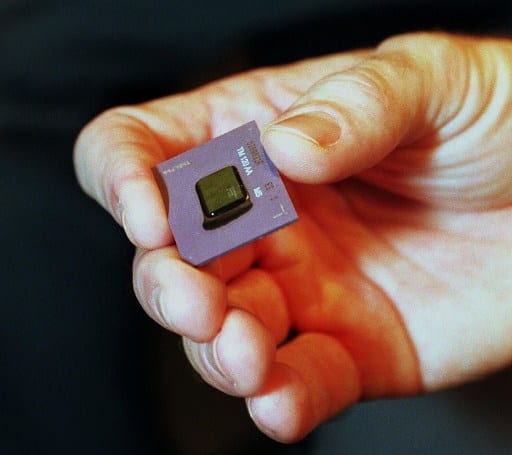

Memory chip manufacturing project breaks ground

DALIAN – SK hynix, a semiconductor firm headquartered in the Republic of Korea, started constructing a non-volatile memory manufacturing project in northeast China’s Dalian City on Monday. The project will include a new wafer factory to produce non-volatile 3D NAND chip memory products. SK hynix closed the first phase of the transaction to acquire Intel’s…

CommSec morning report Tuesday 17 May

Latest news In US economic data, the New York Empire State manufacturing index fell from +24.6 to -11.6 in May (survey: +17). European sharemarkets were mixed on Monday with investor sentiment dented by weak Chinese economic data. Luxury good stocks fell with LVMH down 1.1%. But miners rose 1.6%. The panEuropean STOXX 600 index was…

Markets evening report

Latest News The Australian sharemarket started the week on a somewhat positive yet cautious note, extending its gains from Friday by 0.3 per cent or 18 pts to 7093. Today’s gains followed the US sharemarket’s strong performance on Friday, which seemed encouraged by calming comments on interest rates by Federal Reserve Chair Jerome Powell. With…

Former financial advisor with 17 offences

On 13 May 2022, Mr Ashley Grant Howard, of Hobart, Tasmania, appeared in the Newcastle Local Court via his legal representative, charged with 17 offences under the NSW Crimes Act. It is alleged Mr Howard used 17 false transfer forms to arrange for shares in GPS Alliance Holdings Limited, BHP Billiton Limited and Aquarius Platinum…

China’s economy expected to recover gradually

BEIJING – China’s economy is expected to recover gradually as the country achieves major anti-epidemic outcomes and pro-growth policies take effects, Fu Linghui, spokesperson for the National Bureau of Statistics, said Monday. The country’s economy took a hit from the domestic resurgence of COVID-19 cases in April, but the impacts are “short-lived and external,” Fu…

China’s property investment down 2.7%

BEIJING – China’s investment in property development went down 2.7 percent year on year in the first four months of 2022, data from the National Bureau of Statistics showed Monday. Originally published by Xinhua

CommSec morning report Monday May 16

Latest news In US economic data, import prices were flat in April (survey: +0.6%), but were up 12% on a year ago (survey: +12.3%). Export prices rose by 0.6% in April to be up by 18% on a year ago (survey: +19.2%). The University of Michigan consumer sentiment index fell from 65.2 to a near…

Tiny houses can help ease rental affordability

Rental housing in Australia is less affordable than ever before. It is no exaggeration to call the situation a crisis, with vacancy rates at record lows. But there are some relatively simple, easy-to-implement and cost-effective things that can be done to ease rental affordability pressures. These include relaxing planning restrictions on small and non-traditional houses,…

The 4 economic election wildcards

There are four economic wildcards between now and the election, and we know exactly when each will be played. The first is this Wednesday at 11.30am eastern time, when we get the official update on inflation. We’re likely to see a figure so large it will take many of us back to the 1990s, to…

The great recalibration continues

Fixed income has cheapened dramatically, however with uncertainty elevated we expect additional risk premia to be built in before bonds become really appealing. As a result, we’re continuing to run cautious portfolio positions, monitoring (elusive as yet) signs of stability. Recalibration continues The dramatic recalibration of expectations regarding the future level of interest rates continues….