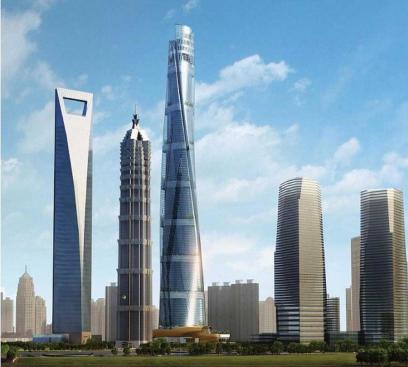

China’s home prices continue to ease

BEIJING – China’s housing market continued to ease in April, with second-tier and third-tier cities seeing a decline in home prices, according to the National Bureau of Statistics (NBS) Wednesday. New home prices in four first-tier cities – Beijing, Shanghai, Shenzhen and Guangzhou – edged up 0.2 percent month on month in April, moderating 0.1…

China builds 358km of new high-speed rail

BEIJING – China put 581 km of new railway lines into service in the first four months of the year, including 358 km of high-speed railway, data from China State Railway Group Co., Ltd. showed. The country saw 157.46 billion yuan (about 23.21 billion U.S. dollars) in fixed asset railway investment in the period, up…

Wednesday evening report

The Australian sharemarket has extended its gains to a fourth straight day after the S&P/ASX 200 index climbed 1 per cent or 70pts, to 7183. This followed an encouraging set of economic reading released overnight, which helped push US stocks higher. While 9 of the 11 sectors finished in positive territory today, mining stocks did…

Federal Court finds timeshare company failed consumers

The Federal Court has made declarations that timeshare company Ultiqa Lifestyle Promotions Ltd breached financial services laws by failing to ensure that financial advice given to consumers was in the consumers’ best interests. Between October 2017 and March 2019, financial advisers acting as authorised representatives of Ultiqa advised consumers to invest in the Ultiqa Lifestyle…

Federal elections: Impact on the sharemarket

In the 11 elections held since 1990, the All Ordinaries Index climbed by an average of 1.2 per cent in the 15 trading days after poll date. In fact, the All Ordinaries Index has risen in the 15 trading days following every one of the eight federal elections held since 1998. In the 15 trading…

CommSec morning report Wednesday

Latest news In US economic data, retail sales rose by 0.9% in April in line with forecasts. Industrial production rose by 1.1% in April (survey: +0.5%). Business inventories rose 2.0% in March (survey: 1.9%). The NAHB housing market index fell from 77 to 69 in May (survey: 75). Speaking at a Wall Street Journal event,…

SGMW posts record new energy vehicle sales

SAIC-GM-Wuling (SGMW), based in Liuzhou of south China’s Guangxi Zhuang Autonomous Region, reported record new energy vehicle sales. By the end of April, the company had sold more than 700,000 units of Hongguang MINI EV, a new energy vehicle model. During the January-April period this year, the company registered sales of 133,902 units of such…

Tuesday evening report

Latest News Despite a mixed lead from Wall St overnight, the Aussie sharemarket lifted by another 0.3 per cent or 20 points, to 7113. This is the ASX 200’s third straight win and its best start to the week in a month. Energy stocks were amongst the best performers, after the sector’s 2.1 per cent…

Former NSW financial adviser sentenced

Ezzat-Daniel Nesseim, of Pymble, NSW, has been sentenced to a three-year intensive correctional order, including one year of home detention, for engaging in dishonest conduct and providing falsified documents to ASIC. Between 16 August 2017 and 11 October 2017, Mr Nesseim engaged in repeated dishonest conduct, including by: using three forged wholesale client certificates by…

PBOC adds liquidity to financial system

BEIJING – China’s central bank on Tuesday conducted 10 billion yuan (1.47 billion U.S. dollars) of reverse repos to maintain liquidity in the banking system. The interest rate for the seven-day reverse repos was set at 2.1 percent, according to the People’s Bank of China. The move aims to keep liquidity in the banking system…