Philippe Bui, Medallion Financial Group

BUY RECOMMENDATIONS

XRF Scientific (XRF)

This equipment and chemicals manufacturer posted solid results for the 2022 first half. Revenue grew by 24 per cent and net profit after tax increased by 17 per cent. Also, results indicated continuing momentum into the second half, with record orders. Increasing capital expenditure is expected in the mining exploration sector, which should provide strong tailwinds for XRF.

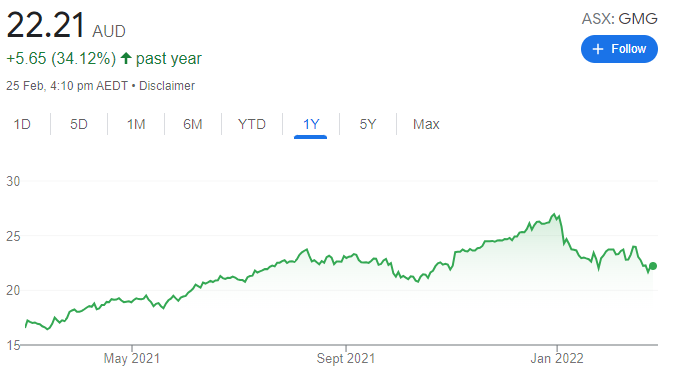

Goodman Group (GMG)

Across the board, the first half 2022 result looked impressive. Management of this global industrial property group has upgraded guidance for fiscal year 2022. Operating earnings per share growth is projected to be 20 per cent. Potential for continuing margin expansion is also positive. In our view, GMG is a business with a strong balance sheet and growth prospects. We view the recent share price retreat as a buying opportunity.

HOLD RECOMMENDATIONS

Credit Corp Group (CCP)

First half 2022 results were broadly in line with consensus expectations. Net profit after tax grew by 8 per cent. Its consumer loan book grew by 9 per cent. It has a strong balance sheet to grow market share in the fragmented US market. It remains a business we hold for the long term.

Gratifii (GTI)

This customer engagement technology company lifted cash receipts to $3.12 million in the December quarter, an increase of 308 per cent on the prior corresponding period. The company is cash flow positive. GTI is still an early stage business. We see substantial upside potential if underlying revenue and cash flow trends continue.

SELL RECOMMENDATIONS

Woolworths Group (WOW)

The supermarket giant trades on a historically high price/earnings multiple, in our opinion. We’re not expecting supply chain pressures to improve in the short term. Consequently, we expect earnings pressure in fiscal years 2022 and 2023. We see more attractive alternatives at the moment.

Mineral Resources (MIN)

The latest half year results missed expectations. Higher than expected costs and lower revenue contributed to the disappointing result. Statutory net profit after tax of $20 million was down 96 per cent on the prior corresponding period. Other stocks appeal more at this point.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

NRW Holdings (NWH)

The earnings outlook is strong for this mining services company. In our view, the valuation remains cheap. From a charting perspective, the share price had been consolidating for the past few months before breaking higher after its half year results. We now expect the shares to trend higher from here.

Top Australian Brokers

- IG - Extensive product array and user-friendly platforms - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

- Quadcode Markets - multi-asset CFD broker - Read our review

Mount Gibson Iron (MGX)

We’re expecting a recovery in iron ore prices. The MGX share price has been recently trending up to trade at 50.2 cents on February 24. But we believe there’s room for the share price to breach 70 cents by June.

HOLD RECOMMENDATIONS

BHP Group (BHP)

Shares in the global miner have been trending higher since bottoming in November 2021. Its recent half year result was robust, with total revenue up 32 per cent to $US33.784 billion. The company lifted its fully franked interim dividend to $US1.50 a share. BHP is well placed to weather higher inflation as we expect commodity prices to continue rising from here.

Commonwealth Bank of Australia (CBA)

Recent half year results again showed that CBA is a proven performer. It delivered a statutory net profit after tax of $4.741 billion, a 26 per cent increase on the prior corresponding period. An interim fully franked dividend of $1.75 a share was up 17 per cent on last year’s first half. We expect buying support when the shares trade below $100.

SELL RECOMMENDATIONS

Woodside Petroleum (WPL)

We were buyers of WPL at the start of January, but suggest investors may want to consider taking some gains. In our view, crude oil prices are spiking into trend-line resistance. Any correction in the crude oil price is likely to be reflected in WPL’s share price. WPL’s share price has enjoyed a solid run this calendar year to trade at $27.52 on February 24.

AUB Group (AUB)

AUB is the largest equity based insurance broker in Australia and New Zealand. Latest half year results missed analyst estimates, with underlying earnings per share increasing by only 1.68 per cent on the prior corresponding period. The share price appears expensive for this rate of earnings due to it recently trading on a price/earnings ratio close to 22 times fiscal year 2022 earnings.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

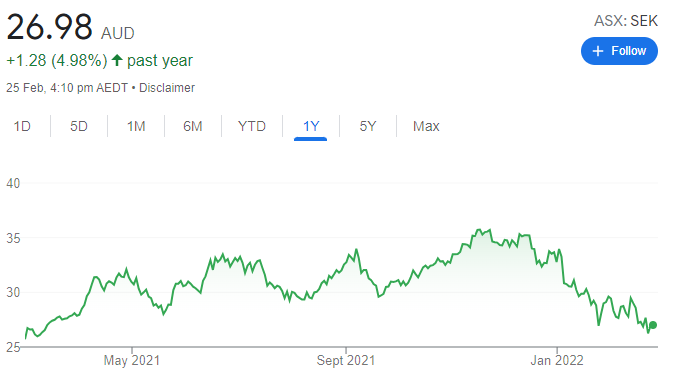

Seek (SEK)

This employment and education company reported a first half 2022 net profit after tax of $124 million and declared a fully franked interim dividend of 23 cents a share. The result and guidance upgrade has prompted us to increase our earnings estimates for the recruitment portal, driven by continuing strength in the Australasian market. We expect Seek to continue extracting value during the next 12-to-18 months.

Seven West Media (SWM)

A first half 2022 underlying net profit after tax of $128.7 million was mostly due to a stronger free-to-air advertising market. We expect advertising bookings to drive another upgrade in the second half. We note Seven’s digital segment also continues to get stronger. Digital earnings comprise 36 per cent of group earnings, with the potential to move to 40 per cent by the end of fiscal year 2022.

HOLD RECOMMENDATIONS

Bendigo and Adelaide Bank (BEN)

First half 2022 cash earnings after tax of $260.7 million was marginally weaker than our forecast due to a larger provision write-back. The company declared a fully franked interim dividend of 26.5 cents a share. Management is now targeting flat costs between fiscal years 2021 and 2024.

GPT Group (GPT)

Funds from operations of $555 million, or 28.8 cents a share, in calendar year 2021 were well below our forecast of $581 million, or 30.2 cents a share. This was due to rent assistance exceeding our expectation. An unfranked final distribution of 9.9 cents per security took the full year payout to 23.2 cents. Funds from operations guidance in calendar year 2022 implies growth from this diversified property group.

SELL RECOMMENDATIONS

Carsales.com (CAR)

The company reported a first half 2022 underlying net profit of $88.7 million, which was broadly in line with our forecast. It declared a fully franked interim dividend of 25.5 cents a share. We expect long term growth from offshore businesses to offset maturing Australian legacy operations, although these segments, in our view, are priced for perfect execution. The potential for softer margins to accompany top line growth is a concern.

Origin Energy (ORG)

The energy giant reported a first half 2022 underlying net profit of $268 million, which was in line with our forecast. It declared an unfranked interim dividend of 12.5 cents a share. We were expecting 16 cents a share. We believe closing the Eraring power station in 2025 suggests limited value in the asset. We have reduced our earnings forecasts.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.