Harrison Massey, Argonaut

BUY RECOMMENDATIONS

AIC Mines (A1M)

AIC Mines owns and operates the Eloise copper mine in Queensland. Eloise is a high grade underground mine with a 26-year operating history. The company recently increased its mineral resource to 115,000 tonnes of contained copper and 101,100 ounces of contained gold. A1M bought an adjacent exploration company in late 2022, which should significantly enhance the size and economics of the Eloise project.

Anova Metals (AWV)

The company recently acquired 100 per cent of the rights to the Golden Dragon and Fields Find projects in the Murchison region of Western Australia. These highly prospective exploration assets have an existing JORC resource of 19.2 million tonnes at 1.5 grams a tonne gold, including more than 460,000 ounces of gold in measured and indicated categories. The company has identified several walk up targets and has been drilling. Assay results are expected soon.

HOLD RECOMMENDATIONS

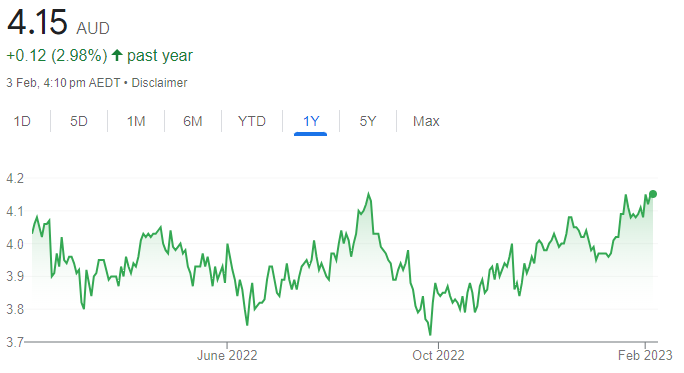

Telstra Group (TLS)

This telecommunications giant remains an attractive defensive investment. Forecasted total income is expected to range between $23 billion and $25 billion in fiscal year 2023. TLS offers one of the more competitive dividend yields on the market.

Northern Star Resources (NST)

Northern Star sold more than 400,000 ounces of gold in the December quarter, which was largely in line with guidance. The company remains bullish about producing 2 million ounces by 2026, but immediate production guidance remains subdued. NST remains an attractive proxy hold in portfolios for gold exposure. Also, production upside in future years adds to the hold rating.

SELL RECOMMENDATIONS

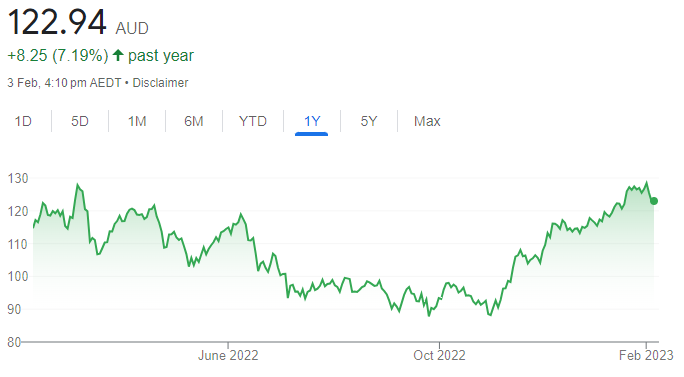

Rio Tinto (RIO)

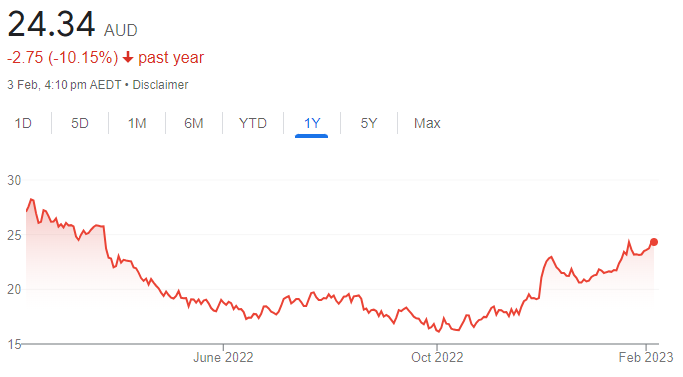

The share price of this global miner has risen from $90.49 on November 1, 2022 to trade at $125.57 on February 2, 2023. Despite the company typically paying attractive dividends, it may be prudent for investors to consider taking a profit around these levels. Ongoing concerns about a global economic slowdown may impact iron ore spot prices in the medium term.

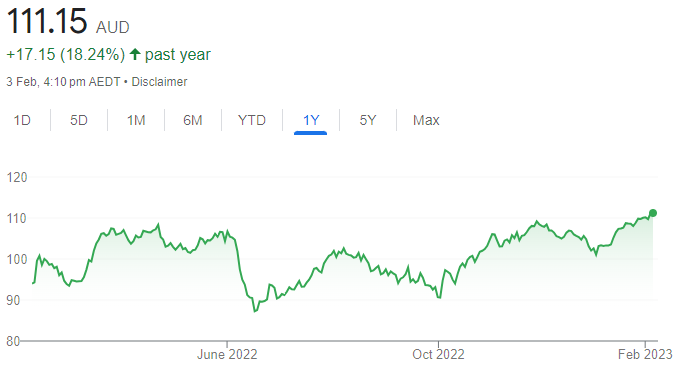

Commonwealth Bank of Australia (CBA)

CBA is the biggest of the major banks. The share price has risen from $90.61 on October 3, 2022 to trade at $110.06 on February 2, 2023. The bank offers attractive defensive qualities. However, at recent levels, it may be prudent to trim exposure and pocket a profit.

Jean-Claude Perrottet, Medallion Financial Group

BUY RECOMMENDATIONS

Santos (STO)

Favourable industry dynamics paint a bright outlook for the energy sector. STO’s fourth quarter result met production expectations. Sales revenue hit record levels of $US7.8 billion in fiscal year 2022, up 65 per cent on the prior year. Also, Santos recently announced an increase in its share buy-back, offering an additional $US350 million increase to now total $US700 million.

Top Australian Brokers

- Pepperstone - multi-asset Australian broker - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

IDP Education (IEL)

This global education services provider delivered strong results in fiscal year 2022. The company lifted revenue by 50 per cent on the prior corresponding period. Further, China recently banned its students from online learning at overseas universities. We expect IEL to benefit from an influx of Chinese students returning to Australia.

HOLD RECOMMENDATIONS

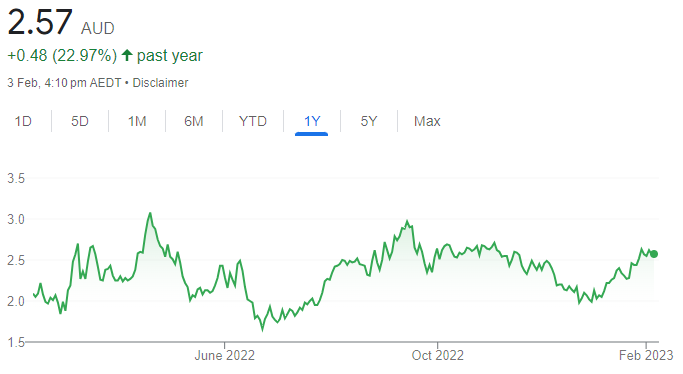

Boss Energy (BOE)

The explorer is focusing on its Honeymoon uranium project in South Australia. Committed expenditure to the re-development program has reached the half way mark totalling $55.1 million. The project is on time and on budget. A start-up is set for the December quarter. The sector appears to be building momentum, and we’re encouraged by the global shift towards nuclear energy.

Fisher & Paykel Healthcare Corporation (FPH)

This leading manufacturer and marketer of health care products and systems reported encouraging first half 2023 results. Although first half revenue was down 23 per cent on the previous corresponding period, it was up 21 per cent on the comparable pre-pandemic period. We believe this business is returning to long-term growth trends.

SELL RECOMMENDATIONS

Breville Group (BRG)

This kitchenware company has benefited from retail sales growing faster than market expectations due to elevated household savings rates. However, we expect household savings to subside in this higher interest rate environment. The shares have risen from $18.04 on December 23, 2022 to trade at $23.18 on February 2, 2023. Investors may want to consider cashing in some gains.

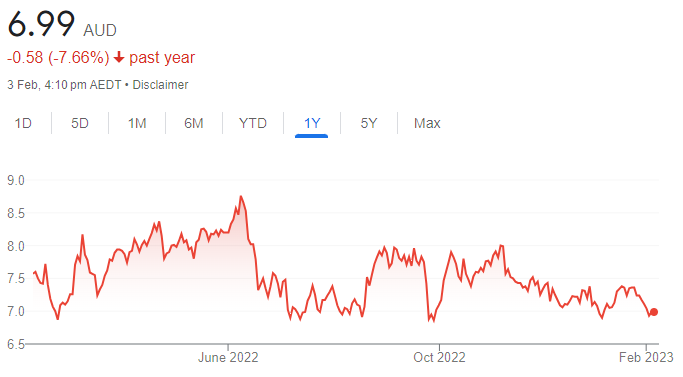

Harvey Norman Holdings (HVN)

The retail giant reported a 3.6 per cent fall in net profit in fiscal year 2022. Our concern is higher interest rates impacting discretionary spending as households struggle to meet rising mortgage repayments and rental increases. HVN offers an attractive dividend. But we remain cautious about the outlook for discretionary retailers at this stage of the economic cycle.

Christopher Watt, Bell Potter Securities

BUY RECOMMENDATIONS

Netwealth Group (NWL)

Netwealth is a financial services company. Funds under administration increased 10.2 per cent or $5.8 billion for the 12 months to December 31, 2022 despite negative market movement of $4.6 billion. While recent flows have been weaker than expected, we anticipate an improvement underpinned by recent client wins. Further, higher cash margins and slowing cost growth are expected to result in stronger earnings growth.

Ampol (ALD)

Australia’s largest refined fuel retailer reported a statutory net profit after tax of $695.9 million in the 2022 first half. It represented an increase of more than 100 per cent on the prior corresponding period. We expect stronger refiner margins and capital management to drive future success. The stock offers attractive fully franked dividends.

HOLD RECOMMENDATIONS

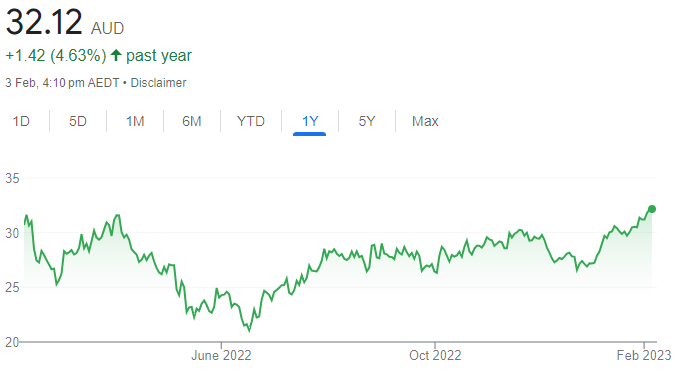

Macquarie Group (MQG)

This financial services company remains one of the highest quality stocks on the ASX, in our view. It retains a dominant global position as a big infrastructure asset manager. This leaves the firm well placed to benefit from underlying demand for assets and from investors searching for sustainable income streams.

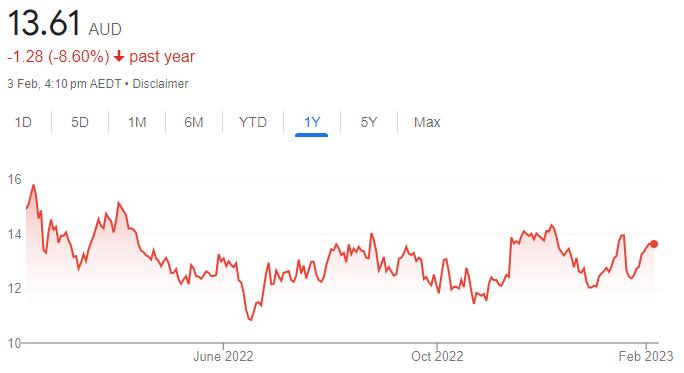

JB Hi-Fi (JBH)

Preliminary and unaudited earnings before interest and tax in the first half of fiscal year 2023 were well ahead of consensus estimates. Trading momentum from Black Friday appears to have continued through to the Boxing Day period. However, we anticipate a slowdown during the next six months in response to weaker discretionary spending as a result of higher interest rates filtering through to households.

SELL RECOMMENDATIONS

Iluka Resources (ILU)

Iluka Resources is a leading global mineral sands miner. December quarter production and sales were up on the September quarter. Average realised prices were also up on the September quarter. Sentiment towards Chinese property has improved. However, expect completions in calendar year 2023 to be possibly lower than in calendar year 2022. Lead indicators point to a challenging year ahead.

Link Administration Holdings (LNK)

This share registry and administration company recently announced it had become aware that British law firm Harcus Parker had served a group action in England against Link Fund Solutions Limited (LFSL), a wholly owned subsidiary of LNK. The group action is on behalf of 1912 claimants in relation to the LF Equity Income Fund, formerly known as the LF Woodford Equity Income Fund. Link said LFSL would vigorously defend itself against these proceedings. We believe Link’s core businesses may struggle to grow meaningfully beyond low to mid-single digit rates.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.