The Graphene Promise – Disruptor or Disrupted

What’s the “next big thing” to hit the market? This question has tantalized rabid investors in search of the big payoff since forever. Next big thing candidates typically are involved in business operations that have the potential to make a significant impact on the way things get done in the world. Many are technology firms. …

Macpac dresses up Super Retail Group

My daughter needed a new winter jacket. It had to be from Macpac, the New Zealand-based outdoorwear maker Super Retail Group bought earlier this year.Like many teenagers, my daughter is growing quickly and is easily influenced in fashion. Others her age deemed Macpac the brand of choice and the rest was history. Buying the jacket meant…

In a disruptive world ‘Big Brands’ offer protection

Australian entrepreneur Dick Smith teared up when he heralded the closure of his 19-year-old locally sourced all-profits-to-charity Dick Smith Foods because the German discount chain Aldi, which only entered Australia in 2001, has “destroyed us”. Smith said, when announcing the closure in July, that he had written to Coles, Metcash and Woolworths to warn them that Aldi’s…

Gold Juniors’ Second Quarter 2018 Fundamentals

The junior gold miners’ stocks have been thrashed in August, plummeting to brutal multi-year lows. Such carnage naturally left sentiment far more bearish than usual in this forsaken contrarian sector. But these extremely-battered gold-stock prices certainly aren’t justified fundamentally. Junior gold miners’ collective results from their just-completed Q2’18 earnings season prove their stock prices need…

ASX Most Innovative Companies

One of history’s all-time great investors – US based Warren Buffett, of Berkshire Hathaway – coined the term “economic moat” to characterize a company’s competitive advantage in its operating sector. High on the list of business practices that constitute a competitive advantage are cutting-edge technologies. For the past seven years, the Australian Financial Review’s Most Innovative…

Robots and algorithms are likely to automate workplaces at a frenzied pace

Believe it or not, a motion to the European parliament recommends that autonomous robots be deemed “electronic persons”. The motion for resolution suggests that self-learning robots, those that make independent decisions and interact freely, be held to have an “electronic personality”.The proposals in the 2017 motion aren’t as bizarre as it might seem because companies…

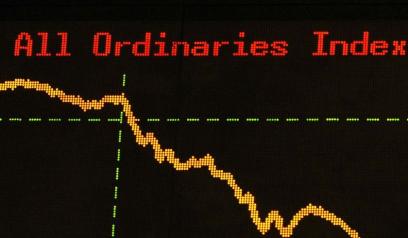

Protecting your portfolio from major downturns

By Michael O’Dea, Head of Multi Asset, Perpetual It is nine years after the global financial crisis but we still have ultra-low interest rates. This is great if you are a borrower, but not if you are a saver. If you avoid risk today and invest in interest rate products (cash, term deposits etc), your…

The economics of ridiculously expensive art

What would possess someone to buy Leonardo da Vinci’s Salvator Mundi for US$450 million? You might think it’s an investment – after all it was previously sold for just US$10,000 in 2005. From an economic point of view, art can be an investment. Although the research shows art investing has mixed results. Art also has…

Why invest in utilities?

Regulated utilities are known for their ability to generate moderate but predictable returns regardless of market conditions. For this reason, we often describe utility stocks as the ‘lead in the keel’ of our infrastructure portfolios. They allow us to navigate shifts in global equity markets with confidence as we seek to deliver annualised returns of…