Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

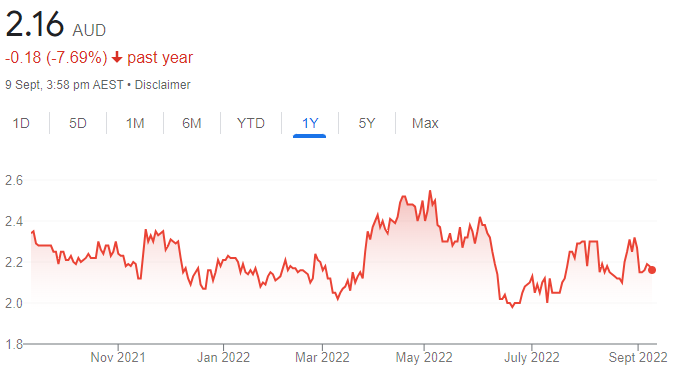

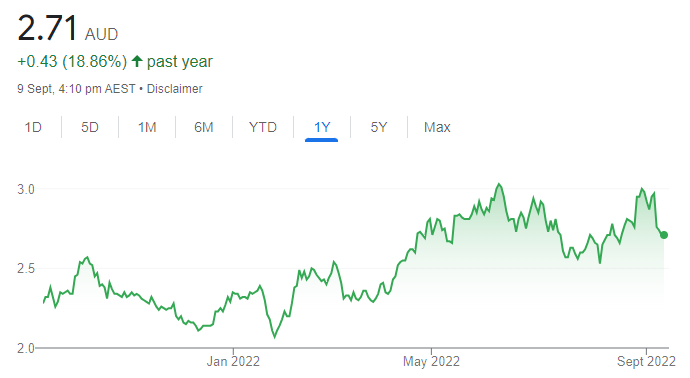

Silk Logistics Holdings (SLH)

This integrated logistics provider posted underlying group net profit after tax of $15.8 million in fiscal year 2022, a 45 per cent increase on the corresponding period. SLH continues to evaluate merger and acquisition opportunities as a means of adding further capacity across port and contract logistics. Management has also flagged the likelihood of adding further warehousing sites to bolster the business. Our price target is $3.50.

Lovisa Holdings (LOV)

This fashion jewellery and accessories retailer has developed a vertically integrated business model that’s capable of responding rapidly to changing trends. The company offers a broad product range and delivers high gross margins. Investors reacted positively to its fiscal year 2022 result. LOV offers a bright outlook.

HOLD RECOMMENDATIONS

Smartgroup Corporation (SIQ)

SIQ provides salary packaging and fleet management services. Despite vehicle supply disruptions, SIQ delivered revenue of $113.6 million in its 2022 half year result, up 4 per cent on the corresponding period. In our view, SIQ is undervalued.

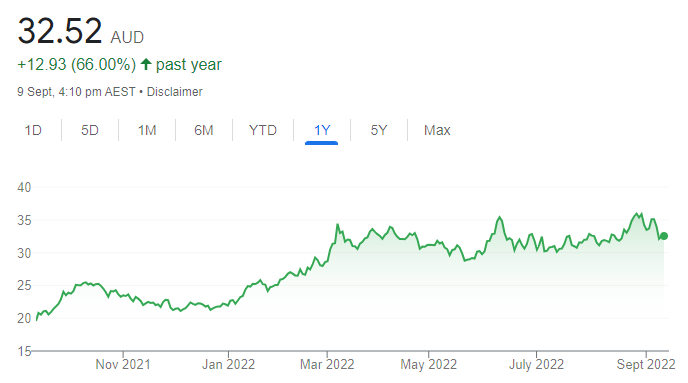

Woodside Energy Group (WDS)

The energy giant delivered a solid first half 2022 result, with earnings beating consensus. The company posted underlying net profit after tax of $US1.819 billion, up 414 per cent on the prior corresponding period. It delivered an interim dividend of $US1.09 a share, up 263 per cent. WDS has achieved our target price, so we have downgraded from adding to a hold.

SELL RECOMMENDATIONS

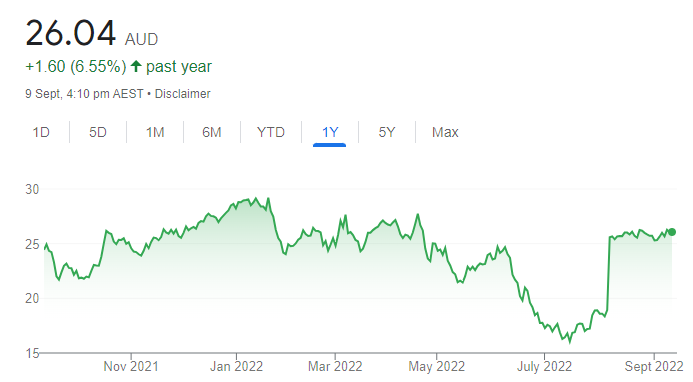

Oz Minerals (OZL)

This copper and nickel miner has rejected a conditional and non-binding takeover proposal from BHP Group at $25 a share. The OZL board believes BHP’s proposal significantly undervalues its company. Investors can consider holding some stock for a possibly higher bid, while trimming their holdings to cash in capital gains. OZL was trading at $26.28 on September 8.

Viva Energy Group (VEA)

The company supplies about 25 per cent of Australia’s fuel requirements. VEA posted an impressive first half 2022 result. Group EBITDA of $611.7 million beat consensus of $562 million. The interim dividend of 13.7 cents was also above consensus. In our view, the company is trading near the top of the cycle, so we suggest investors consider trimming holdings.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Demetallica (DRM)

This explorer has released high grade copper results from the Jericho project, south-east of Cloncurry in Queensland. The 56-hole drill data will be incorporated into a revised mineral resource estimate due in late October 2022. Jericho has an existing resource of 9.1 million tonnes at 1.4 per cent copper. In our view, the stock is highly speculative and suited to investors with an appetite for risk.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Proteomics International Laboratories (PIQ)

Proteomics International and Sonic Healthcare USA have signed a binding and exclusive letter of intent regarding an exclusive licence for PromarkerD in the US. The PromarkerD blood test can predict kidney function decline in type 2 diabetes. An early blood test for endometriosis showed encouraging signs with accuracy of 78 per cent. This adds to the pipeline for PIQ.

HOLD RECOMMENDATIONS

Evolution Mining (EVN)

Underlying profit after tax of $274.7 million in fiscal year 2022 was down 22 per cent on the prior corresponding period. The gold producer declared a fully franked dividend of 3 cents. While conditions remain challenging for gold producers in response to COVID-19 impacts and higher costs, EVN is well positioned for a recovery.

Maronan Metals (MMA)

In August, MMA began its maiden exploration drilling program at its flagship Maronan project near Cloncurry in north-west Queensland. The Maronan project contains 30.8 million tonnes at 6.5 per cent lead and 106 grams a tonne of silver. The project has 11 million tonnes at 1.6 per cent copper and 0.8 grams a tonne of gold. Drilling is aiming to test for possible extensions to reported resources.

SELL RECOMMENDATIONS

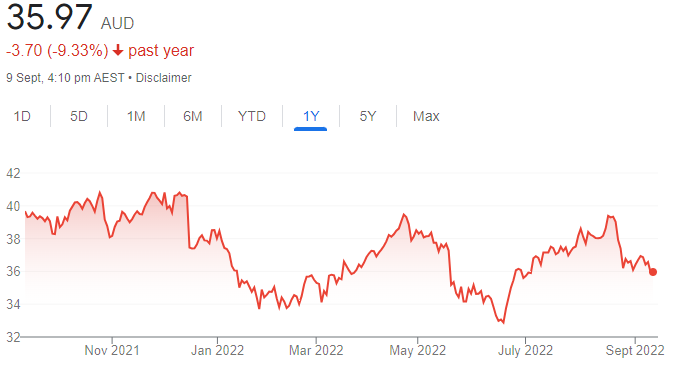

Woolworths Group (WOW)

The share price of this supermarket giant has risen from $32.88 on June 20 to close at $36.57 on September 8. Group net profit after tax of $1.514 billion in fiscal year 2022 grew 0.7 per cent on the prior corresponding period. While cost pressures have eased, we’re concerned about the impact from broad cost of living increases on its customers moving forward.

Wesfarmers (WES)

The company reported net profit after tax of $2.35 billion in fiscal year 2022, a 2.9 per cent fall on the prior corresponding period. COVID-19 impacted the result in the first half. Hardware giant Bunnings performed well. The company declared a fully franked dividend of $1. In our view, a strong share price amid economic headwinds provides a profit taking opportunity.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

The Lottery Corporation (TLC)

Formerly part of Tabcorp, TLC is a high quality business with reliable earnings. It posted a record fiscal year 2022 result, with revenue up 9.4 per cent on the prior corresponding period. TLC improved profit margins. The company is targeting new domestic and overseas acquisitions. In our view, TLC has strong earnings characteristics across its lotteries and Keno divisions. Cash generation is attractive.

Mirvac Group (MGR)

Mirvac is one of Australia’s biggest residential developers. MGR appeals for its high quality portfolio of assets with low financial leverage and exposure to apartments, which, we believe, may be a favourable part of the residential market in the near term. It has significant upside from a $30 billion development pipeline, despite potential for a declining asset values.

HOLD RECOMMENDATIONS

JB Hi-Fi (JBH)

The consumer electronics giant posted a strong fiscal year 2022 result. The company revealed a robust July trading update. Despite several interest rate increases, we are yet to see the impact on JB Hi-Fi sales, although we anticipate that momentum will likely slow in fiscal year 2023.

REA Group (REA)

We expect REA Group to continue leveraging its dominant position in the Australian online real estate listings market in a bid to increase revenue, profit margins and to expand internationally. Despite this, REA is facing a challenging macro-economic backdrop of weaker property prices and a decline in economic conditions. Consequently, this may impact performance if real estate sales volumes decline.

SELL RECOMMENDATIONS

Zip Co (ZIP)

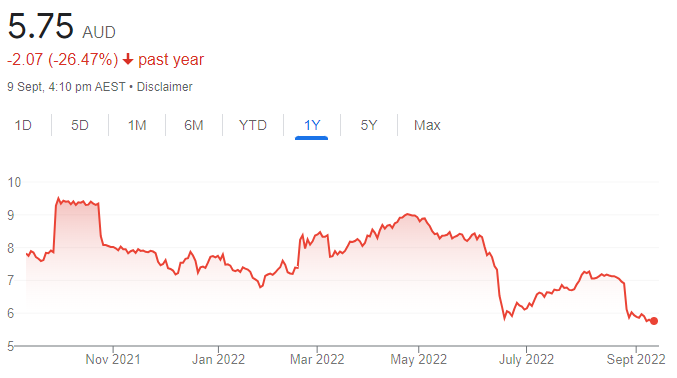

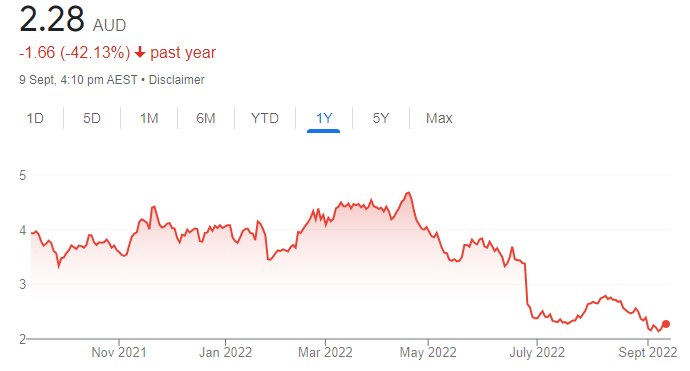

This buy now, pay later company (BNPL) reported a net loss of $1.1 billion in fiscal year 2022. Reducing cash burn is part of the company’s strategy. The company has decided to close its operations in Singapore and the UK. The company is winding down non-core products. We view the BNPL sector as highly competitive and susceptible to further regulation.

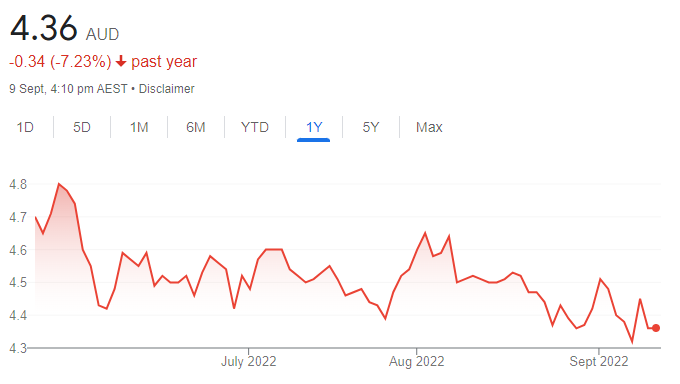

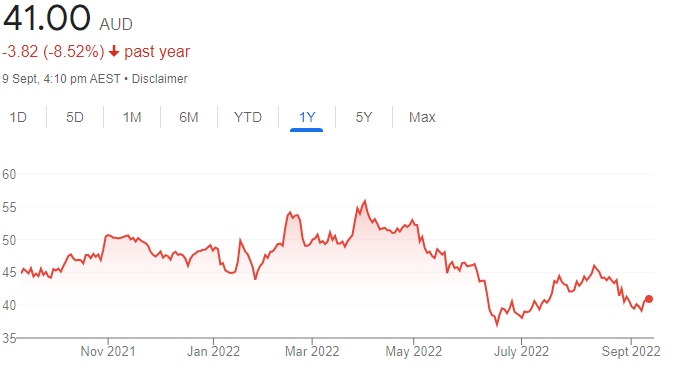

Platinum Asset Management (PTM)

Platinum is an Australian investment manager focusing on international shares. The underlying funds have been a good performer over the longer term. But in recent periods, the company has experienced outflows. In August 2022, Platinum experienced net outflows of about $99 million. We prefer others at this point in the cycle.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.