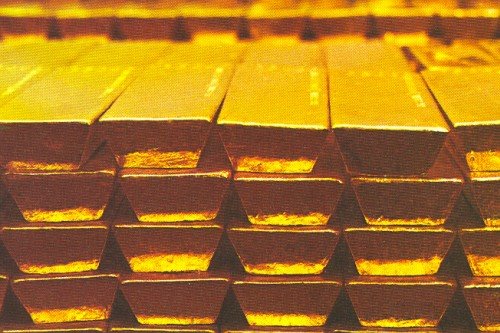

Gold mining companies fundamentals

The mid-tier and junior gold miners in their sector’s sweet spot for upside potential have powered higher in recent months. Amplifying gold’s young upleg, they have already surged to major breakouts. And the smaller gold miners’ gains are likely to grow much larger. Their recently-reported Q4’21 earnings season revealed ongoing strong fundamentals. Those along with…

Gold Stocks Surge Back

The gold miners’ stocks surged back this week, blasting higher out of early-year weakness. Those big-and-fast gains were fueled by gold’s own, which shot up without any news catalyst. Seeing battered gold stocks showing signs of life has piqued traders’ interest, starting to shift sector sentiment back towards bullish. These leveraged plays on gold have…

3 local solutions to replace coal

As the world shifts to renewable energy, helping the communities that have depended on fossil fuels for jobs is becoming ever more pressing. The 2015 Paris Agreement notes the imperative of a “just transition” for affected workforces, with “the creation of decent work and quality jobs” to replace those lost. Trade unionists have been arguing…

Gold investors ignoring the Fed

Gold was just hammered lower after the latest FOMC decision. Heavy gold-futures selling erupted after a third of top Fed officials implied they saw a couple potential rate hikes way out into year-end 2023. While leveraged gold-futures speculators panicked, gold investors ignored these faint tidings of slight tightening way off in the distant future. Their…

Silver stocks: What investors need to know

The silver miners’ stocks have mostly been consolidating high since last summer. While they’ve enjoyed some sharp rallies, those have been within that sideways-grind trend. That lack of overall upside progress has left this tiny contrarian sector out of favor, with apathy reigning. But as their recently-reported Q1’21 operating and financial results revealed, silver stocks’…

Gold miner stocks fundamentals

The mid-tier gold miners’ stocks are in this sector’s sweet spot for upside potential. After a spectacular upleg out of last March’s stock panic, they have mostly been correcting since early August. That is doing its necessary work of rebalancing sentiment, paving the way for mid-tiers’ next bull upleg. These great miners are thriving fundamentally…

Can Technology Rescue Coal

The Australian Bureau of Statistics (ABS) tells us coal was first discovered in Australia in 1797 in New South Wales, followed by Victoria in 1825. Early efforts to mine and market coal were less than satisfactory until the government stepped in in 1889 to begin registering coal producing companies. Given the fact Australia now ranks…

Mining Service Providers to Watch

Newcomers to share market investing emboldened by the dramatic reversal in market movements in late March of this year have to remain dazed and confused. Months of tracking market movements could easily lead to the conclusion that negative economic news matters little to profit-hungry investors. It is the future that counts and to a large…

Saudi Arabia eyes total dominance in oil and gas

Saudi Arabia’s Energy Minister Prince Abdulaziz claimed last week that the Kingdom will be the world’s biggest hydrocarbon producer “even” in 2050. “I can assure that Saudi Arabia will not only be the last producer, but Saudi Arabia will produce every molecule of hydrocarbon and it will put it to good use … It will…

Junior Gold Explorers to Watch

On occasion market experts have anointed wild swings in market volatility as a market with a “split personality.” It would be hard to argue that market movements since the potential scope of the COVID-19 Pandemic began to become obvious in mid to late February of 2020 has been anything but volatile. On 19 February markets…