Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

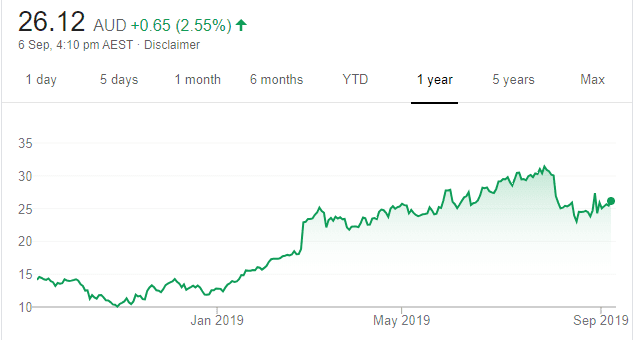

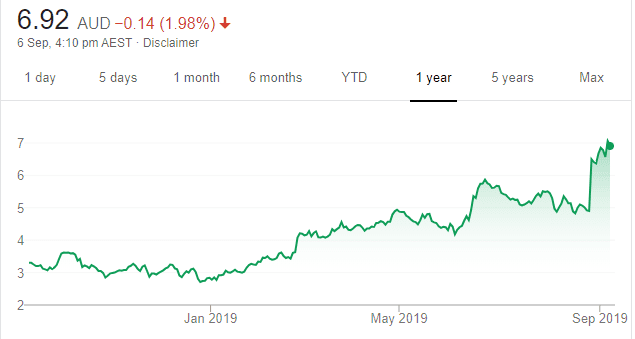

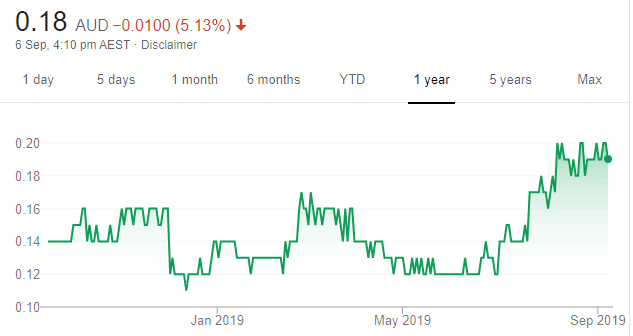

Appen (APX)

Chart: Share price over the year

Provides data and services in more than 150 languages and dialects to technology companies and government agencies. The company recently reported strong half year results and has indicated it’s on target to achieve the top end of its guidance. Despite this, the share price still tracked about 10 per cent lower after releasing its half year report on August 29. Perhaps investors were expecting an upgrade to fiscal year guidance. APX remains a buy.

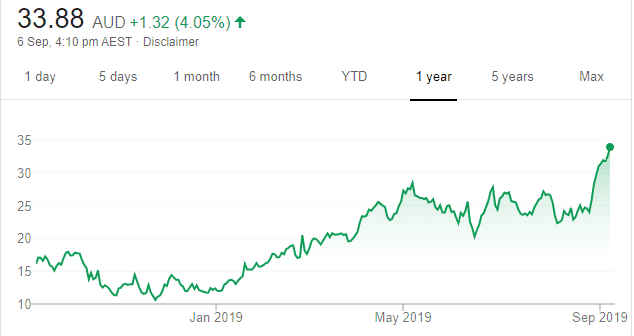

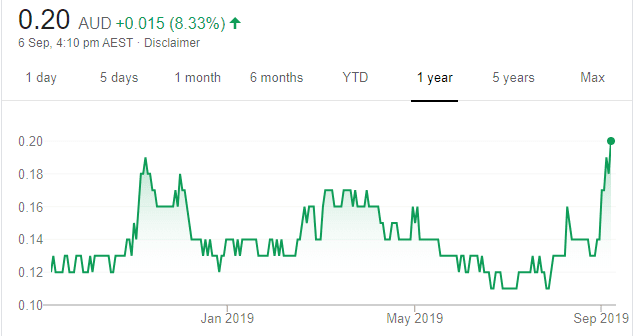

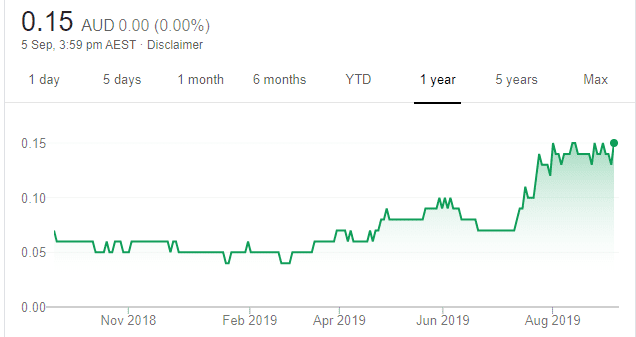

PolyNovo (PNV)

Chart: Share price over the year

An Australian based biotechnology company that designs, develops and makes dermal regeneration solutions using its patented NovoSorb biodegradable polymer technology. This product is mostly used to re-generate skin on patients after extensive surgeries, or on others suffering from burns. Revenue in fiscal year 2019 was up 128 per cent on the prior corresponding period to $13.683 million. We believe the future looks bright.

HOLD RECOMMENDATIONS

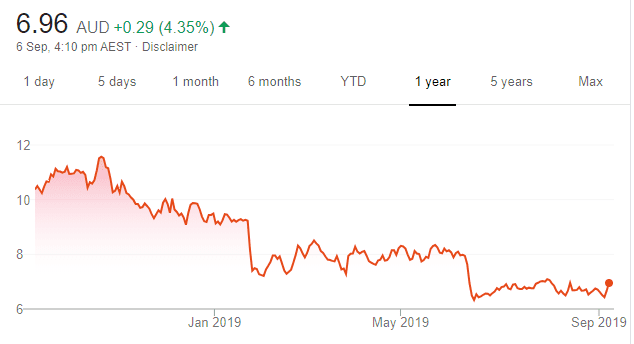

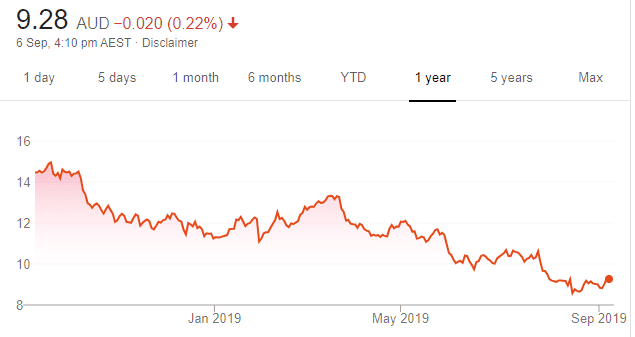

Challenger (CGF)

Chart: Share price over the year

A diversified financial services firm, CGF operates two core businesses within the annuities and funds management space. Fiscal year 2019 results were broadly in line with market expectations. Although sales momentum has slowed over the years, we believe this has been well factored into the current share price. On a recent price/earnings ratio of about 14 times and a dividend yield above 5 per cent, we retain a hold recommendation.

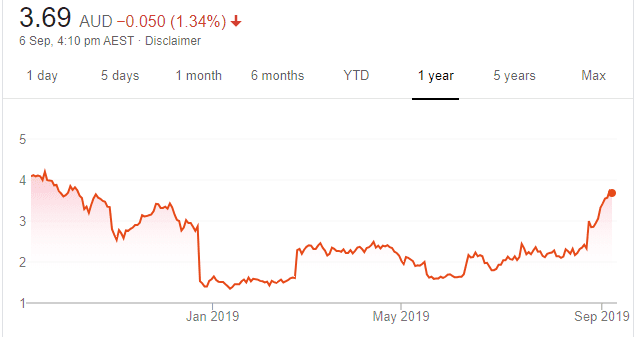

BWX Limited (BWX)

Chart: Share price over the year

Develops, makes and distributes natural branded skin and hair care products. After a series of earnings downgrades in 2018 and 2019, the company reported better than expected results and guidance in fiscal year 2019. Changes in the management team could result in positive share price momentum continuing in fiscal year 2020.

SELL RECOMMENDATIONS

Domino’s Pizza Enterprises (DMP)

Chart: Share price over the year

Operates retail food outlets and franchise services. Overall, we believe its fiscal year 2019 result fell marginally short of expectations. Offshore operations are helping to offset continuing headwinds in the Australian and New Zealand operations, which still contribute almost half of DMP’s earnings. The 52 week high was $56.83 on October 23 last year. The shares were trading at $43.99 on September 5, 2019.

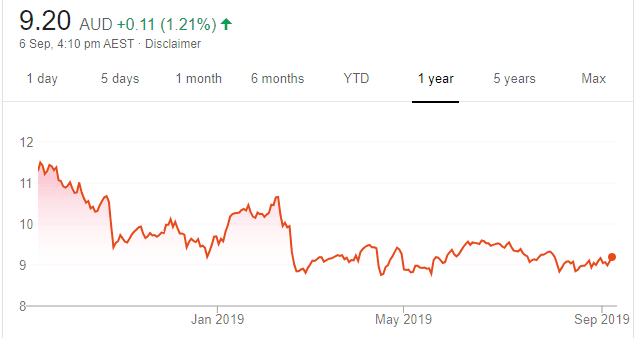

Bank of Queensland (BOQ)

Chart: Share price over the year

Engaged in retail banking, leasing finance and insurance. There seems to be ongoing challenges due to weaker mortgage growth, downward pressure on margins and the need for significant investment. The shares have fallen from $9.51 on July 1 to trade at $9.04 on September 5, 2019.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

Justin Klimas, Wilsons

BUY RECOMMENDATIONS

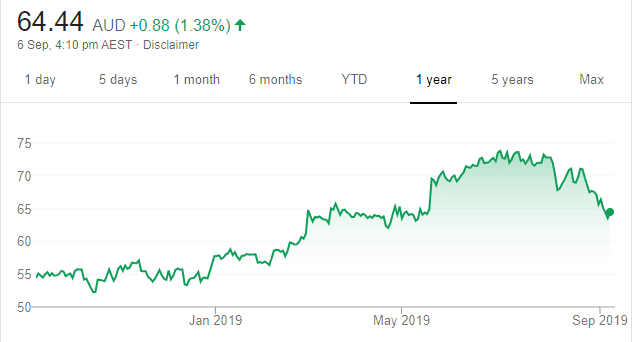

GUD Holdings (GUD)

Chart: Share price over the year

This automotive parts group has been sold off sharply since providing a relatively subdued outlook commentary at its 2019 financial year results in July. Recent results from peers Supercheap Auto (SUL) and Bapcor (BAP) suggest improving trading conditions, with both companies confirming same stores sales growth for the first six weeks of financial year 2020. GUD’s dividend yield is appealing. The shares were trading at $9.28 on September 5.

Whispir (WSP)

Chart: Share price over the year

This cloud based communications platform provider listed on the ASX in June 2019. Its 2019 financial year results were ahead of prospectus forecasts. Encouragingly, the group announced key renewal and contract wins with companies, including Qantas, Westpac and AIA. Operating expenditure is tightly managed.

HOLD RECOMMENDATIONS

Ramsay Health Care (RHC)

Chart: Share price over the year

The private hospital operator reported a full year result in line with expectations, driven by its Australian and French operations. However, its northern European business Capio continued to be drag on earnings. In Australia, a decline in private health insurance is a headwind for future gains. While some earnings growth is expected, the shares look appropriately priced around current levels.

Afterpay Touch Group (APT)

Chart: Share price over the year

This buy now, pay later company has been a market darling in recent times. The 2019 fiscal year results were largely in line with expectations. Growth in the US has been strong and a strategic collaboration with Visa has been announced. The company is also gaining momentum in the UK market. The current company valuation seems full, tempering my expectations.

SELL RECOMMENDATIONS

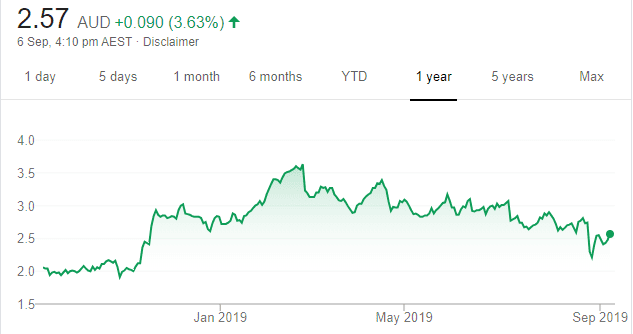

G8 Education (GEM)

Chart: Share price over the year

The childcare centre operator reported a modest occupancy growth rate of 1.5 per cent for the 2019 first half compared with the prior corresponding period. GEM is up against competitors providing an increasingly supply of childcare places, so I expect GEM occupancy growth rates to remain under pressure going forward.

Nanosonics (NAN)

Chart: Share price over the year

This manufacturer and distributor of the trophon ultrasound probe disinfector posted a record profit for the 2019 financial year. However, continuing strong sales from its US consumables re-supply business will be difficult to sustain given existing high levels. In my view, the market is factoring in too much growth going forward and this leaves little room for error.

Gavin Wendt, MineLife

BUY RECOMMENDATIONS

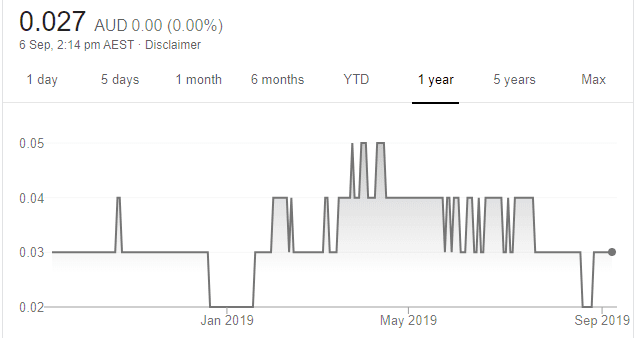

St George Mining (SGQ)

Chart: Share price over the year

The share price has surged by about 60 per cent from a recent low of 10.5 cents on the back of strong nickel prices and a new discovery of nickel-copper sulphides at its Mt Alexander project in Western Australia. Drilling at the Radar prospect has intersected nickel-copper sulphide mineralisation at a depth of between 44.2 metres and 51.7 metres down hole, with average readings of up to 6 per cent nickel and 1.92 per cent copper. The occurrence of high grade nickel-copper sulphide mineralisation at shallow depths is rare, with mineralisation extending for a strike length of 5.5 kilometres.

Sunstone Metals (STM)

Chart: Share price over the year

STM has provided a revised assessment for its Bramaderos copper project in southern Ecuador after recently completing first drill holes at its Main and Limon prospects. STM believes the results so far underpin its bullish view of the exploration potential within the greater project area and that Bramaderos is highly prospective for the discovery of porphyry gold-copper and epithermal gold systems.

HOLD RECOMMENDATIONS

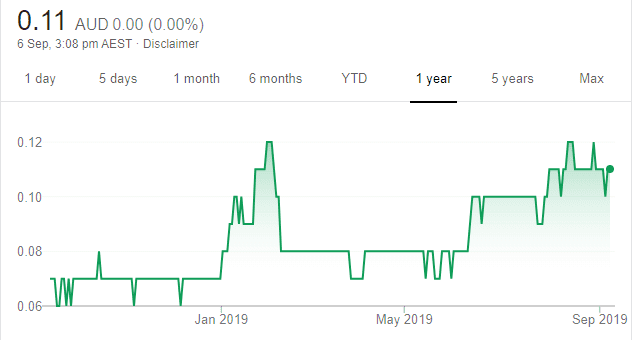

Australian Potash (APC)

Chart: Share price over the year

APC has released its much anticipated definitive feasibility study results for its Lake Wells Potash Project in Western Australia. The project is based on a 150,000 tonnes per annum and a 30-year mine life of Sulphate of Potash (SOP) solar salt development. The project boasts sector leading capital expenditure, with development capital expenditure of $208 million. Importantly, Lake Wells also boasts lowest quartile production costs, with life of mine cash costs of $US262 a tonne placing Lake Wells in the first quartile of the SOP cost curve.

Chalice Gold Mines (CHN)

Chart: Share price over the year

CHN has identified several highly prospective electromagnetic (EM) conductors from recent ground based and airborne EM geophysical surveys over the King Leopold Nickel Project in the west Kimberley region of Western Australia. CHN is encouraged by this first phase, with two highly prospective drill targets identified in a similar geological setting to the nearby Merlin Prospect, owned by Buxton Resources (ASX: BUX) and Independence Group (ASX: IGO).

SELL RECOMMENDATIONS

Allegiance Coal (AHQ)

Chart: Share price over the year

AHQ has performed strongly since we initiated coverage in mid 2017, generating an almost seven-fold price gain. Its Tenas metallurgical coal project in north west British Columbia represents an attractive development opportunity, with potential for low cost production, strong operating margins and modest start-up costs. AHQ has recently broadened its North American coal exposure, with the planned acquisition of the production-ready 656 million tonnes New Elk Coal Mine in Colorado. While the outlook remains positive, some long term holders might look to lock in gains. The shares closed at 15 cents on September 5.

Strike Energy (STX)

Chart: Share price over the year

STX and Perth Basin operator Warrego Energy have confirmed a significant gas discovery in the West Erregulla-2 well in the onshore Perth Basin of Western Australia. The results have exceeded expectations and indicate a significant discovery that appears to have very high reservoir quality. Another stock with a positive outlook, but some long term holders may want to consider locking in profits. The shares finished at 27 cents on September 5.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing.

Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.