty apparel retailer posted total revenue of $324.8 million in the first half of fiscal year 2023, up 13 per cent on the prior corresponding period. However, like-for-like sales were down 4.9 per cent on the prior corresponding period. Low price points provide support, but we remain cautious in the current economic climate.

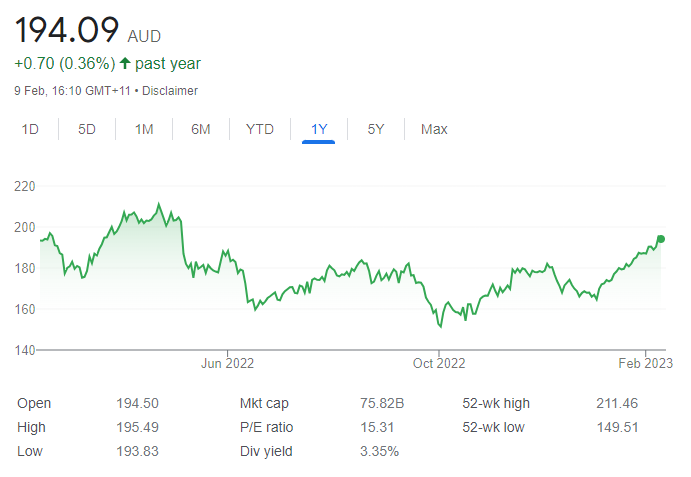

Macquarie Group (MQG)

Net profit after tax for this financial services company for the nine months to December 31, 2022 was marginally higher than the prior corresponding period, according to a recent update. The commodities and global markets business enjoyed a strong December quarter. The company has a strong track record of performance. The share price has risen from $164.67 on January 3 to trade at $194.27 on February 9.

SELL RECOMMENDATIONS

JB Hi-Fi (JBH)

Preliminary and unaudited earnings before interest and tax of $479.2 million in the first half of fiscal year 2023 represents a 14 per cent increase on the prior corresponding period. The update was above analyst expectations. However, our concern is a likely slowdown in discretionary consumer spending in response to higher interest rates. Also, households are experiencing cost of living increases. The share price of this consumer electronics giant has fallen from $49.31 on January 25 to trade at $46.40 on February 9.

Lynas Rare Earths (LYC)

The rare earths miner experienced water supply disruptions in 2022, impacting production at the Lynas Malaysia plant. But sales revenue of $232.7 million in the second quarter of fiscal year 2023 was up on the first quarter and on last year’s corresponding period. However, we’re concerned as to whether the company’s Malaysian licence will be renewed in March.

Tony Langford, Seneca

BUY RECOMMENDATIONS

Credit Corp Group (CCP)

The company buys debt ledgers and operates in Australia, New Zealand and the United States. It collects outstanding debts from consumers. The company’s consumer loan book grew by 32 per cent to $331 million in the first half of fiscal year 2023. However, first half net profit after tax of $31.8 million was down 30 per cent on the prior corresponding period. The company expects earnings to recover in the second half and full year net profit after tax guidance remains intact. CCP is well managed.

Caravel Minerals (CVV)

CVV is a Western Australian-based copper explorer and development company. The company has recently appointed an experienced chief executive and has raised $12 million to progress a definitive feasibility study. Construction is expected to start in 2024, with first production planned for 2026. Caravel offers exposure to patient investors who are confident about the outlook for this essential metal.

HOLD RECOMMENDATIONS

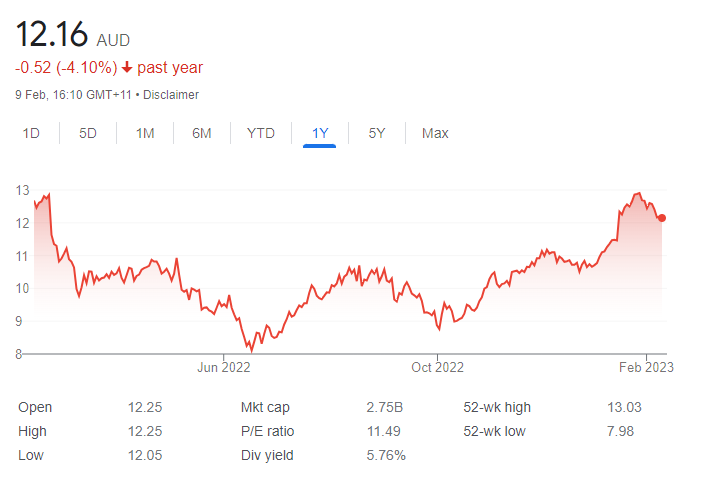

Elders (ELD)

The share price of this Australian agribusiness has fallen from $13.25 on November 11, 2022 to trade at $9.02 on February 9, 2023. In our view, unseasonable wet conditions in most of eastern Australia in the last quarter of 2022 appeared to be a contributing factor to the price fall. However, underlying earnings before interest and tax in fiscal year 2022 were $232.1 million, up 39 per cent on the prior corresponding period. This quality stock offers an attractive entry point.

Charter Hall Long WALE REIT (CLW)

This Australian real estate investment trust invests in high quality real estate assets, mostly leased to corporate and government tenants for a long term. The company’s diverse portfolio occupancy rate is 99 per cent, comprising 550 properties at the end of the first half of fiscal year 2023. CLW has long term income security given a portfolio weighted average lease expiry of 11.8 years.

SELL RECOMMENDATIONS

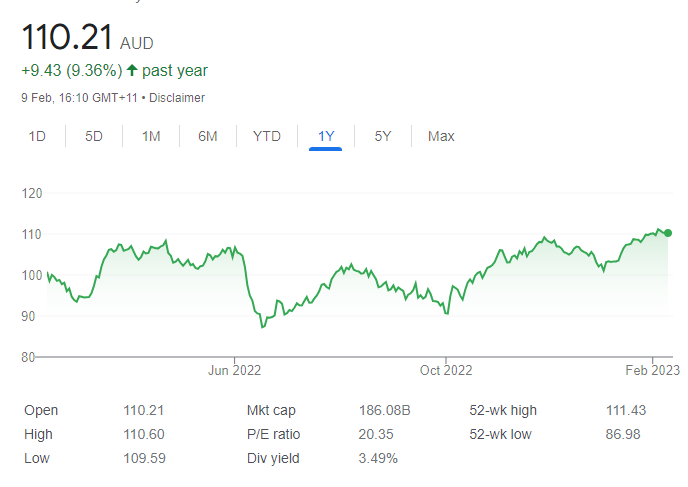

Commonwealth Bank of Australia (CBA)

Australia’s biggest bank has a high quality board and management team. The share price has risen from $90.61 on October 3, 2022 to trade at $109.92 on February 9, 2023. The bank offers attractive defensive qualities. However, in our view, the bank is expensive at these levels, particularly compared to competitors. Investors may want to consider banking some capital.

Whitehaven Coal (WHC)

WHC operates coal mines in New South Wales and Queensland. It produces metallurgical and thermal coal. The share price rose steadily after the Russian invasion of Ukraine. The price rose from $3.19 on February 21, 2022 to close at $10.96 on October 3, 2022. The shares were trading at $8.045 on February 9, 2023. Investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.