Chris Batchelor, Spotee.com.au

BUY RECOMMENDATIONS

AVA Risk Group (AVA)

The company announced the sale of its services business and a capital return to shareholders of 16 cents a share. The existing technology business was recently trading on an undemanding price/earnings multiple of about 11 times. Revenue and other income grew significantly in fiscal year 2021, despite the pandemic. The company’s valuation multiples look attractive. I own shares in AVA.

Janison Education Group (JAN)

JAN is an education technology company. It provides online assessments and e-learning solutions. It recently acquired the global rights to two exams administered by schools to provide standardised testing across school-aged students. In our view, JAN is poised to generate significant growth in the years ahead. It also benefits from the pandemic, as education providers require technology-based solutions.

HOLD RECOMMENDATIONS

City Chic Collective (CCX)

This multi channel retailer has generated sales growth averaging about 20 per cent per annum in the past four years. Sales are forecast to grow by about 35 per cent this financial year. It has a track record of good execution focused on a well-defined target market. The outlook is positive, so we suggest holding for now.

Aussie Broadband (ABB)

The broadband provider has been growing rapidly in terms of customers and revenue. The company recently completed an institutional placement and raised $114 million. The shares have risen from $2.92 on August 2 to close at $5.09 on September 23. We retain a hold recommendation, as the company was recently trading on a lofty forward price/earnings multiple of 52 times.

SELL RECOMMENDATIONS

Webjet (WEB)

The online travel agency has rallied strongly in the past year on hopes the pandemic would be brought under control via vaccination. The company is trading on high multiples. In our view, the shares are priced to perfection, leaving little room for error. The pandemic continues to create uncertainty about the outlook for travel across the world.

Cettire (CTT)

This online luxury retailer reported sales revenue of $92.4 million in fiscal year 2021, an increase of 304 per cent on the prior corresponding period. Sustaining high levels of sales growth will remain a challenge in an increasingly competitive online space. The company was recently trading on a price-to-sales ratio of 15 times, according to our analysis. This is three times higher than its nearest competitor. We find the company’s valuation difficult to justify.

Tony Paterno, Ord Minnett

BUY RECOMMENDATIONS

Telstra (TLS)

Management is targeting mid single digit growth in underlying operating earnings to fiscal year 2025. It expects increasing earnings to be driven by mobile service revenue growth, improving consumer and small business fixed margins and further cost reductions. Expect fully franked dividends to remain at a minimum of 16 cents a share. TLS plans to return any excess cash flow to shareholders – in the absence of merger and acquisition opportunities – via an unfranked special dividend, or further on-market share buybacks.

Top Australian Brokers

- IG - Extensive product array and user-friendly platforms - Read our review

- eToro - market-leading social trading platform - Read our review

- IC Markets - experienced and highly regulated - Read our review

- Quadcode Markets - multi-asset CFD broker - Read our review

Aussie Broadband (ABB)

The company has executed a $114 million institutional placement, with a share purchase plan to follow. The war chest of capital is intended to fund one or more acquisitions and to accelerate the company’s ambitions in the business market. The company has signed a 10-year fibre capacity swap agreement with VicTrack in Victoria. VicTrack’s fibre network will provide ABB with a short cut to a wider distribution footprint in regional Victoria without deploying incremental capital.

HOLD RECOMMENDATIONS

ResMed Inc (RMD)

This medical device maker may potentially expand its market leading position, with the launch of its AirSense 11 device. This device, combined with a rapidly growing patient database, may enable RMD to generate superior patient outcomes.

A lift in mask share is another positive. The company is clearly focused on generating recurring revenue.

InvoCare (IVC)

The funeral services provider reported underlying operating earnings of $63.6 million in the first half of fiscal year 2021, up 30.9 per cent on the prior corresponding period. The Australian funerals business was a key driver of the stronger than expected result. Operating costs were also kept in check, with the business delivering on its operating leverage target. It declared a fully franked interim dividend of 9.5 cents a share.

SELL RECOMMENDATIONS

Flight Centre Travel Group (FLT)

The company reported a normalised net loss of $366.6 million versus our forecast of $349.7 million in fiscal year 2021. The underlying loss before tax was $507 million. The result highlighted the devastating impact of the pandemic in all regions. In our view, the key challenge for the company is to continue reducing costs to protect group earnings. We prefer other stocks at this point in time.

Reece (REH)

This plumbing products supplier reported normalised EBITDA of $720 million in fiscal year 2021, up 11 per cent on the corresponding period. Net profit after tax rose 25 per cent to $286 million. It declared a final dividend of 12 cents a share, taking the full year dividend to 18 cents a share. The company’s share price has performed well this calendar year, so investors may want to consider taking a profit.

Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

CSL (CSL)

This blood products group has underperformed the market in the past year. However, recent good buying volumes supported the stock to break above several important resistance levels. I expect the stock to rally and surpass its highs in early 2020, as it’s enjoying favourable momentum. The shares have risen from $300.68 on September 14 to trade at $311.77 on September 23.

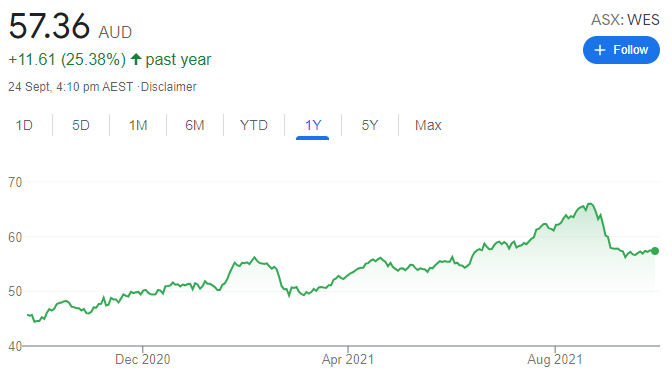

Wesfarmers (WES)

The industrial conglomerate’s recent full year results were solid, but it appears the valuation was stretched. The share price has retreated from $66.06 on August 20 to trade at $57.66 on September 23. Now, the valuation is more attractive, the stock appears to be generating stronger support levels on the chart. What also appeals is a capital return due later this year.

HOLD RECOMMENDATIONS

Fortescue Metals Group (FMG)

The recent falls in iron ore prices surprised some of the most bearish of analysts. But the commodity price falls appear to be overdone, in my view. Fortescue’s shares were punished in response to iron ore price falls, but now appear to be finding buyer support at recent levels. Any lift in Chinese iron ore demand will flow to a higher FMG share price, in my opinion.

Aristocrat Leisure (ALL)

This gaming machine company is one of my favourite businesses. Despite a strong share price performance in the past 12 months, recent volatility suggests a softening price in the short term. But the longer term outlook remains positive. In a world where markets are going to be concerned about economic growth levels, I expect investors will be attracted to ALL’s dependable and high earnings growth.

SELL RECOMMENDATIONS

Insurance Australia Group (IAG)

The share price has been drifting lower during the past two years. Recent selling pressure on high volumes suggests there’s a risk of further price falls. The share price has fallen from $5.45 on September 6 to trade at $4.86 on September 23. I believe IAG may need to cut costs to support premium growth. Other stocks appeal more at this time.

Brambles (BXB)

Shares in this global logistics company have fallen from $12.49 on September 7 to trade at $11.04 on September 23. In my view, concerns about potentially increasing costs and a possible hefty investment in plastic pellets are contributing to share price pressure. According to my technical analysis, the share price is likely to take another dip.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.