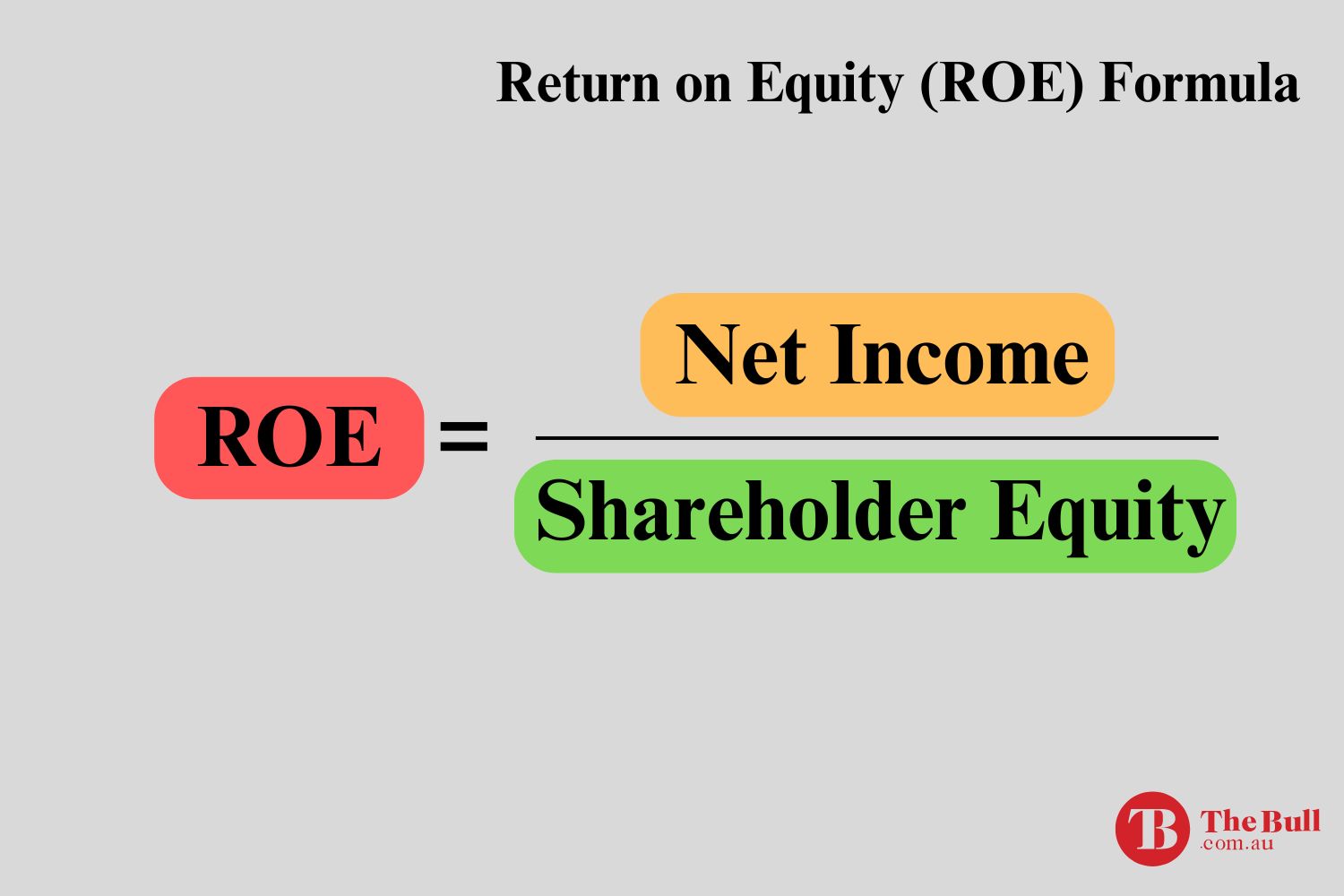

Return on Equity (ROE) – Is It the ‘Magic Number’ of Share Picking Tools?

For most share market investors around the world, fundamental analysis is the essential strategy for identifying worthy investment targets. In the long distant past, the process began with investors combing through a company’s financial statements reported to the investing public – the Balance Sheet, the Income Statement, and the Statement of Cash Flows – to…

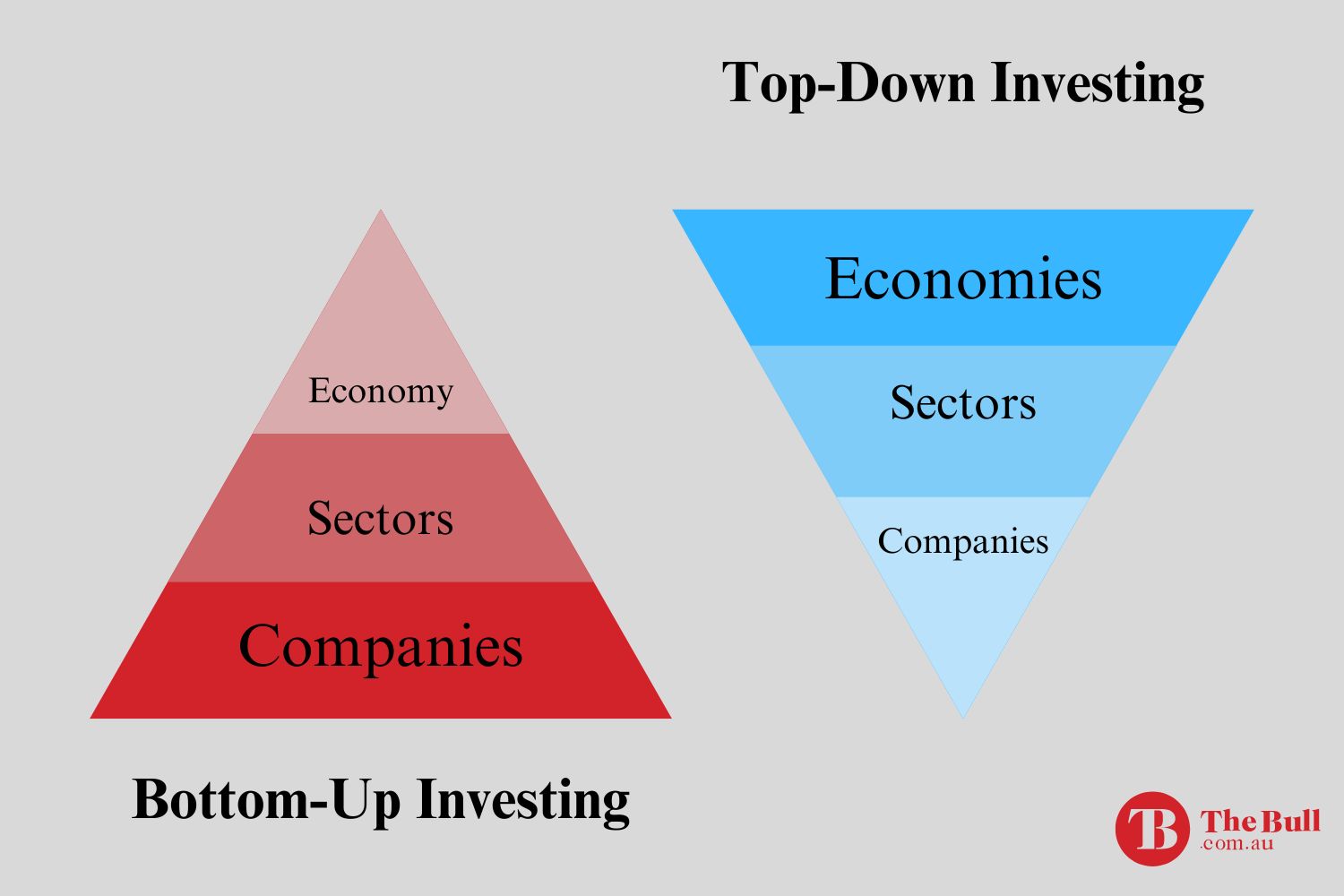

What’s the difference between top down and bottom up investing?

Top Down and Bottom Up Investing Strategies Newcomers to stock market investing surged during the COVID 19 Pandemic, but the trend preceded COVID and remains in place. Some jumped into markets without much investment analysis, relying on tips from friends and relatives or business news highlighting the hot stock of the day. Others approach investing…

Who is Shemara Wikramanayake? Meet Australia’s Richest CEO

Meet Shemara Wikramanayake – Australia’s Highest Paid CEO It was 2008 before a woman broke through the male-dominated class of CEOs of companies that trade publicly on the ASX when Gail Kelly assumed the title at Westpac Banking Corporation (ASX: WBC). By 2025 Australia has made little progress in the broader market but the Australian…

How to Set Up a Watch List

Newcomers to share market investing quickly learn the need for a plan to guide investing decisions. The critical question facing investors is how to make an investment decision. How does one determine which stocks, or bonds, or commodities to buy? In today’s market environment, many younger investors rely on social media investing groups for ideas…

The Importance of Portfolio Diversity

What is Portfolio Diversity? Portfolio diversity is a risk management strategy where investors spread their investments across different asset classes, industries, and geographic regions so the risk of a downturn in one investment can be offset by better performance in another asset class or geographic region. Investing history has seen repeated collapses in notable industries…

Want Growth and Value Shares? – Try the GARP Investing Strategy

Combining Strategies with Growth at a Reasonable Price (GARP) Investing Newcomers to share market investing quickly learn there are two major categories of stocks around which they can build their trading strategy – Value stocks and Growth stocks. Investing in either category requires an assessment of the fundamentals of the company’s business. This fundamental analysis…

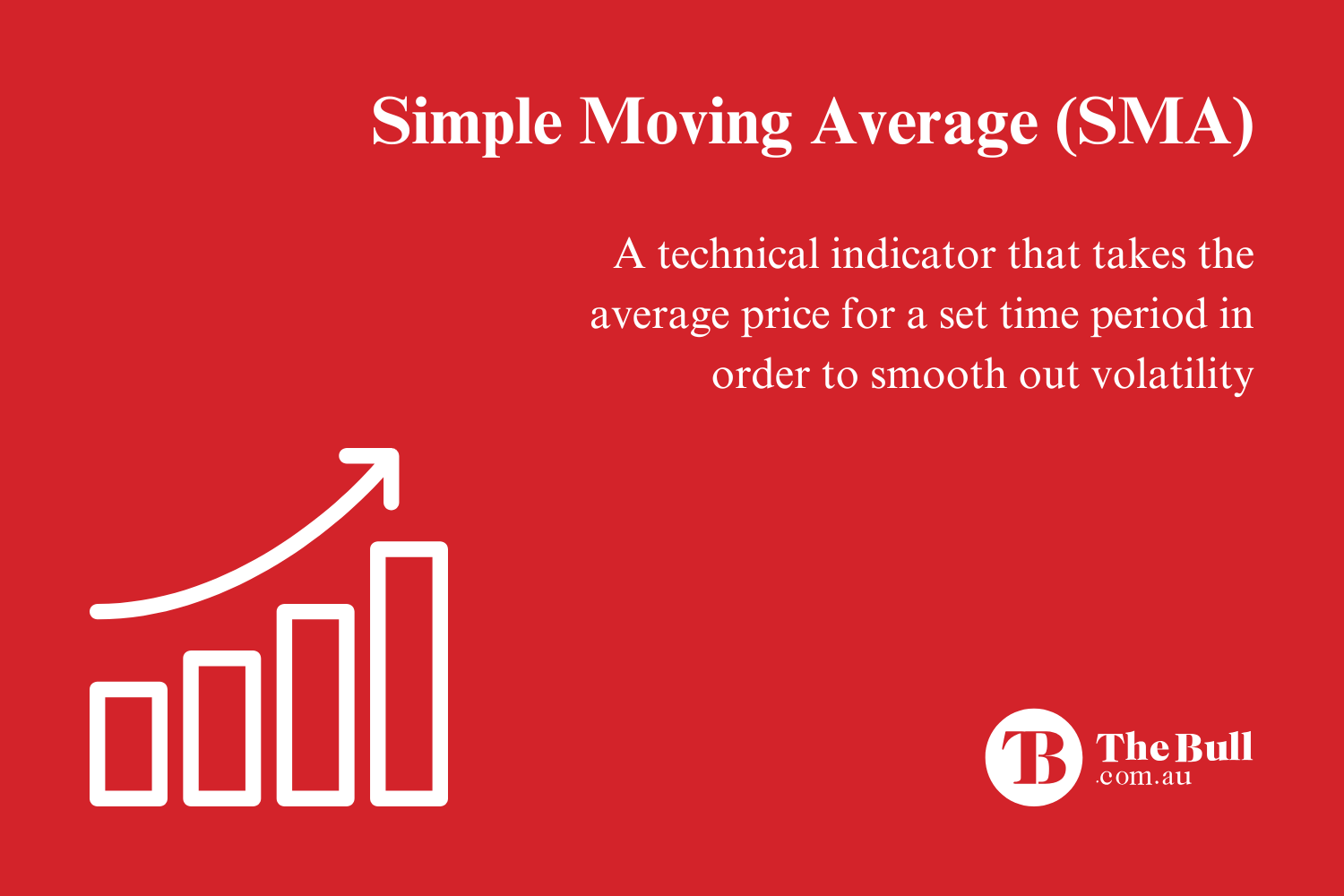

How to Use the Simple Moving Average (SMA) to Trade Australian Stocks

Trading with the Simple Moving Average (SMA) Moving averages are technical analysis indicators designed to smooth out price movements by determining an average price over a period of time. There are two major types of moving averages in use – the simple moving average (SMA) and the exponential moving average (EMA). The EMA is considered…

A Trader’s Daily Routine

A Regimen for a Daily Trader To a large extent, a trader’s daily routine is determined by the kind of trader he or she is. Some market experts claim there are eight different types of stock market traders, differentiated by the time frame of their trades. Timing is common to all traders and investors as…

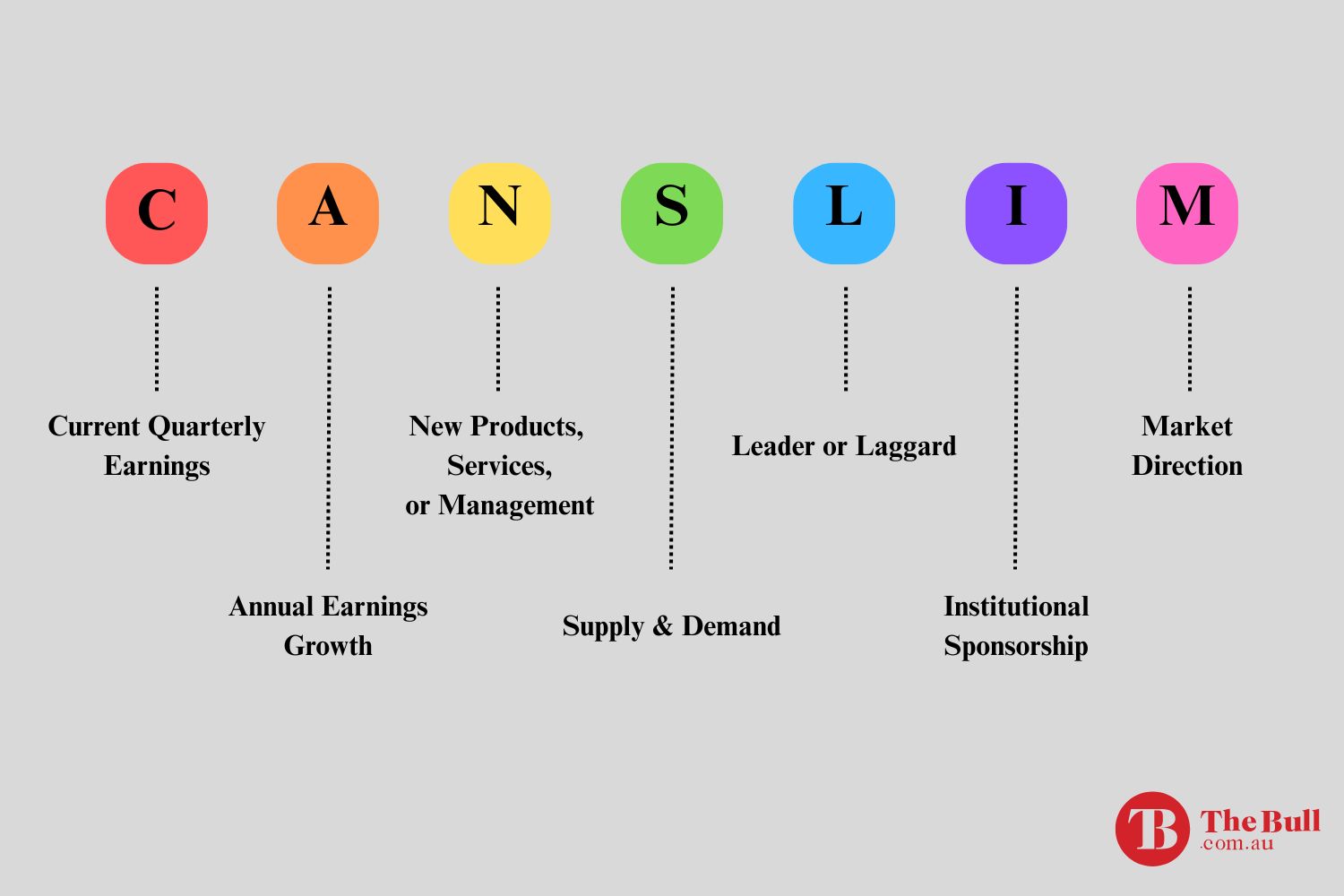

CANSLIM Investing – Does It Really Work?

Does the CANSLIM Investing Strategy Live Up to its Claims? In the 1950’s, a young stock broker based in the US wondered if the high performing companies he followed shared any common attributes. In short, were the secrets of their success following the same path. After years of research, William J. Oneill uncovered seven traits…

How to Use the Relative Strength Index (RSI) to Trade Australian Stocks

Using the Relative Strength Index for Buy and Sell Signals Investors overwhelmed by the host of technical indicators they find on most stock selection graphs available on trading platforms and financial websites might be surprised to learn in 1978, there were only two technical indicators in use. Then came engineer turned real estate developer turned…