All Ords Shed 1.38% On A Red Day : Latest From Markets

CBA shares closed down 1.88% today on a tough day for Aussie bank stocks and the markets generally. The ASX200 dropped 1.34% whilst the All Ords shed 1.38% as some of the spill over from the broader market pullback seen yesterday in international markets touched down at home. In the U.S. financial markets this Tuesday,…

Westpac shares (ASX: WBC) down 1.07% today – analysts differ from sentiment

Westpac shares (ASX: WBC) ended the day firmly in the red, 1.07% down as the Aussie bank stocks and the markets generally pulled back to start Q2. Taking a closer look at Westpac reveals some interesting numbers and forecasts. Riding the wave of a 11.92% increase since the start of the year, Westpac Banking Corp…

US Markets In 2024 – Strong Q1 Winners, What Next?

Stocks took a plunge on Monday, with the Dow Jones Industrial Average shedding 264 points or 0.7%, as market participants braced themselves for a potentially tighter monetary policy landscape. Tuesday has started the early part of trading in similar fashion, with the DJIA shedding more than 1% in early trading, as the S&P 500, Nasdaq…

What are Australian Clinical Labs (ASX:ACL) Growth Prospects?

Australian Clinical Labs Limited shares (ASX:ACL) have become a point of interest for investors as it has demonstrated a robust share price growth of 7.60% on the ASX over the past month. This performance sparks an inquiry: is it too late to consider buying ACL shares, or does this growth foreshadow a promising future for…

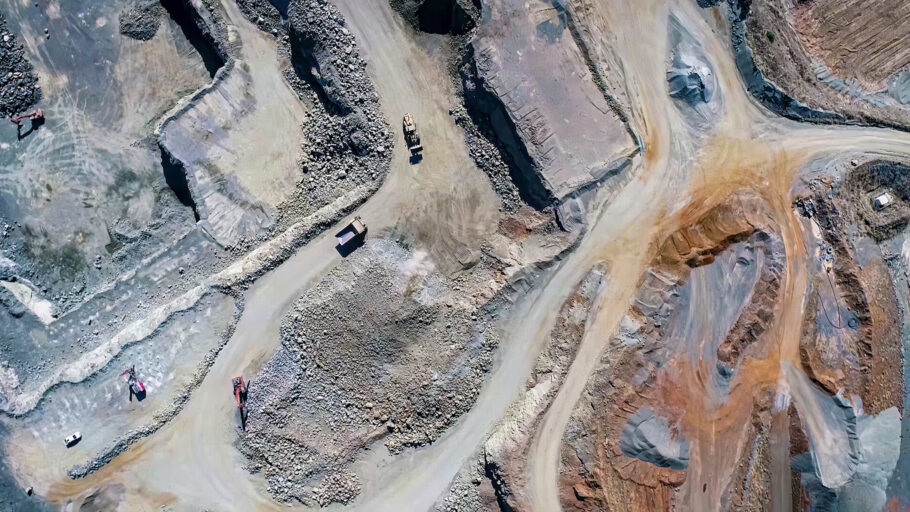

Lynas Rare Earth Shares (ASX: LYC) Down 20.64% YTD, But Why?

Lynas Rare Earths Limited (ASX:LYC) shares are down 20.64% YTD, and compared to some of its’ industry peers has a rather uncommon shareholder composition that may impact volatility to some respect. For a company of its size, LYC finds itself majorly owned by individual retail investors, who hold a commanding 53% of the company’s shares….

Why Is (ASX: PLS) Pilbara Minerals Share Price Dropping?

In the turbulent tides of the markets, Pilbara Minerals Limited (ASX: PLS) share price is currently weathering a downturn with its share price experiencing an 13.15% slip over the past month. This decline might disconcert investors at a glance, but a deep dive into the company’s fundamental financial health indicates this may be little more…

Commonwealth Bank of Australia (ASX: CBA) – BUY, HOLD, or SELL?

Commonwealth Bank of Australia has long been acknowledged to be the best of Australia’s renowned Big Four Banks. The share price is up double digits year over year. Analysts are bearish on CBA shares. Although Commonwealth has a stable track record of financial performance over the last four fiscal years, Half Year 2024 results broke…

Does the Rising Price of Gold Make Aurumin (ASX: AUN) a BUY?

Aurumin listed on the ASX in 2020 with early positive drilling results on its Mt Dimer Project. After hitting an all-time high in mid-2021, the share price collapsed. Aurumin has now sold Mt Dimer, coupled with a capital raise, fully funding the company’s work at its Sandstone project. In December of 2021, junior gold explorer…

QBE Insurance Group Ltd (ASX:QBE) Stellar Performance and Bumper Dividend Payouts

QBE Insurance Group (ASX:QBE) has emerged with a gleaming report card, boasting a significant upswing in its net income to US$1.355 billion for the year ended December 31, 2023. As a reward to its shareholders, QBE upped its final dividend to A$0.48 per share for 2023, likely stirring the interest of yield-hungry investors. QBE closed…

ASX200 Evening Roundup

The Australian stock market capped off an extraordinary week, with the ASX 200 soaring to set a new record, reflecting a surge of unrestrained demand from investors. The benchmark index firmly concluded the trading session on a high note, advancing 77.3 points or gaining 0.99% to establish a fresh record. In what has been an…