Building a Portfolio

We have arrived at the final part of our short course on the basics of investing. So far we have covered the mechanics of stocks and the markets in lesson one. Lesson two looked at how to research shares. Lesson three examined fundamental analysis, while lesson four looked at technical analysis.

In lesson five we will look at how to build and manage a portfolio of investments. We will cover:

- Understanding your investment goals

- How to manage risk

- Diversifying your investments

- Rebalancing your portfolio

Setting Your Investment Goals

People do not build houses by randomly plonking bricks next to each other. Houses are carefully built on architectural plans that determine such things as the floor layout, or the relationship between rooms, walls and doors.

Investment portfolios should be constructed with the same level of care – using a plan that takes into consideration factors like an individual’s age, attitude to risk, investment timeframe, existing assets, income, tax rate, investment goals and so on.

Your investment plan must be specific to your goals and risk appetite, as well as your investment timeframe. An architect doesn’t design the same house for a family of six, as he does for a childless professional couple. Similarly, a 35-year old should not have the same investment strategy as a 65-year old. A person planning to take up full-time study will have a different investment strategy to one that plans to work full-time for the next 20 years.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Your personal circumstances, attitude to risk, investment timeframe and many other things need to be taken into account when deciding on your investment goals.

Risk Management

Most investors mistakenly believe that they’re risk takers. In reality a 20 per cent fall in their investments, sending their portfolio from $10,000 to $8000 or lower, would cause them considerable stress.

When thinking about how to manage the amount of risk you are taking, the question of where you should invest is an important one. Most of us would head straight to the ASX for answers, but it’s important to consider the range of asset classes available. As well as Australian shares, these include international shares, direct and listed property, fixed interest, and cash. Having a strategy for selecting the right investments is key to controlling the amount of risk in your portfolio.

A simple way to ensure you are not risking too much capital in any one position is to follow the 1% rule. This rule states that you should risk no more than 1% of your total capital on any one position. For example, a $10,000 portfolio would cap position sizes at $100. This means that even in the worst case scenario, your losses are capped at 1%.

Another tool for managing risk – especially when trading assets such as stocks – are stop-loss orders. These are automated instructions that close out positions once losses exceed a certain level. You set the cut-off price and can adjust stop loss orders at any time.

Diversification

Portfolio diversity is a risk management strategy where investors spread their investments across different asset classes, industries, and geographic regions, in order to smooth out the bumps of short-term volatility to produce higher returns over time. This ensures the risk of a downturn in one investment can be offset by better performance in another asset class or geographic region.

Diversifying your portfolio means looking for stocks or other asset classes with low or negative correlations with each other. For example, if the price of oil skyrockets, airline stocks will fall. Conversely, if the price of oil falls, airline stocks will rise.

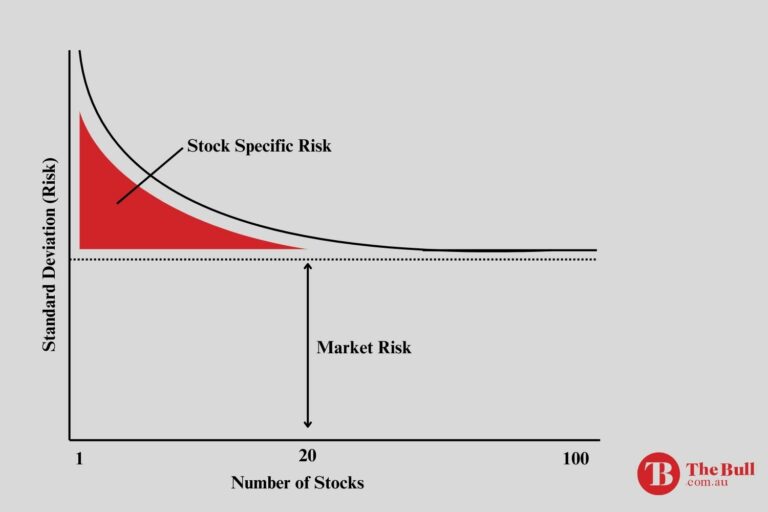

However, it is possible to have too much of a good thing. Overdiversifying an investment portfolio may spread investing resources too thin. While some investors think adding more stocks to their portfolio will keep reducing risk, research has shown little reduction in risk beyond the 20th stock in a well-diversified portfolio.

Stocks are arguably the most glamorous and exciting of all asset classes, so many investors concentrate their time and effort in building a diversified portfolio of stocks, paying less attention to other asset classes. However, it is important to also diversify across asset classes. The digital world has enabled investing in a broad array of asset classes from precious metals like gold and silver, to commodities, to cryptocurrencies, to real estate to a wide range of financial instruments.

Rebalancing

So you’ve decided on an investment strategy and you have a carefully weighted and diversified set of assets in your portfolio. However, the different assets in your portfolio will return different amounts. This will alter the percentage of your total capital that you have invested in each asset, changing the amount of risk you are exposed to.

Rebalancing is the process of buying and selling assets to bring the weightings of each asset class back into line with your chosen investment strategy. An investor may also choose to rebalance their portfolio if their risk tolerance or life situation changes, or they decide to change their investment strategy. Rebalancing can be used to change the percentage of each asset class to reflect this.

Let’s look at an example to illustrate this. Our investor has $10,000 that he wants to split equally between higher risk stocks and lower risk bonds, investing $5,000 in each. During the first year, the stocks perform very well and are now worth $8,000. However the bonds have performed poorly and are now worth $4,000.

While the total value of the investments has increased to $12,000, the percentage of each asset class has changed. The stocks are now two thirds of the portfolio and the bonds are just one third, significantly increasing the level of risk. To bring the allocation back to 50% of each asset class, our investor will need to either sell stocks or buy bonds, until the value of each is equal once again.

Key Points

- It is important to consider your investment goals and life situation when planning your investment portfolio.

- Risk management is the process of controlling the amount of risk your investments are exposed to.

- Keeping positions to 1% of your total capital is a good guideline for controlling risk.

- Diversifying your portfolio by investing in a range of asset classes, industries and geographic regions can also reduce risk.

- However, over-diversifying can spread your resources too thin and limit potential profits.

- Different assets will return different amounts, changing the amount of risk in your portfolio.

- Rebalancing is the process of buying and selling assets to bring the percentage allocations, and risk levels, back into line with your strategy.