Tools for Finding Safer Shares (Part 3) – The Cash Conversion Cycle

If liquidity is a key metric to consider when looking for safer shares, what is the best measure of liquidity? Financial websites tell us to focus on a combination of the Current Ratio and the Quick Ratio. As you know, both have flaws relating to the time required to turn assets into available cash. The…

Return on Equity (ROE) – Is It the ‘Magic Number’ of Share Picking Tools?

Although some share market skeptics claim most share picking tools yield results no better than throwing darts at a wall, there are numbers any investor can look at to help pick solid investments. Return on Equity (ROE) is one such number. Simply put, ROE measures how well a company makes use of the money its…

Top Down Strategy – Stocks To Gain From Flood Recovery

Think of top down investing as a “big picture” strategy. The big picture is the global market and all it encompasses. If you think of the global market as a forest, if it looks green and healthy, you enter the forest looking for the healthiest trees. When you find a grove of healthy trees, you…

Setting Up A Watchlist

What progress have watchlists made! From the yellow pad and end-of-day newspaper quotes to instantaneous online watchlists that transverse a multitude of search criteria: sectors, market capitalization, growth, moving averages or trading volume. All this could be at your fingertips, for free, in just few seconds. For decades, stocks have been the most popular investment…

Can I make a living trading forex?

“Make $20,000 per month in income trading currencies! Trade on autopilot and rake in the cash!” If you have ever received any of these colorful junk e-mail messages, you are not alone. Across the world, smooth-talking swindlers with get-rich-quick schemes bombard internet users with stories that sound entirely too good to be true. If you…

Overseas shares not so taxing

It’s all very well to talk about buying overseas shares, but what about the tax issues? As one of our readers pointed out, two issues that may impact negatively on Australians investing in foreign shares are our dividend imputation system, and the foreign with-holding taxes on dividends and capital gains. Let’s deal with the second…

Top places to invest $500, $1000, $3000 and $5000

It’s not a bad time for novice investors to risk their arm in the sharemarket. For relatively small amounts, they can buy good Australian companies at possibly bargain-basement prices, courtesy of the credit crunch. The sharemarket may not have bottomed, but, unless you fluke it, it’s almost impossible to pick the peaks and troughs of…

Where the wealthy stash their cash

Think mega wealthy, seriously cashed up, an embarrassment of riches and the elite and exclusive world of private banking, add to that investment strategies for tens, hundreds, thousands of millions of dollars. Are you visualising brilliantly conceived systems of complex, sophisticated asset allocation schemes? From the outside looking in there is a distinct notion of…

Two market crashes later – Robert Kreft, a story of a full-time trader

It took the loss of a massive $300,000 during the bear market of 2001 to cause Robert Kreft to come to his senses. Declaring that from experience he has learned that human nature will usually overlook the risks in favour of the rewards, he confesses that greed drove his second foray into trading in 1999….

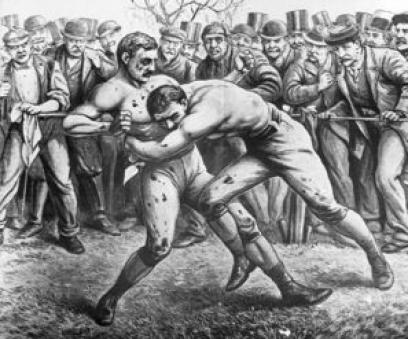

Battle of the CFD providers

The Australian contracts for difference (CFD) market is estimated to be worth up to $400 billion – not bad for a market that did not exist six years ago. But this very lucrative market is being competed for by providers of two different CFD trading models – the market-maker model, and the direct market access…