Think you don’t need financial advice? Think again.

If you’re a DIY investor who researches thoroughly and has translated that into a well-managed and high performing portfolio, you may think you don’t need a financial advisor. If so it may pay you to think again… and read on. You might find that you don’t know as much as you thought you did. Dominic…

The perils of sudden wealth

Two lottery wins in two consecutive years and the combined total of $5.4 million gone in just over two decades. Evelyn Adams, who achieved the Great American Dream twice when she won the New Jersey lottery in 1985 and 1986, is now destitute and living in a trailer. The tragedy is that hers is not…

Is your share portfolio a dud?

It takes a while for investors to cotton onto the fact that investment booms are happening every day – somewhere around the world. By the time the last property boom had run out of puff in Australia, the commodities bull was well into the swing of things and canny investors had already smelt out profits…

Does the strategy to buy and hold really work?

One of the most straightforward sharemarket investment strategies is ‘buy-and-hold’ investing, where you simply buy a portfolio of stocks and hold them for the long term. If you stay in the market long enough, the theory goes, you minimise the risk that your portfolio may lose its value and you allow compounding to get to…

How Australia’s wealthiest investors are navigating the financial crisis

High net worth individuals are cashed up, debt free and waiting for opportunities. But they are in no hurry to rush back into buying equities, say advisers to people with millions to invest. Paul Huggins, director of RetireInvest, Melbourne has clients telling him it is a good time to go on holiday and not look…

The best stock to invest in

These companies are rare, but when you find them – hold on for the ride – as this could be the stock of a lifetime. We are talking about companies with wide economic moats, generally regarded as the best companies to invest in. But before we sift through the Australian investing landscape in search of…

A stock for a lifetime

Australian investors are becoming less willing to pour money into costly managed funds when other investments such as listed investment companies (LICs) do the same thing for a fraction of the price. Both LICs and managed funds are share portfolios that are externally managed by a professional fund manager – the difference being that LICs…

10 Aussie stocks with the highest debt

What a difference a year makes when it comes to attitudes towards corporate gearing. Companies once lauded for having ‘ballsy borrowings’ are now as popular as Scrooge himself on Christmas morning. The global credit squeeze brought to front and centre the stress debt can place a company under. And the 180-degree about-face on what now…

How to insure your investment portfolio before it’s too late

There’s nothing like a 23 per cent fall in the sharemarket to focus investors’ minds on protecting their portfolio. Arguably, it’s a bit late to think about this now but for those who have used the slump to establish new shareholdings, the summer’s experience should have portfolio insurance high on the agenda. You can get…

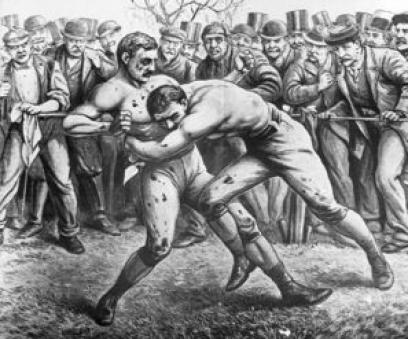

Battle of the CFD providers

The Australian contracts for difference (CFD) market is estimated to be worth up to $400 billion – not bad for a market that did not exist six years ago. But this very lucrative market is being competed for by providers of two different CFD trading models – the market-maker model, and the direct market access…