Toby Grimm, Baker Young

BUY RECOMMENDATIONS

South32 (S32)

The share price has fallen from $4.76 on March 3 to trade at $4.245 on April 6. We believe this represents a buying opportunity, as we see attractive value in Australia’s biggest mid-tier diversified miner with increasing exposure to energy transition metals and commodities. The company posted encouraging first half 2023 results, in our view.

Pilbara Minerals (PLS)

The company produced more than 300,000 dry metric tonnes of spodumene concentrate in the first half of fiscal year 2023, up 83 per cent on the prior corresponding period. The board has approved the P1000 project to increase Pilgangoora production capacity by 47 per cent. It’s worth noting that lithium company Liontown Resources rejected a takeover proposal from Albemarle on March 28. We believe PLS is worth adding to portfolios.

HOLD RECOMMENDATIONS

ANZ Group Holdings (ANZ)

Much has been made of the likely peaking of Australian bank profitability and the prospect for declining margins as competition for deposits increases. We feel this has been more than adequately priced into ANZ, which was recently trading at a 25 per cent discount to our fair value. ANZ offers an attractive dividend yield during the next two years.

Megaport (MP1)

Megaport provides elastic interconnection services. A slowdown in new customer wins is a concern for MP1. However, swift moves by competent founder Bevan Slattery to appoint a new chief executive officer and interim chief financial officer should build confidence in stabilising the business. Longer term, the company remains well positioned to benefit from meta data trends.

SELL RECOMMENDATIONS

InvoCare (IVC)

The share price of this funeral services provider jumped following news of a takeover offer from private equity firm TPG Global LLC at $12.65 a share. The IVC board wasn’t prepared to grant access to full due diligence. However, an opportunity exists for TPG to return with a higher bid. Any transaction remains uncertain. Therefore, we suggest taking part profits and retaining a reduced stake around current levels.

Origin Energy (ORG)

ORG’s board has agreed to a takeover offer at $8.91 a share from a consortium led by Brookfield Asset Management. However, this deal still requires foreign investor and competition regulatory approvals, a risk in the current energy-sensitive political climate. We recommend locking in a portion of the bid premium.

Top Australian Brokers

- IG – Extensive product array and user-friendly platforms – Read our review

- eToro – market-leading social trading platform – Read our review

- IC Markets – experienced and highly regulated – Read our review

- Quadcode Markets – multi-asset CFD broker – Read our review

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Chris Batchelor, Stockopedia

BUY RECOMMENDATIONS

Universal Store Holdings (UNI)

This Australian retailer specialises in casual fashion and accessories, with a particular focus on the youth market. The company listed in November 2020. The shares have risen from $4.20 on November 16, 2020 to trade at $5 on April 6, 2023. Total group sales of $145.7 million in the first half of fiscal year 2023 were up 34.5 per cent on the prior corresponding period. We rate UNI as one of the top businesses listed on the ASX, and have assigned a stock rank rating of 97 out 100.

SG Fleet Group (SGF)

SGF provides motor vehicle fleet management and salary packaging services across Australia, New Zealand and the United Kingdom. Recent changes to the fringe benefits tax for electric and low emission vehicles in Australia have made it far more attractive to lease rather than buy these vehicles. SGF represents a good value opportunity. We have assigned a value rank rating of 93 out of 100. The forecast fully franked dividend yield is 7.9 per cent.

HOLD RECOMMENDATIONS

Kelsian Group (KLS)

The group owns a fleet of about 4000 buses and 113 ferries operating in Australia, Singapore and the United Kingdom. The company is raising capital to fund the acquisition of a charter bus company in the US. Most business deals involve long term service contracts, which are usually government backed. This enables a predictable revenue stream, which can be hedged against inflation. Consistent performance has resulted in a quality rating of 94 out of 100.

GUD Holdings (GUD)

The automotive parts and accessories arm generates most of the revenue, with the balance derived from the water segment. The recent interim results were well received by the market. Earnings per share are forecast to almost double in fiscal year 2023. Our momentum rating has been improving, as the stock has been steadily rising for the past six months.

SELL RECOMMENDATIONS

Aurizon Holdings (AZJ)

This rail haulage business reported a disappointing first half 2023 result, in our view. EBITDA of $673 million was down 7 per cent on the prior corresponding period. The result was impacted by wet weather. Coal volumes fell by 8 per cent. The company has cut EBITDA guidance for fiscal year 2023. The shares have fallen from $3.77 on February 9 to trade at $3.355 on April 6.

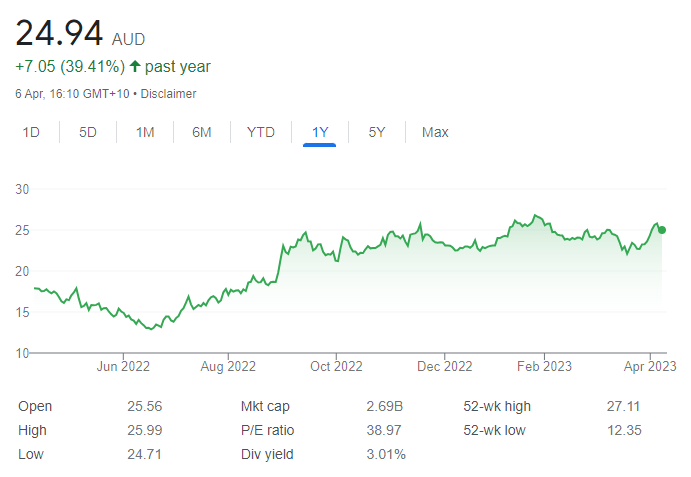

HMC Capital (HMC)

HMC Capital is an alternative asset manager. It invests in real asset strategies on behalf of individuals, institutions and super funds. HMC is undertaking a capital raising to fund the purchase of new hospitals. The first half 2023 result was disappointing, in our view. The shares have fallen from $5.15 on February 3 to trade at $3.755 on April 6. Other stocks appeal more at this point in the cycle.

Tony Locantro, Alto Capital

BUY RECOMMENDATIONS

Saturn Metals (STN)

STN is a gold exploration company. The Apollo Hill gold resource in Western Australia comprises 1.47 million ounces at 0.6 grams a tonne of gold. Recent drilling results have been favourable. The company announced broad and higher grade intersections at and near the surface. In my view, it suggests there’s potential for higher grade ore to be discovered. Pilot plant production from Apollo Hill is anticipated in calendar year 2024. STN has considerable regional exploration potential. The shares closed at 19 cents on April 6.

Proteomics International Laboratories (PIQ)

PIQ recently announced that a potential new blood test for diagnosing endometriosis returned an accuracy rating of up to 90 per cent from 901 patients involved in the study. The latest results are encouraging given one in nine women suffer from the disease. We expect an update on the PIQ plan to roll out its PromarkerD test in the US. The PromarkerD test can predict future kidney function decline in patients with type 2 diabetes, and with no existing diabetic kidney disease.

HOLD RECOMMENDATIONS

Copper Search (CUS)

CUS has narrowed down their copper-gold projects in South Australia’s Peake and Denison region to four high priority targets. Drilling is now expected in coming weeks, with programs set to continue through calendar year 2023. In my view, CUS suits investors with a high tolerance for risk involving mineral exploration.

Maronan Metals (MMA)

MMA is working towards expanding the Maronan resource in the Cloncurry region of Queensland. It consists of a JORC compliant resource of 30.8 million tonnes at 6.5 per cent lead, with 106 grams a tonne of silver, 11 million tonnes at 1.6 per cent copper with 0.8 grams a tonne of gold. Moving forward, keep an eye on the news flow for new targets and the latest results.

SELL RECOMMENDATIONS

Lovisa Holdings (LOV)

The fashion jewellery and accessories retailer reported strong half year 2023 results. Revenue of $315.5 million was up 44.8 per cent on the prior corresponding period. Comparable store sales were up 12.5 per cent, with 86 net new stores opened during the period. It takes the global store network to 715. LOV has been forced to increase prices due to inflation. Investors can consider locking in a profit given a recent strong share price.

Coles Group (COL)

The supermarket giant generated total sales revenue of $20.8 billion in the first half of fiscal year 2023, up 3.9 per cent on the prior corresponding period. Net profit after tax of $616 million from continuing operations was up 11.4 per cent. Shoppers may reduce spending given higher interest rates and cost of living increases. Investors may want to consider cashing in some gains.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.