Investment Strategies

Welcome to the third lesson in our short course on the basics of investing. After looking at the basics of stock markets in lesson one, and how to research shares in lesson two, the third lesson will look at investment strategies.

We will look at some common methods for choosing shares for your portfolio including dividends, value and growth. We will cover:

- Dividend investing

- Growth stocks

- Value stocks

- GARP investing

- CANSLIM investing

Dividend Investing

Dividends are your share of a company’s profit. When a company makes money, the board can decide to return some of that to shareholders in the form of dividends. Not every company pays dividends, some prefer to re-invest all profits into growing the company. There are different types of dividends, the most common being cash, but they can be in the form of additional shares or, in rare cases, other assets.

Dividends are generally a sign of financial health. Companies that have consistently paid a dividend over a long period of time are highly favoured by dividend investors as they can add stability to their portfolio. Dividends can help offset fluctuations in share prices by providing a steady, predictable income. Cash dividends can also be re-invested into more shares and build the value of your portfolio over time through compounding.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While dividend-paying companies are generally well-established with a stable share price, they don’t offer much opportunity for growth. They are a lower-risk investment, but their share price is not likely to increase very much.

Growth Stocks

Growth stocks are generally smaller companies with huge potential to grow. These stocks can provide impressive returns long-term, and investors can be willing to pay a premium for this huge growth potential. However, these companies are largely untested and so are a fairly high-risk investment.

Growth stocks tend to have higher price-to-earnings (P/E) ratios, indicating that investors are willing to pay more than the stock is worth right now, in anticipation of a big increase in price as the company grows. These companies do not pay dividends, instead they re-invest profits in order to grow the business.

Value Stocks

Value stocks are essentially the opposite to growth stocks. They are stocks that are trading for less than the company is truly worth. This strategy might seem simple, but uncovering the true value of a company is not an easy task.

These stocks can be seen as being ‘on sale’. Value investors believe that the market will eventually catch up to what the stocks are really worth and the share price will increase. In contrast to growth stocks, value stocks tend to have low price-to-earnings (P/E) ratios.

Stock prices are driven not by the value of the company but by market perceptions. If the Aussie investing community believes a stock has substantial future potential they will rush in to buy and buy again, driving up the price. While these perceptions may cause short-term price fluctuations, the reality of the company’s fundamentals and future opportunities remain the same.

US investor Benjamin Graham is credited with creating the value school of investing in the 1930’s with one of his disciples – Warren Buffet – holding the title as one of history’s greatest value investors.

GARP Investing

Peter Lynch, manager of the Magellan Mutual Fund between 1977 and 1990, was the first to ask the question – why not growth and value? And the growth at a reasonable price (GARP) strategy was born. The aim of this strategy is to invest in stocks with growth potential but avoid paying over-the-odds for them.

While value and growth investing rely primarily on the P/E ratio, the gold standard valuation metric for GARP investors is the P/EG ratio (Price to Earnings Growth), developed by Lynch. The P/EG replaces historical earnings per share, with anticipated future earnings per share. Some calculations use the EPS growth estimated by the company and some using consensus analyst estimates. A P/EG of 1.0 indicates the stock is fairly priced and P/EGs under 1.0 indicate the stock is undervalued.

As with any investment strategy, the stock selection process does not end with attractive valuation metrics. Valuation ratios alone will not uncover critical information on how efficient and effective the company’s operating performance is.

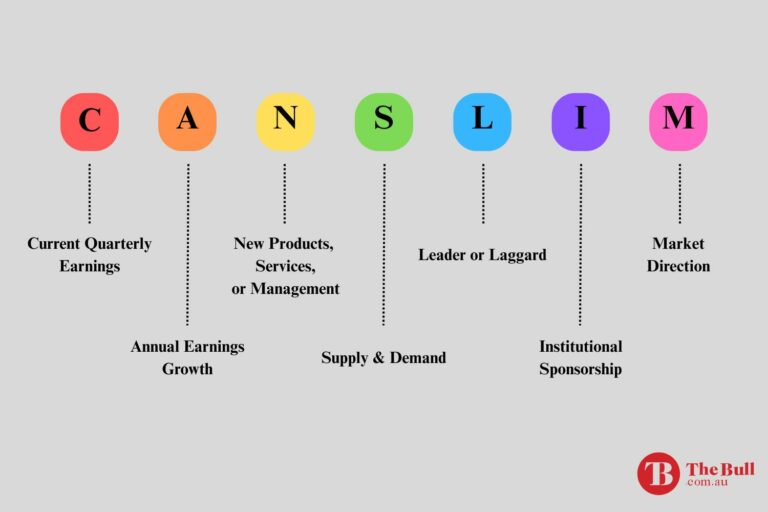

CANSLIM

The CANSLIM system was developed by William J. O’Neill, based on seven traits shared by the top performing companies on the stock market. The advantage of this model is that it provides a simple framework for assessing a stock which helps new investors to keep emotions out of the process. The seven key attributes are:

C – Current Quarterly Earnings. Investors using the CANSLIM system look for companies whose EPS (earnings per share) has increased 25% year over year. Higher growth rates are more desirable.

A – Annual Earnings Growth. Investors should be looking for earnings growth of at least 25% over a minimum of three years, with some investors opting for annual earnings growth over five years.

N: New Product, Services, or Management. Successful companies are not satisfied with the status quo and are always looking for ways to become more profitable. Successful companies regularly develop new products and services, and bring in new personnel, in order to grow the business.

S: Supply and Demand. Stock prices go up and down based on the demand for the stock and the availability of shares for trading, regardless of company fundamentals. Companies with high trading volume and modest or low shares outstanding are good targets. High trading volume is indicative of institutional buying increasing demand for the stock.

L: Leader or Laggard. O’Neill believed investors should look for leaders in the market, and avoid the laggards, even if some analysts predict the laggards can emerge to become solid choices for investors. The system requires that companies are the leaders in the business sector or geographic area in which they operate.

I: Institutional Sponsorship. Investors using the CANSLIM system search for stocks being bought up by institutions like mutual and exchange traded funds, hedge funds, pension funds, banks, and insurance companies . Following institutional investing adds the services of the many trained analysts at those institutions to the research capability of retail investors.

M: Market Direction. Advocates of the CANSLIM investing system caution to shy away from bear markets, as even the best of breed will move in the general direction of the market. Some analysts estimate that 75% of all stocks will follow the lead of the market.

Key Points

- Dividends are a share of a company profits paid to shareholders. Investors buy dividend paying shares for a stable income.

- Growth stocks are newer and smaller companies with huge potential that re-invest all profits into growing the business instead of paying dividends.

- Value stocks are shares in companies that are trading for less that they are truly worth.

- The growth at a reasonable price (GARP) strategy looks for companies with growth potential that are available for a good price.

- CANSLIM is a framework for picking stocks based on seven traits of top performing companies.