Overseas shares not so taxing

It’s all very well to talk about buying overseas shares, but what about the tax issues? As one of our readers pointed out, two issues that may impact negatively on Australians investing in foreign shares are our dividend imputation system, and the foreign with-holding taxes on dividends and capital gains. Let’s deal with the second…

Overseas shares not so taxing

It’s all very well to talk about buying overseas shares, but what about the tax issues? As one of our readers pointed out, two issues that may impact negatively on Australians investing in foreign shares are our dividend imputation system, and the foreign with-holding taxes on dividends and capital gains. Let’s deal with the second…

Top places to invest $500, $1000, $3000 and $5000

It’s not a bad time for novice investors to risk their arm in the sharemarket. For relatively small amounts, they can buy good Australian companies at possibly bargain-basement prices, courtesy of the credit crunch. The sharemarket may not have bottomed, but, unless you fluke it, it’s almost impossible to pick the peaks and troughs of…

Where the wealthy stash their cash

Think mega wealthy, seriously cashed up, an embarrassment of riches and the elite and exclusive world of private banking, add to that investment strategies for tens, hundreds, thousands of millions of dollars. Are you visualising brilliantly conceived systems of complex, sophisticated asset allocation schemes? From the outside looking in there is a distinct notion of…

Two market crashes later – Robert Kreft, a story of a full-time trader

It took the loss of a massive $300,000 during the bear market of 2001 to cause Robert Kreft to come to his senses. Declaring that from experience he has learned that human nature will usually overlook the risks in favour of the rewards, he confesses that greed drove his second foray into trading in 1999….

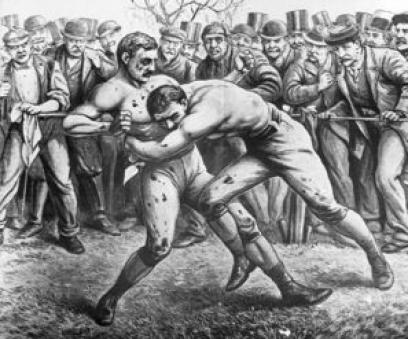

Battle of the CFD providers

The Australian contracts for difference (CFD) market is estimated to be worth up to $400 billion – not bad for a market that did not exist six years ago. But this very lucrative market is being competed for by providers of two different CFD trading models – the market-maker model, and the direct market access…

Measuring the strength of the Australian sharemarket

Most agree that the major ingredients required to herald a sharemarket crash are investor euphoria combined with an overvalued sharemarket; like a pressure cooker, as prices for stocks soar upwards, a market becomes overheated and the likelihood of a market crash is ever more present. Last week we looked at the fundamental reasons for why…

Why do commodities traders always check the LME website?

Why do traders regularly check the London Metal Exchange (www.lme.co.uk)? Response: The London Metals Exchange (LME) has been established for over 130 years and is the world’s foremost non-ferrous metals and plastics market. Traders can obtain accurate price data, forecasts, and analysis about the futures contracts that are offered by the exchange. The LME offers…

Why do forex traders always talk about range trading?

No, range trading doesn’t require you to use a laptop while you are in the saddle….it is a way of taking advantage of markets where a clear trend exists, and prices range up and down within a well-defined channel. Range trading is a strategy that depends on selling highs and buying lows of a well-defined…

How do you trade Australian shares after hours?

The market opens at 10:00am, and normal trading occurs until 4pm. From 4.01pm to 4.10pm, the market goes into a pre-open phase where investors may continue to enter orders into the market. The ‘Closing Single Price Auction’ (CSPA), determines the closing price of stocks each trading day and this occurs between 4.10pm and 4.11pm on…