ASX 200 VIX Spikes Thursday – What Does A VIX Tell Us?

The popular Wall Street Fear Index known as the VIX has seen a substantial upward movement in the last few days triggering the attention of markets. The VIX has increased 15.15% over the last 5 complete trading days in the US, and the rise seems to be persistent. Whilst the level of the VIX is…

UniSuper To Make Significant Investment In Macquarie Renewables Fund (MGECO)

Hot on the heels of an announcement that Macquarie Green Energy and Climate Opportunities Fund is set to acquire a diverse portfolio of six investments spanning solar, wind, energy storage, and natural climate solutions from Macquarie Asset Management, comes a significant piece of investment news from UniSuper. The earlier announcement effectively confirmed that the agreement…

(ASX:RIO) Rio Tinto Battles Production Headwinds In Q1

Mining giant Rio Tinto (ASX:RIO) had a green day today, gaining 2.16 points, translating to a 1.68% increase. Despite a stellar last month where Rio’s shares shot up 10.49 points (8.71%), the company have reported subdued production figures for the first quarter of 2024, indicating a series of operational challenges that have impacted its output…

A Closer Look at Reliance Worldwide Corporation Shares – Is RWC A Buy?

Despite coming off the back of a 1 month drop in share price of 9.20%, Reliance Wordwide Corporation has delivered admirably for shareholders over the past 6 months. In the landscape of modern investing, the movement of stocks often serves as a barometer for the market’s perception of a company’s future prospects, but peaks and…

ASX 200 Sheds 1.81%, All Ords Drop 1.84% To Go Red On Year

The Australian stock market faced a wave of selling pressure, resulting in a broad decline with the ASX 200 index plummeting by 140 points, translating to a substantial 1.81% drop on Tuesday. The All Ords suffered a similar fate with a 1.84% drop, down 147.10 points. The last 5 days has seen a reversal in…

Are Recent Gains In Ampol Shares (ASX: ALD) Sustainable?

In last six months, Ampol Limited (ASX:ALD) has witnessed its stock price appreciate by a notable 19.85%, inviting investors to consider if its underlying financial performance is a driving factor for the upturn in market sentiment. As the last week brought a pullback in ALD shares, down 5.43%, we want to take a closer look….

ASX 200, All Ords Market Roundup, Banking and Technology Down, Mining Up

Australian shares closed on a somber note on Monday, with the banking sector leading the downturn as the latest U.S. inflation figures led investors to temper expectations for rate cuts. The ASX 200 index concluded the trading day 0.46% lower, settling at 7,752.5 points. The All Ords Index has also fallen 0.5%, down from 8050.20…

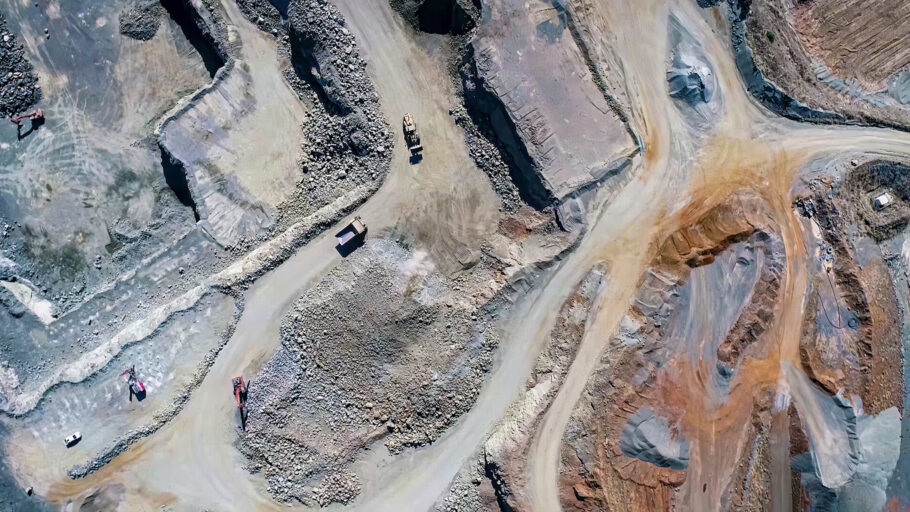

Rio Tinto Shares Up 3.63% Today – Will Space Tech Help Exploration Efforts?

Rio Tinto shares (ASX: RIO) have climbed 3.63% today, to add to an excellent recent trend, having added 12.83% in the last month. In the mining giant’s relentless quest to uncover new resources, the company is taking a bold step by integrating space-age technology into its earthbound operations. After a hiatus in major mineral discoveries since…

Australian Silver Miners Soaring: 4 Top ASX Silver Stocks To Watch

In the vibrant commodity markets, Australian silver miners remain a staple for investors seeking tangible assets and industrial demand continues to underpin its value. Silver prices have soared so far this year, hitting levels not seen for 3 years, and looking to take out highs not seen in a decade. XAGUSD is pushing towards new…

ASX 200 fell 0.45% and All Ords down 0.44%. US CPI and Chinese Economic to Blame?

In the latest market wrap-up, the ASX 200 index showed resilience in the face of international pressures, closing 34.9 points lower, translating to a 0.45% dip from its peak of the day. The All Ords index also closed 0.44% down after a green 5 days. The market remained buoyant despite a rocky start which saw…