Does the strategy to buy and hold really work?

One of the most straightforward sharemarket investment strategies is ‘buy-and-hold’ investing, where you simply buy a portfolio of stocks and hold them for the long term. If you stay in the market long enough, the theory goes, you minimise the risk that your portfolio may lose its value and you allow compounding to get to…

The best stock in the market – stock screening software and how to use it

For investors who favour a fundamental approach to investing, there is plenty of help available from software programs that crunch the numbers they need – digesting and comparing companies’ reported sales revenue, cash flow, earnings, dividends, assets and liabilities. Programs such as Stock Doctor, Conscious Investor, Value Gain, Bourse Data and MetaMarket+ have made it…

Use these 5 ratios to unearth superior stocks

We all want to find the next Rio Tinto, but long before it’s trading at $100 a share, or Google when it was a tiny IT company with only a vision. But how do we know that a company will be a superior player over the long haul? What key ratios unlock the secret to…

How to insure your investment portfolio before it’s too late

There’s nothing like a 23 per cent fall in the sharemarket to focus investors’ minds on protecting their portfolio. Arguably, it’s a bit late to think about this now but for those who have used the slump to establish new shareholdings, the summer’s experience should have portfolio insurance high on the agenda. You can get…

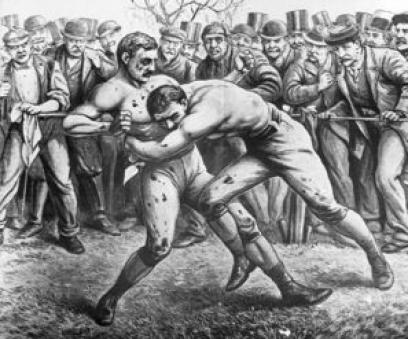

Battle of the CFD providers

The Australian contracts for difference (CFD) market is estimated to be worth up to $400 billion – not bad for a market that did not exist six years ago. But this very lucrative market is being competed for by providers of two different CFD trading models – the market-maker model, and the direct market access…

How to trade CFDs without losing your shirt

Trading is a great occupation if you don’t lose money doing it. Once losses are made – and start to pile up – trading can begin to lose its appeal very quickly. Amateur traders who try their hand on Contracts for Difference (CFDs) can find that a small loss can escalate into a more serious…

How to trade CFDs without losing your shirt

Trading is a great occupation if you don’t lose money doing it. Once losses are made – and start to pile up – trading can begin to lose its appeal very quickly. Amateur traders who try their hand on Contracts for Difference (CFDs) can find that a small loss can escalate into a more serious…

Starting a share portfolio from scratch

Many newcomers to share investing spend a couple of agonising months tossing up which stocks to buy, and after taking the plunge into their first share purchase begin snatching up stocks at an increasing rate. Stock picking is where the action is, and the consumer in us is compelled to buy up big and fast….

Guide to analysing stocks – part 1

Academics and researchers have spent considerable time searching for the secret to making it rich on the sharemarket. The trouble for investors is that – when every supposed ‘expert’ yells from the rooftops proclaiming the secret to successful stock investing – it’s almost impossible to separate the researched theory from the pure sales pitch. For…

Measuring the strength of the Australian sharemarket

Most agree that the major ingredients required to herald a sharemarket crash are investor euphoria combined with an overvalued sharemarket; like a pressure cooker, as prices for stocks soar upwards, a market becomes overheated and the likelihood of a market crash is ever more present. Last week we looked at the fundamental reasons for why…