Braden Gardiner, Tradethestructure

BUY RECOMMENDATIONS

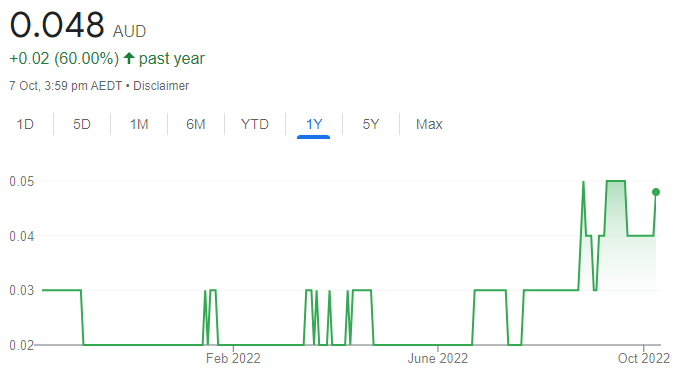

Hartshead Resources NL (HHR)

This small gas explorer focuses on the UK Continental Shelf in the Southern Gas Basin. The share price has risen from 2.6 cents on August 9 to finish at 4.2 cents on October 6. The company is gathering momentum and buyer support in response to the energy crisis. I expect the bullish tailwinds to continue moving the share price towards 10 cents. HHR suits investors with an appetite for risk.

Kingsgate Consolidated (KCN)

This gold and silver company owns the Chatree mine in Thailand. Work on refurbishing the mine has started. The company has announced a 46 per cent increase in Chatree ore reserves. While the spot gold price has been under pressure, KCN is showing bullish signs from a technical perspective. I expect the price to move higher from here.

HOLD RECOMMENDATIONS

IGO Limited (IGO)

This mining and exploration company focuses on nickel, copper, cobalt and lithium – all critical to a clean energy future. From a technical perspective, the company needs to stay above $15 for a sustained period of time to generate positive momentum. A fall below $15 may result in a further share price retreat. Keep an eye on the action. The shares finished at $15.18 on October 6.

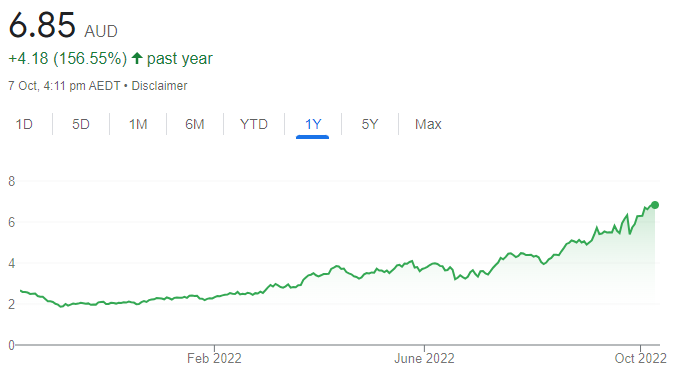

New Hope Corporation (NHC)

The share price has soared this calendar year on the back of booming coal prices. A big dividend increase announced at its full year 2022 results generated further support from income investors. In the absence of a short-term solution to the energy crisis, I expect NHC to remain in an uptrend.

SELL RECOMMENDATIONS

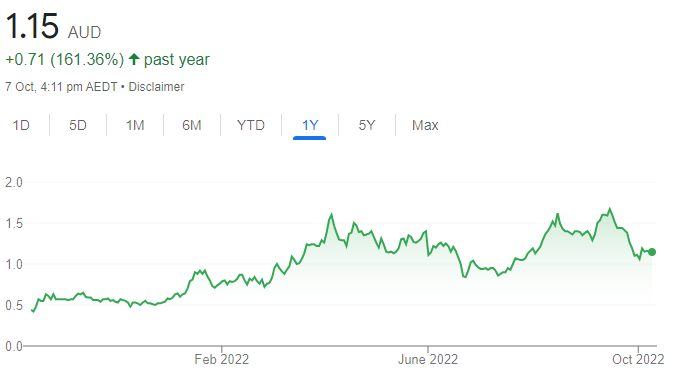

Core Lithium (CXO)

The emerging lithium producer couldn’t breach resistance at $1.67. The shares have fallen from $1.67 on September 13 to finish at $1.16 on October 6. From a technical perspective, momentum appears to be to the downside, in my view. Investors may want to consider cashing in some gains.

West African Resources (WAF)

The share price of this gold producer has fallen from $1.40 on August 10 to close at $1.08 on October 6. The share price recently broke technical support at $1.15 and fell to 94.5 cents on October 3. I expect a stronger US dollar to continue pressuring the gold price until US inflation stabilises.

Nathan Lodge, Securities Vault

BUY RECOMMENDATIONS

Suvo Strategic Minerals (SUV)

SUV is an Australian hydrous kaolin producer and explorer. The company recently announced it had signed a binding subscription and option agreement to acquire a 26 per cent interest in Dingo HPA, an Australian proprietary company aiming to produce high purity alumina from recycled feedstock. We believe this will generate value in the foreseeable future. The shares were trading at 5.7 cents on October 6.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Premier Investments (PMV)

Premier owns the retail conglomerate Just Group. Its brands include Just Jeans, Portmans and Smiggle, among others. Total fully franked dividends in fiscal year 2022 were up 56.3 per cent on the prior corresponding period. The company also announced an on-market share buy-back of up to $50 million. The outlook appears bright.

HOLD RECOMMENDATIONS

Camplify Holdings (CHL)

The company’s digital market platforms connect recreational vehicle owners to hirers. In fiscal year 2022, the company substantially grew total revenue and transaction value on the prior corresponding period. The strong results show the company’s offerings appeal to families.

Aston Minerals (ASO)

This nickel-cobalt explorer focuses on the Edleston project in Ontario, Canada. The company recently announced that resource definition drilling continues to expand the scale of nickel-cobalt sulphide mineralisation at its Bardwell deposit. ASO is also a gold explorer. Keep an eye on the news flow.

SELL RECOMMENDATIONS

Iress (IRE)

Iress provides software to the financial services sector. The company recently announced a profit downgrade for fiscal year 2022, citing delays in converting new sales opportunities. It’s also experiencing higher-than-anticipated supplier costs, mostly in technology. The shares have fallen from $12.17 on September 13 to trade at $9.56 on October 6.

Telix Pharmaceuticals (TLX)

This biopharmaceutical company focuses on developing and commercialising diagnostic and therapeutic radiopharmaceuticals. It recently withdrew a marketing authorisation application for its drug illuccix in Europe. The company intends to re-submit an application for illuccix in Europe at a later date. We prefer others in these volatile financial markets.

Layton Membrey, Marcus Today

BUY RECOMMENDATIONS

Premier Investments (PMV)

The retail conglomerate delivered a strong fiscal year 2022 result. Headline numbers beat consensus. A sales update was ahead of expectations. The final fully franked ordinary dividend of 79 cents a share, which includes a special dividend of 25 cents, is most appealing. PMV announced an on-market share buy-back for up to $50 million.

Telstra Corporation (TLS)

This leading telecommunications provider is likely to generate new customers following a cyber attack at competitor Optus and the negative sentiment that followed towards Optus. Telstra recently re-affirmed full year total income guidance of between $23 billion and $25 billion in fiscal year 2023.

HOLD RECOMMENDATIONS

Liontown Resources (LTR)

Full year 2022 results were in line with expectations. A net profit after tax of $40.9 million and a cash balance of $453 million appears sufficient to progress the Kathleen Valley lithium project. Lithium is driven by sentiment and the sector tends to lead the market when sentiment is positive. We expect much more upside in the lithium sector.

AGL Energy (AGL)

The energy giant is exiting coal-fired generation by 2035, accelerating the closure of the Loy Yang A power station by 10 years. Management lifted earnings guidance in fiscal years 2023 and 2024. Stronger futures prices are expected to drive higher customer prices and gross margins for an extended period.

SELL RECOMMENDATIONS

Iress (IRE)

The financial software provider downgraded full year guidance for fiscal year 2022. It expects net profit after tax to range between $54 million and $58 million. Prior guidance was between $63 million and $72 million. A recovery will take time, so other stocks appeal more at this point.

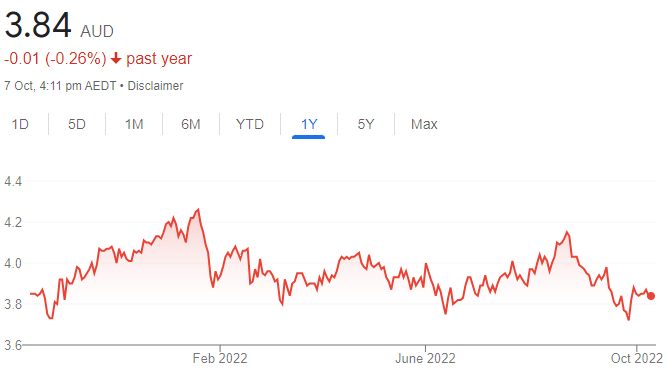

Goodman Group (GMG)

Goodman is an industrial property group. Real estate investment trusts (REIT) are lacking support in a challenging macroeconomic environment. Interest rates are expected to continue rising. We’re avoiding REITs until the macroeconomic outlook improves. GMG’s share price has fallen from $20.55 on August 16 to trade at $16.53 on October 7.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.