Predicting the future: Astrologers or economists?

If you ask most people what economists do, they might tell you it has something to do with money. Or perhaps forecasting what the economy will look like a year from now. Most of the other comparisons would be less charitable. I’ve heard plenty that can’t be printed. The reality is very different. For example,…

Electric vehicles are the next revolution in automobiles

But problems need to be overcome to hasten the switch and cement the climate benefits. For Formula E motorsport, the 2020-21 racing season was transformational. Seven years after electric single-seaters first raced, Formula E gained the elevated ‘championship’ status enjoyed by Formula 1, World Endurance, World Rally and World Rallycross. Then came the embarrassment, the…

ESG investing – Fad or future?

From time to time, investors become irrationally enthusiastic. The important thing to note about these manic moments is that the investment theme underpinning them makes perfect sense. The narratives are rational; it is the market excess surrounding them that is not. In the early 1970s investors became transfixed by a group of seemingly bullet-proof stocks,…

Markets at an inflection point

Investors who decided to “sell in May and go away” were left disappointed as May 2021 saw global equities rally 1.4% and Australian equities rally almost 2% over the month in local currency terms. Over the past 70 years the May to October period has usually been the worst 6-month period for returns but more…

Why middle-aged entrepreneurs do better

Bill Gates was 21 when he and Paul Allen registered Microsoft. Steve Jobs was 22 when he and Steve Wozniak launched Apple. Mark Zuckerberg started Facebook in his Harvard dormitory. The biographies of these tech billionaires who achieved great success in their twenties has helped cement the perception that entrepreneurship is a young person’s game….

New Investors

A Sydney based financial research firm – Investment Trends – conducted a recent survey that yielded some interesting conclusions: over 400,000 Australians placed their first trade in the Australian securities market over the last 12 months. One in six first-time investors is under the age of 25. Given the size and scope of market meltdowns…

Are gold stocks heading for a bull-market?

Following a necessary correction, the gold miners’ stocks have spent much of recent months bottoming. This healthy basing process is rebalancing sentiment, preparing the way for this sector’s next bull-market upleg. That is looking to coincide with gold stocks’ spring rally, one of their strongest times of the year seasonally. That stiff tailwind blowing behind…

The justification of Tesla’s share price

Elon Musk is now the world’s richest person, edging out previous title holder Amazon’s Jeff Bezos. His rocketing fortune is due to the booming share price of Tesla, the maker of electric vehicles and clean energy technologies. In the past week Tesla’s share price surpassed US$880, ten times its March 2020 low of US$85, giving…

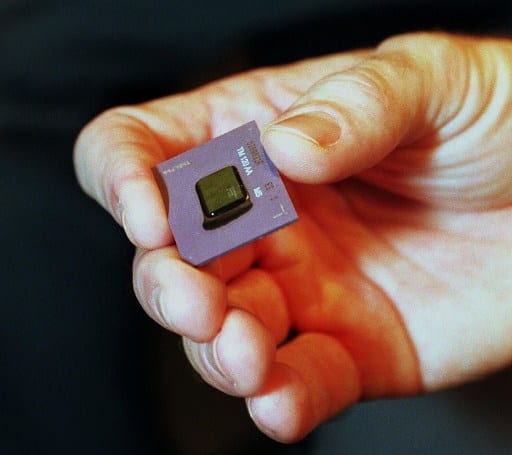

The pivotal fight between China and the US is over the microchip

The campaign for dominance in semiconductors could hurt both countries. Japan’s Kioxia Holdings, which in the early 1980s invented flash memory computer chips, was set for one of the country’s biggest initial public offers for 2020. In September, however, the semiconductor maker reduced the asking price of its offer by 25%. Days later, the company…

Investing in high-voltage transmission lines

When, in the midst of the pandemic, the Economic Society of Australia invited 150 of Australia’s keenest young thinkers to come up with “brief, specific and actionable” proposals to improve the economy, amid scores of ideas about improving job matching, changing the tax system, providing non-repayable loans to businesses and accelerating telehealth, two proposals stood…