52 Week Highs in the Eye of the Storm

The Australian Stock Exchange has managed to escape a plunge into official Bear Market Territory but there are some market experts of the opinion it is only a matter of time before we follow the lead of US markets into the abyss. All major US exchanges are in Bear Market territory and still falling. In…

The energy crisis is likely to last years

An overreliance on vanishing Russian fossil fuels will torment Europe. Europe is restarting mothballed coal-based power plants because the benchmark electricity price has exceeded 1,000% above its average of the past decade (where prices are set by the marginal cost of the last unit – essentially, the most expensive unit – of energy purchased to…

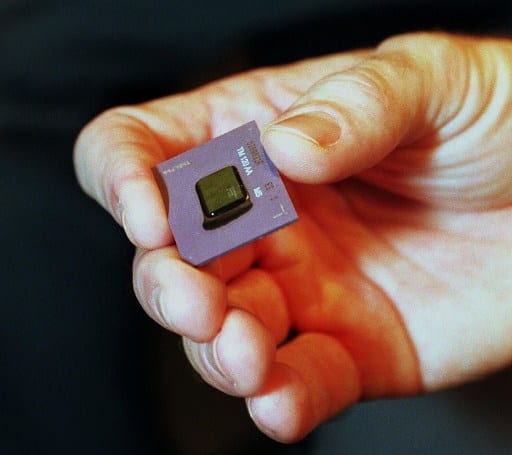

From Squid Game to semiconductors

Since the late 1990s, the Korean Wave, or “Hallyu”, has been gaining momentum. The country has enjoyed phenomenal success in exporting its popular culture around the world, benefitting from growth in the internet, smartphones, and online video streaming along the way. Many will be familiar with K-pop and K-dramas, in particular last year’s Netflix hit,…

Keep liquid and embrace volatility

A challenging macroeconomic backdrop of rising inflation and interest rates has tested investor patience over 2022 and more recent recession fears have done little to help. We asked portfolio managers Anthony Aboud and Sean Roger how a bottom-up stock picker goes about adding value when the broader market is so dominated by macro themes. Twelve…

Many jobs summit ideas for wages don’t make sense

Treasury’s issues paper for the jobs summit says fair pay and job security “strengthen communities, promote attractive careers and contribute to broad-based prosperity”. But it notes “many Australians have not experienced real wage gains”. It says real (inflation-adjusted) wages have grown by only 0.1% per year over the past decade and have declined substantially over…

Greenhouse Gas from a Surprising Source

After what seemed an eternity of talk without significant governmental action to combat climate change, the US has passed what some are saying is the biggest climate bill in history. Oddly named, the Inflation Reduction Act commits $740 billion US dollars to target a variety of long-standing concerns – energy production and manufacturing, reducing carbon…

Australia’s inflation rate is about to go monthly

Australia’s consumer price index is about to go monthly, meaning Australia will join most of the developed world in getting an update on inflation at the end of every month, instead of once every three months as at present. Until now Australia has been the only member of the Group of 20 leading industrial nations…

Fixed income returns to the winner’s podium

The good news is fixed income assets posted strongly positive returns in July. The bad news is why. Central banks’ aggressive tightening of monetary policy to fight inflation is raising concerns of a material slowdown in growth, with recession an increasing possibility, The global economy is in the midst of a marked slowing, and recessionary…

Nuclear energy is a promising solution for climate change

But the clean-energy option will forever risk a catastrophe. (Reading time: 4 mins) Fukushima, on the northeast of Japan’s largest island, is vulnerable to earthquakes and tsunamis. From 1971, the area hosted the Daiichi nuclear plant. Based on global appraisals of tsunamis, the facility was built 10 metres above sea level. The commercial plant and…

What next for climate change?

With just over 100 days to go until the UN climate summit, we kick off our running blog with a COP26 recap and a look at what’s next. The United Nations’ climate conference COP27 is set to take place in Egypt this November. Lisa Sizeland in Schroders’ global content team has summarised what COP27 is…