Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

Alcidion Group (ALC)

Alcidion develops software products for the healthcare sectors in Australia, New Zealand and the UK. The company recently announced a $15 million capital raising to acquire UK business ExtraMed. ALC delivered a strong performance in the third quarter – it generated $4.8 million in contracted revenue. ALC offers a bright outlook.

PointsBet Holdings (PBH)

The online corporate bookmaker delivered impressive third quarter results. The group’s net win was up 246 per cent on the prior corresponding period to $64.9 million. Active clients in the US grew by 87 per cent since December 31, 2020, to 127,470. The US still presents a huge opportunity for PBH and remains a buy, in our view.

HOLD RECOMMENDATIONS

Sandfire Resources (SFR)

SFR is the second largest pure play copper producer on the ASX after Oz Minerals. Yet, SFR was recently trading on an undemanding price/earnings multiple of around 10 times. SFR offers good long term upside if it can successfully execute on its planned mine development in Botswana. The share price has been rising since April and is enjoying good momentum.

BARD1 Life Sciences (BD1)

The company has a portfolio of diagnostic technologies and products. BD1 is focusing on developing and commercialising tests that can detect multiple cancers early. Initial findings in February were most encouraging for accurately detecting early breast and ovarian cancers. The outlook is bright if the company can continue to deliver encouraging results.

SELL RECOMMENDATIONS

Corporate Travel Management (CTD)

The company’s share price has recovered since COVID-19 lows in March 2020. The share price has risen from $5.45 on March 16, 2020 to close at $17.33 on May 5, 2021. It appears domestic travel revenues are rapidly recovering. COVID-19 restrictions across the globe continue to hamper international travel. We believe better value can be found elsewhere in the short term.

IOOF Holdings (IFL)

In a third quarter update, this financial services company reported outflows of $2.1 billion from 53 advisers departing IOOF’s self employed advice business. It generated inflows of $700 million from new self employed advisers joining IOOF licensees and from organic inflows. The share price has fallen from $5.09 on July 23, 2020 to close at $3.56 on May 5. Although the company appears cheap on many metrics, we prefer other stocks until results improve, in our view.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Coles Group (COL)

The supermarket giant is well managed and offers defensive characteristics. It has a strong balance sheet. Management is focusing on extensive cost saving initiatives and building its e-commerce strategy. This strategy appears to be working. It reported third quarter online growth of 49 per cent.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

ANZ Bank (ANZ)

ANZ is our preferred bank on a valuation basis. Total stock return is forecast to be about 20 per cent during the medium term. We believe the consensus view on bad debts is still too pessimistic. A strong balance sheet is positive. The dividend outlook is worthy of consideration. Capital management potential – as opposed to revenue growth – are key reasons to invest.

HOLD RECOMMENDATIONS

Sydney Airport (SYD)

Company revenue has been affected by COVID-19 related restrictions. In our view, this is no longer a yield stock, but rather a capital growth play. We like SYD, as it remains a premier airport asset. We expect the share price to rebound with a recovery in travel.

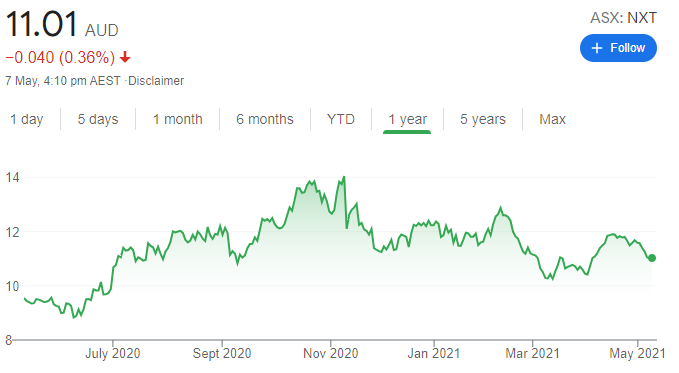

NextDC (NXT)

This data centre and cloud storage provider reported a strong first half result. Also, it upgraded guidance for the year ahead. Structural demand for cloud and collection remains robust, and NXT should continue to benefit. NXT appears on track to generate between $233 million and $300 million in EBITDA in the next five years.

SELL RECOMMENDATIONS

Paradigm Biopharmaceuticals (PAR)

This Australian biopharmaceutical company is focusing on re-purposing existing drugs for treating inflammation. The company’s application for trial has been placed on hold pending questions from the Food and Drug Administration. We want to see more data before making further assessments.

Commonwealth Bank of Australia (CBA)

In our opinion, the CBA trades at a premium to the banking sector. Other banks trade on a cheaper price/earnings multiples. CBA is a worthy performer. It may be prudent to trim CBA and look at fundamentally cheaper investments in the banking sector.

Peter Day, Sequoia Wealth Management

BUY RECOMMENDATIONS

Marley Spoon AG (MMM)

We believe that Covid has caused a permanent step change in consumer adoption and brand awareness of the meal kit model. Further, we believe that MMM and its main competitor Hello Fresh have developed a powerful customer friendly business model that ticks a lot of our boxes.

Ansell (ANN)

Ansell designs, develops and makes personal protection equipment. Beyond the pandemic, the ungeared balance sheet provides further upside potential for mergers and acquisitions. Share buybacks may also be on the agenda. We assume sales will normalise in 2023 and growth rates will return to normal beyond that. Upside risk remains beyond 2022.

HOLD RECOMMENDATIONS

ResMed Inc (RMD)

The company makes medical devices for treating sleep apnea. Results show the company generating growth in what we consider a volume-constrained industry. Third quarter net operating profit increased by 3 per cent. The core sleep business remains strong and plans include a new product cycle.

Tabcorp Holdings (TAH)

Private equity giant Apollo Global Management has entered the race for Tabcorp’s wagering, media and gaming services business after lodging a $4 billion bid. It follows a revised $3.5 billion bid from UK bookmaker Entain. The UK bookmaker previously offered $3 billion. We value Tabcorp’s wagering and media business at $3.68 billion on a discounted cash flow basis. Tabcorp announced it had not formed a view on the merits of the proposal and will assess it in the context of a strategic review.

SELL RECOMMENDATIONS

Ardent Leisure Group (ALG)

During the depths of COVID-19 last year, ALG announced that US private investment firm RedBird Capital Partners would acquire a stake in Ardent’s Main Event Entertainment business in the US. At the time, we noted that while this was positive for AGL’S near term cash flow, the deal could cap the upside to a potential recovery from the pandemic. In our view, this likely outcome leads us to cut our recommendation to a sell. Investors may want to consider taking some risk off the table.

Nickel Mines (NIC)

March quarter production of nickel metal was down 12.7 per cent on the December 2020 quarter. We have downgraded our price target from $1.26 to $1.01. We have downgraded full year earnings by 17 per cent. The shares were priced at $1.09 on January 4. The shares closed at $1.105 on May 7.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.