Does the P/E Ratio Really Tell You Which Stock To Buy?

The Price to Earnings Ratio for the vast majority of shares in which you might be considering investing is readily available, and for those you cannot find, the vaunted P/E is easy to calculate on your own. All you have to do is get your hands on a copy of the company’s latest annual report….

How do I get an order filled before the open of the market ?

Question: “I was waiting to buy “SIP” on Friday morning and on opening at 11:00 it was already +38%! How do people get their orders filled before open to receive the gain? On Thursday I put an order in at 7:30am to buy “AEC” at 2.680 and when it opened I did not get my…

How to set up a watchlist

What progress have watchlists made! From the yellow pad and end-of-day newspaper quotes to instantaneous online watchlists that transverse a multitude of search criteria: sectors, market capitalisation, growth, moving averages or trading volume. All this could be at your fingertips, for free, in just few seconds. For decades, stocks have been the most popular investment…

Options Shorting Strategies for Beginners

Before proceeding into trading any type of instruments and strategies you have to ask yourself: – What is my goal? – How much time can I dedicate to trading? – What is my risk tolerance? – What is my strategy? Option selling (writing) offers reasonable profit potential and generally requires only couple of hours a…

Developing a trend-following system

I became more interested in moving averages when I was looking into developing a trend-following system, since moving averages help identify trend reversals. Therefore, I took a closer look at the differences between the different types of moving averages and the possible benefits of using one versus another. For those of you new to trading,…

Trader’s Toolkit – Simple Moving Average (SMA)

What is a moving average and why should I care about it? Imagine that you are at the grocery store, but instead of seeing 20 varieties of beer displayed at slightly different prices, you see your favorite beer displayed at the 20 different prices it had for the last 20 sales. Naturally, you ask yourself,…

How To Make Money By Thinking Big Picture

Think of top down investing as a “big picture” strategy. The big picture is the global market and all it encompasses. If you think of the global market as a forest, if it looks green and healthy, you enter the forest looking for the healthiest trees. When you find a grove of healthy trees, you…

Tools for Finding Safer Shares (Part 2) – The Quick Ratio

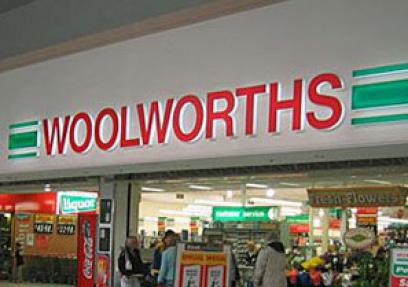

Something happened a short time ago – January 24th, 2011 – that shines a spotlight on the issue of finding safer shares. Australia’s giant retailer, Woolworths (WOW), lowered its guidance for the first half of 2011. Today’s earnings release cited the following conditions that led to the revised forecast: • Consumer Confidence Levels • Inflation…

Tools for Finding Safer Shares (Part 3) – The Cash Conversion Cycle

If liquidity is a key metric to consider when looking for safer shares, what is the best measure of liquidity? Financial websites tell us to focus on a combination of the Current Ratio and the Quick Ratio. As you know, both have flaws relating to the time required to turn assets into available cash. The…

How to take advantage of the commodity boom

There’s little doubt that commodities – at least some of them – will continue their price boom this year, despite concerns about slowing Chinese growth and the fragile recoveries occurring in the US and Europe. But getting on board to take advantage of the trend as an ordinary investor takes some thinking through, and as…