How to Invest In Japanese Stocks in Australia

Diversifying Your Portfolio with Japanese Stocks Many newcomers to share market investing are tempted to restrict their initial investments to the “hot stocks” of the moment, but many experienced traders choose to invest in Japanese stocks as a way to diversify their portfolios. At the turn of the century, .com stocks were the place to…

How to Invest In US Stocks in Australia

Diversifying in the US Stock Market The COVID 19 Pandemic accelerated a trend already in place – the arrival of a new class of investors, largely young. Those investors while educating themselves soon learned the value of building a portfolio of diversified holdings. Diversification reduces investment risk by spreading investments across various assets with differing…

How to Invest In UK Stocks in Australia

Diversifying Beyond the ASX The Australian Stock Exchange may be small in size compared to the world’s behemoths like the US S&P 500 and the UK’s FTSE 100, but our national stock market index has features attractive enough to lure stocks from around the world as a launching pad for an initial public offering (IPO)….

How to Buy Tesla Shares in Australia

Tesla for Aussie Investors Tesla. The name has become synonymous with Electric Vehicles, as the company rose to be the largest manufacturer of EVs on the planet, offering four different models with a range of price points, performance, and features. Although the name Elon Musk immediately conjures up images of Tesla ‘s luxury sedan –…

How to Invest In Indian Stocks in Australia

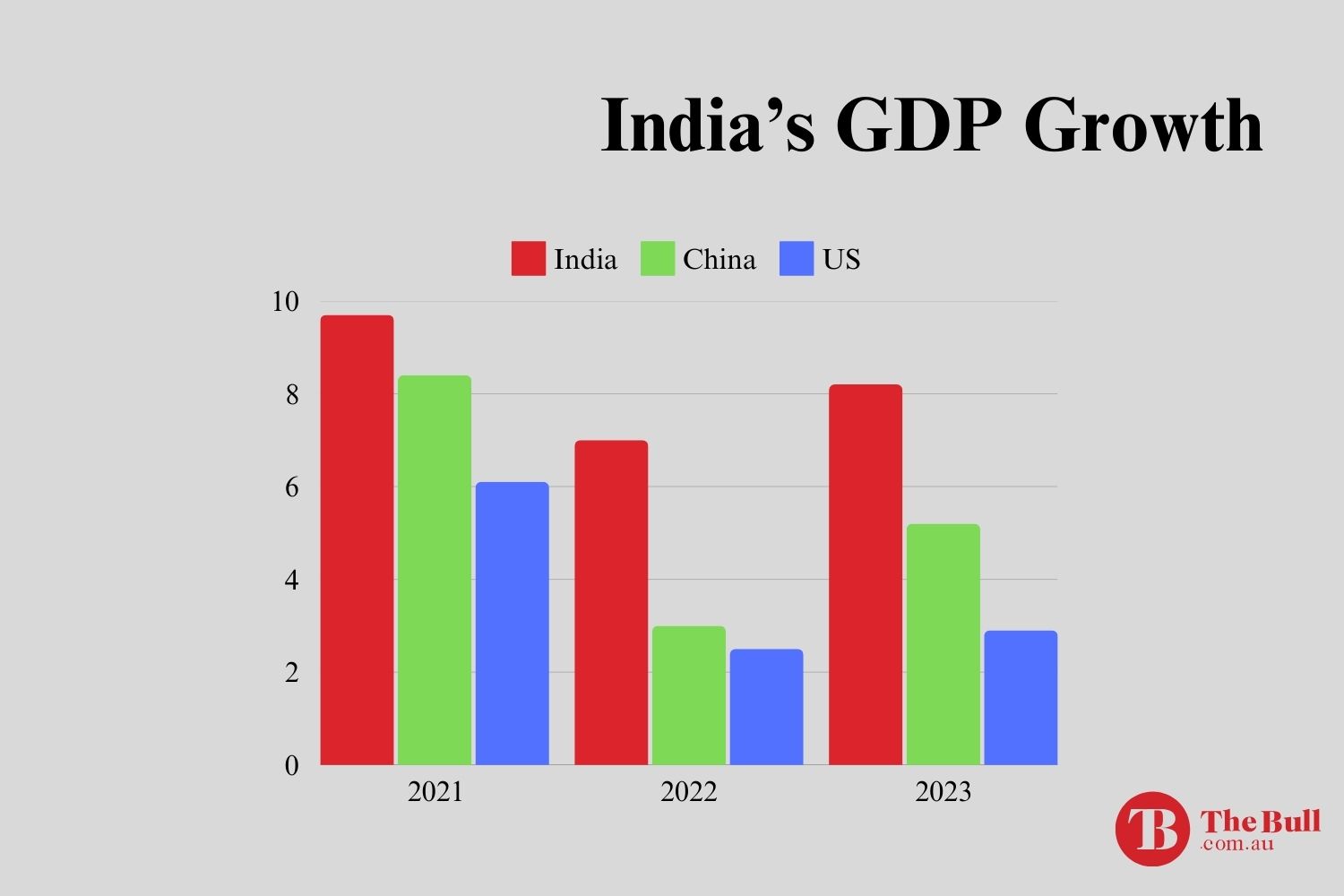

Why Australians Should Invest in Indian Stocks Aussie investors looking to “globalize” their investment portfolios have long looked to the most powerful economy in the world – the United States. Investors lured by the repeated claims that China would one day overtake the US to become the largest economy on the planet looked for opportunities…

The Best US Tech Stocks to Buy in 2023

Although the lacklustre performance of tech stocks in 2022 disappointed investors, the sector jet-propelled in 2023. This resulted in 33% growth year on year (as of 5th September 2023) based on the Technology Select Sector SPDR ETF (ticker: XLK) versus the S&P 500, reflecting less than half that metric for the same period. Source: money.usnews.com…

Big US Stocks Q2 Fundamentals

The fundamentals of the gigantic American companies dominating the major indices are more important than ever. The US stock markets plunged into a bear market last quarter, hammered lower by the Fed’s extreme tightening. That along with raging inflation also slammed the US economy into a recession. So how big US stocks are faring as…

Where to from here for value stocks?

While US markets are undeniably in nose-bleed territory, the gap between the most highly rated and least highly rated stocks is at record levels. That means undervalued parts of the market could provide stellar returns in the coming years. The performance of US equity market in recent years has been outstanding. The top 10 stocks…

Fed Caves on Tightenings

At mid-December’s Federal Open Market Committee meeting, Fed officials began discussing quantitative tightening. Effectively selling previously-monetized bonds to unwind quantitative-easing money printing, this revelation from the minutes rattled markets in early January. But hawkish-jawboning talk is cheap, as the Fed’s last QT campaign proved. It was prematurely abandoned after stock markets threatened a bear. The…

US stocks fundamentals and analysis

The US stock markets continue to power ever higher to an endless series of new records. Leading the way are the big US stocks, with extraordinary gains fueled by the Fed’s radically-unprecedented money printing. The winding-down Q2’21 earnings season illuminates how these massive companies are faring fundamentally. While their results were spectacular, their valuations are…