Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

Alcidion Group (ALC)

Develops and licenses its own software products for the healthcare sector. The company’s main markets are in Australia, New Zealand and the UK. A promising update in late January revealed revenue of $21.7 million for the 2021 first half. In our view, the company offers long term potential if management can continue to successfully execute its strategy.

Audinate Group (AD8)

AD8 develops and sells digital audio-visual networking solutions. The group’s technology platform distributes quality digital audio and video signals over computer networks. First half 2021 results revealed revenue had already returned to pre-COVID-19 levels. Given its market leading product and sustained high margins, AD8 offers a bright outlook.

HOLD RECOMMENDATIONS

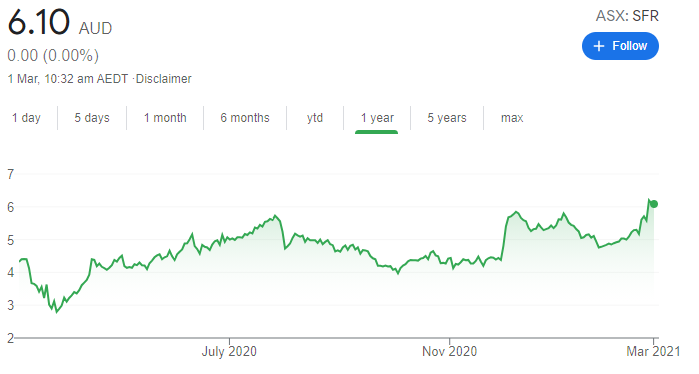

Sandfire Resources (SFR)

SFR operates the DeGrussa copper-gold mine in Western Australia. It has exploration assets in Botswana and the US. Copper prices were recently trading at multi year highs, and the longer term trend remains strong. Also, SFR appeals for its recent fully franked dividend yield of 3.8 per cent. The shares performed well in February.

Unibail-Rodamco-Westfield (URW)

Owns and operates shopping centres in Europe and the US. The company was severely impacted by COVID-19 restrictions in 2020 and, at this point, the 2021 operating environment remains uncertain. However, its quality assets are close to big populations in prized locations. In our view, the company offers substantial upside when COVID-19 restrictions ease.

SELL RECOMMENDATIONS

Telstra (TLS)

The 2021 half year result from this telecommunications giant was uninspiring, in our view. Net profit after tax fell 2.2 per cent to $1.1 billion. Total income was down 10.4 per cent to $12 billion. We believe investors can find better value in other stocks offering superior long term earnings and dividend growth.

Corporate Travel Management (CTD)

Provides cost-effective travel solutions for the corporate and leisure sectors. The company operates a strong business. The share price enjoyed a solid rise in February. However, the international travel outlook remains uncertain. Until a clearer outlook emerges, we would look at other stocks that are poised to benefit sooner in line with easing of COVID-19 restrictions.

Please note CTD is recommended as a buy and a sell this week as analysts take different views about the outlook.

Jabin Hallihan, Morgans

BUY RECOMMENDATIONS

Westpac Bank (WBC)

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Unaudited cash earnings of $1.97 billion for the first quarter beat our expectations by 23 per cent and were 43 per cent higher than consensus. We expect momentum to continue, as positive revisions to credit impairment provisions and improving net interest margins drive earnings higher. We see strong capital management potential and forecast a gross dividend yield of 8.5 per cent this year. We expect WBC to outperform.

Corporate Travel Management (CTD)

CTD is our key choice in the travel sector, as it’s well placed to benefit when borders fully reopen and travel activity returns. We expect CTD will be materially more profitable given it’s won a lot of new business. It will benefit from synergies after acquiring the Travel and Transport acquisition, and CTD has structurally lowered its cost base. The balance sheet has no debt and, in our view, is the strongest in the sector. Our valuation is $21.75 a share. The stock finished at $20.99 on February 25.

HOLD RECOMMENDATIONS

Treasury Wine Estates (TWE)

The wine giant delivered a better than expected first half result due to stronger performances across Australia, New Zealand and Asia. TWE is making good progress on its US restructure and on the impact from China in response to an anti-dumping investigation into wine imports from Australia. We expect net profit after tax growth to resume from fiscal year 2022. Hold for now. We would be buyers of the stock on any material share price weakness.

Carsales.com (CAR)

The company produced a quality first half 2021 result. Dealer adjusted revenue grew by 10 per cent on the prior corresponding period. The interim dividend was up 14 per cent to 25 cents a share. However, in our view, it will be challenging for CAR to sustain strong margins in the second half. Our price valuation is $21.75.

SELL RECOMMENDATIONS

Rio Tinto (RIO)

The mining giant has enjoyed a significant rally on the back of stronger iron ore prices. But we believe a stronger Australian dollar will potentially push up unit costs in the Pilbara region. Consequently, this creates a difficult outlook for gross margins and profitability levels for the flagship iron ore business. Our valuation is $114 a share. We recommend trimming RIO stock and taking profits.

Pro Medicus (PME)

Provides radiology information systems and advanced visual solutions across the globe. The company continues to benefit from winning new contracts. Investors are likely to focus on whether PME can sustain contract growth over the longer term. The share price has more than doubled since March last year. Our valuation is $41.30 a share. The stock finished at $45.28 on February 25. We recommend trimming PME stock and taking profits.

Thomas Wegner, Marcus Today

BUY RECOMMENDATIONS

Lynas Rare Earths (LYC)

LYC is the only rare earths producer of significant scale outside of China. Accordingly, LYC is widely considered a viable alternative to China, and is well placed to benefit from any European and US demand. News that China is considering curbing supply is another positive. Contracts to build a rare earths plant in Texas amid progressing its processing facility in Kalgoorlie paint a bright outlook.

Baby Bunting Group (BBN)

The group reported sales growth and a strong first half profit in fiscal year 2021. It increased the fully franked interim dividend to 5.8 cents a share. Expect one or two store openings in the second half of fiscal year 2021. The company began shipping online orders to New Zealand in 2020 and anticipates opening its first store there in fiscal year 2022. The New Zealand offering provides a positive tailwind.

HOLD RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

In the first half of fiscal year 2021, the pizza giant posted a 16.5 per cent increase in global food sales on the prior corresponding period to $1.84 billion. It opened 131 new stores, increasing its geographical footprint in Japan, France and Germany. It reported a strong start to the second half, with sales up 21 per cent in the first seven weeks. We expect a strong full year performance.

BHP Group (BHP)

An attractive half year dividend of $US1.01 beat consensus estimates of US84 cents. BHP achieved record production at Western Australia Iron Ore. Cost discipline was another highlight, with full-year unit cost guidance unchanged for its major assets. The outlook for global economic growth and commodity demand remains positive.

SELL RECOMMENDATIONS

AGL Energy (AGL)

The energy giant reported a statutory first half loss of $2.3 billion in fiscal year 2021. Impairment charges stained the result, which was also weighed down by a sharp decline in wholesale electricity prices, lower wholesale gas margins and higher COVID-19 costs. Expect sustained headwinds in fiscal year 2022 before there is the potential for an earnings recovery.

AMP (AMP)

Private equity firm Ares Management has withdrawn its non-binding proposal to buy AMP for $1.85 a share. AMP’s underlying profit missed consensus for fiscal year 2020. There’s no final dividend. Assets under management in its Australian wealth management division were down 8 per cent. Assets under management in AMP Capital were down 7 per cent. The falls reflected volatile investment markets and net cash outflows.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.