Huawei’s window of opportunity closes

When the United Kingdom completed its telecom supply chain review last year it gave a green light to Huawei by concluding that nationality-based bans did nothing to improve network security and could actually harm it by weakening competition. Executives at Huawei celebrated what they saw as a victory for evidence-based decision-making. The decision also seemed…

Apps, backed by ‘dark kitchens’, are changing food delivery

Even though the platform attack is hobbled by poor economics, restaurants are under threat – especially during a pandemic. In 2004, Matt Maloney and Mike Evans were working in Chicago as web developers for appartment.com, a platform that allows people to find rental flats online. The pair often worked late enough to order takeaway. “We…

Covid-19 tearing at the fragilities of Italy and Eurozone

Solutions to appease the crisis face political hurdles. A default or euro exit are possible. ‘il Boom’ is how Italians describe the ‘great transformation’ of Italy over the 1950s and 1960s when a poor country turned itself into a modern industrial powerhouse with a stable currency, the lira. During those decades, rural southern Italians flocked…

Recession Deniers Fading Away

At the close of the 2019 trading year, the second largest investment bank in the US – Goldman Sachs – confidently declared the US economy “all but recession proof.” Goldman now predicts 0% growth in Q1 of 2020 with negative 5% coming in Q2, although the bank along with rival JP Morgan Chase both predict…

Lessons Learned from the GFC

Earlier in the week retail investors still reading the financial news began to see analyst/expert opinions that the dramatic selloffs both here and in the US were an “overreaction” to the uncertainty about the economic impact of the current crisis. The “overreaction” continued in mid-week, with the S&P indices in both countries descending into Bear…

Climate Change: The New Normal

We look back at the climate “super year” of 2019 and examine what investors should look out for in the years to come. The world seems to be losing the battle to halt climate change. Economies and financial markets appear increasingly unprepared for the disruption that higher global temperatures will bring. Moreover, policies to limit…

Interpreting Market News

On many a morning investors around the world awaken to find the price of stocks they own or of stocks in which they have interest has moved dramatically, up or down. There always has been an aura of mystery surrounding share market trading as much of what happens seems to defy explanation, something akin to…

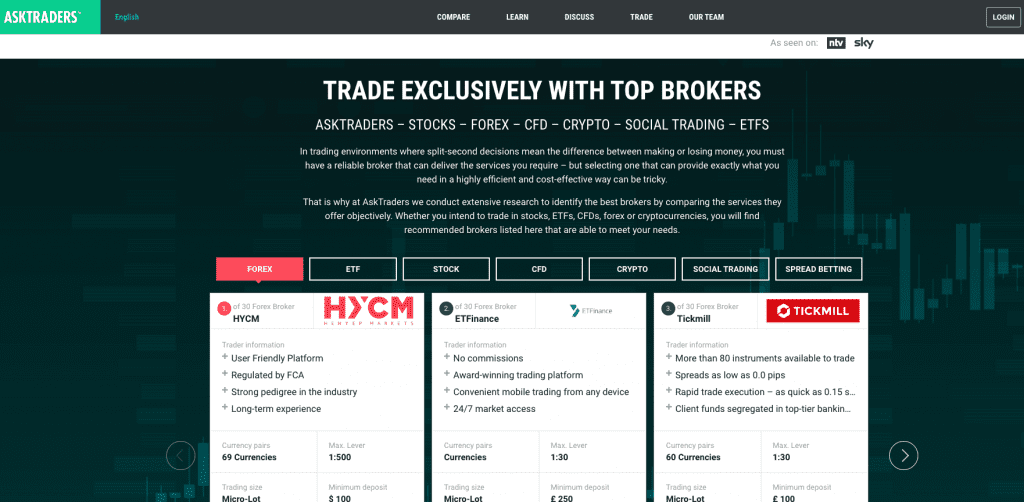

AskTraders.com helps people learn to trade

AskTraders.com has been around for a while now but recently it has had some new features we are loving – especially the Q&A trading forum section. The Q&A section has lots of advice and help for traders who are actively trading and for new traders who are just getting into the game. We can also…

Is This The Next Great Oil Frontier?

Nigeria has long been known for its oil riches. Angola has too, but decades of entrenched corruption have chased foreign investors away. Now Namibia is joining the African oil conversation with one of the most oil-friendly regimes on the continent. It’s offering 5% royalties on what might just be a very productive shale play in…

A look at global investment juggernaut BlackRock

BlackRock, sometimes called the most powerful company you have never heard of, has grown exponentially since its founding in 1988, especially since the 2008 financial crisis. The company has been seen as a shadowy potential beneficiary of the French government’s controversial pension system changes by critics of French President Emmanuel Macron. What BlackRock is The…