Evening report Wednesday

The Australia sharemarket snapped six-straight days of gains and had its worst day in more than two weeks, after the ASX 200 shed 22.2pts or 0.32 per cent, to 6975.9. The index managed to recoup some losses after the mining sector clawed back a 1.5 per cent decline and finished 0.35 per cent higher. The…

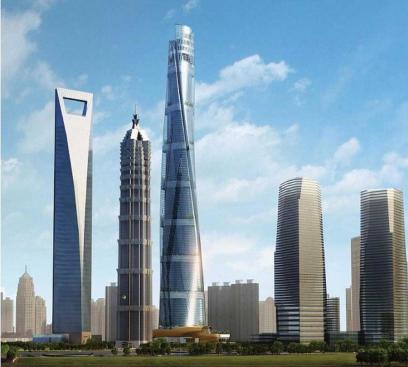

China mulls foreign multinational finance companies

China is mulling allowing foreign multinational groups to establish finance companies in the country in its latest opening-up move. Foreign multinational groups will be able to establish finance companies directly or through foreign-funded investment companies established in China, according to a draft document released by the China Banking and Insurance Regulatory Commission. In the draft,…

The year we went out again

According to the Australian Bureau of Statistics (ABS), retail trade rose 0.2 per cent in June to be up 12 per cent on the year. In the June quarter, sales rose by 1.4 per cent in real (inflation-adjusted) terms to be up 5.5 per cent on the year. Real (inflation-adjusted) spending at cafes and restaurants…

Consumers warned about fake investment opportunities

Losses to imposter bond investment scams have nearly tripled in the first half of this year with consumers losing over $20 million to these sophisticated scams. Imposter bond scams usually impersonate real financial companies or banks and claim to offer government/Treasury bonds or fixed term deposits. People often fall victim to them after searching online…

China’s weekly road logistics price index rises

– Southwest China’s Tibet Autonomous Region has achieved robust economic growth and stability over the past decade, according to a press briefing in the regional capital Lhasa on Tuesday. Tibet’s gross domestic product surged from 71 billion yuan (about 10.5 billion U.S. dollars) in 2012 to 208 billion yuan in 2021, with an annual average…

Most aggressive interest rate moves in 28 years

The Reserve Bank (RBA) Board has lifted the cash rate by 50 basis points (half of a percent) for an unprecedented third straight month, taking the cash rate to 1.85 per cent – the highest level since April 2016. This also represents the most aggressive monetary policy action since 1994. The RBA increased the interest…

Delay to the ASX CHESS Replacement Project and Independent Review

ASIC and the Reserve Bank of Australia (RBA) (the regulators) acknowledge the recent announcement by ASX of the further delay to the Clearing House Electronic Sub-register System (CHESS) Replacement project. The regulators welcome the appointment of Accenture to provide an independent review of the new CHESS application software. This review is expected to assist ASX…

CommSec Moring Report Wednesday August 3, 2022

Latest news In US economic data, the JOLTs survey reported that job openings eased from 11.303 million in May to 10.698 million in June (survey: 11 million). According to Redbook, chain store sales in the past week were up by 15.5% on a year ago, compared with a 13.3% annual increase in the prior week….

International trade channels help enterprises expand globally

In the production workshop of Sirui Advanced Copper Alloy Technology Co., Ltd., based in Xi’an, capital of northwest China’s Shaanxi Province, a batch of high-tech metal materials was ready for export. Despite being located in the inland province, the company has extended its business tentacles to the world. It is a vital supplier to several…

RBA Monetary Policy Decision

At its meeting today, the Board decided to increase the cash rate target by 50 basis points to 1.85 per cent. It also increased the interest rate on Exchange Settlement balances by 50 basis points to 1.75 per cent. The Board places a high priority on the return of inflation to the 2–3 per cent range over time, while keeping the economy on an…